- Bitcoin continues to show its strength with ETF narrative driving the move.

- SEC talks with ETF issuers and have advanced to key detail discussions.

- With the rally in Bitcoin related Alts (ORDI, STX) have been getting momentum. We called out a few of these in our trading discord if you are interested to join follow the link here.

- As 75% of Altcoins are outperforming Bitcoin this could mark the beginning of Alt Season. Is it time to build those Altcoin bags?

- Expectations of a rate cut are too intense at the moment and the Fed may correct the market in a more aggressive manner.

- The number of Bitcoin addresses holding more than 0.01 BTC continues to hit record highs, implying that the Bitcoin price still has the potential for a significant increase.

Contents

Thoughts

While we have noted these bullish signals all the way from the bottom in 2022 it was still hard to imagine Bitcoin recovering so quickly. Many people get trapped in the short-term price volatility of an asset thinking the market is efficient and current prices are fair. But when looking underneath the price we see lots of fundamental factors and people who are accumulating Bitcoin but not selling. Which is a large difference from previous bear-markets. So does looking on chain offer a sneak peak into the positioning and sentiment of some large players or smart money? We believe so. Especially is if you actually believe in the validity of the methods used it could give you conviction in your positioning. Below are some of the data points we looked at in the past year that gave us conviction which we then used with technical analysis and mining cost to offer up our target of approximately $30,000 – $40,000 by the end of 2023.

Technical

Bitcoin

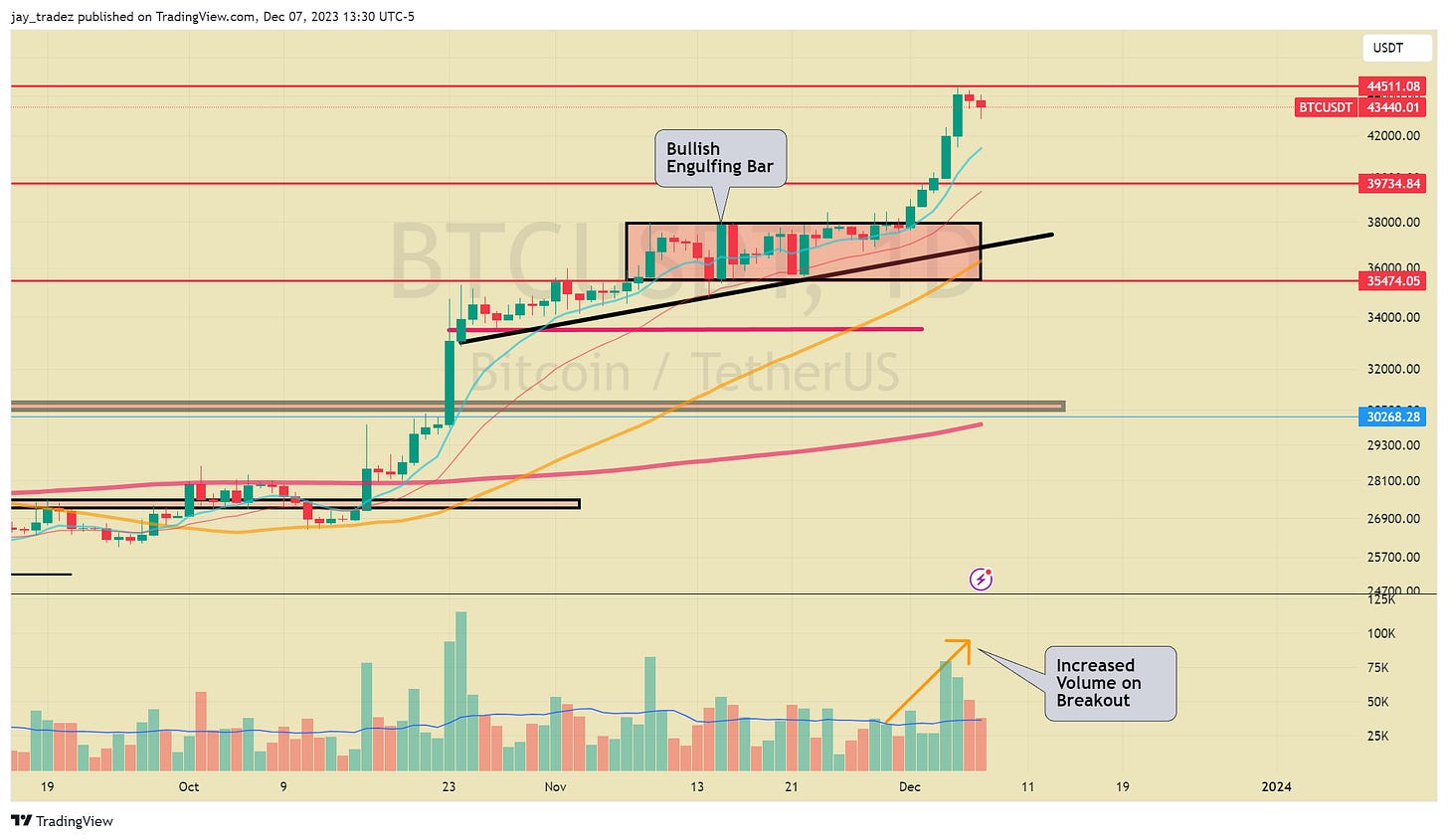

Its funny last week we talked about how there wouldn’t be any major moves into the end of the month, which happened. However, on the 1st of December we broke through $38,500 and Bitcoin has been flying up for the past week. Each candle large then the previous with increasing volume. That is a strong break-out right there. For those who have been with us and are holding Bitcoin, cheers. For those who are still on the sidelines be patient chasing now is not the right play.

On the technical side this we are seeing a 9 on the DeMarks indicator which often signals a reversal or atleast a pause inside of a strong trend. So we recommend hedging your positions or selling some covered calls to generate some yields on your position to decrease holding cost. For shallow pull-backs we want to see open interest down, funding rates down, premium get flattened on the CME and long liquidations up. After seeing these things happen and price stabilizing that would be an opportunity to buy the dip. On a larger pull-back to daily support we want to see prices back at $38,000 which was the recent break-out area and thus the first major level of support.

The next major level of resistance is right here at this 44,000 – 45,000 then after that it’s pretty much clear skies until $50,000. The resistance up here near previous bull market highs are very weak as most of the people who bought up here are all washed out and the realized price for Bitcoin is still very low near $22,000. I would say above $50,000 we have no real resistance or trapped sellers. You could even argue above $45,000 would be the same. Below the percentage of BTC supply in profit is around 85% which proves our point. So right now the real question is when will momentum and this ETF narrative stop. Cause there are no more trapped positioning in Bitcoin.

Ethereum

Eth by itself is technically breaking out but if we look at ETH priced in Bitcoin it is still underperforming like it has been for the past year. However, if Bitcoin does get a pause here we can see money flow into Ethereum for the catch up trade. Sidelined money needs somewhere to go and the next in-line asset could be Ethereum. We want to see this double bottom in ETH/BTC hold and if we reclaim 0.054 again could set up for some Ethereum outperformance.

Looking at the Ethereum chart by itself it has just broken out of its bear-market high which is a bullish signal. While not as strong as Bitcoin itself if our perspective of capital flowing down the asset stack plays out Ethereum could be a good buy at $2,100 – $2,200 given its relative weakness in the recent weeks. The next level of resistance is right above current price of $2,300 – $2,400 but if we clear this area of resistance there is a significant amount of room until we hit the next level of resistance at $3,000. Our view is if Bitcoin consolidates at this resistance capital will flow to the next asset in line which will be Ethereum.

Altcoins

Total3 the total market cap of the Crypto market excluding Bitcoin and Ethereum is showing some signs of life. What we have seen so far is multi week support and holding at the highest level since August of 2022. The whole Altcoin market has been in an accumulation range for the past year and a half and now trading at a 30% premium compared to the lows. However, don’t feel like you have missed out because the best moments to enter is waiting for a confirmation that we are out of the bear range. For example right now after a 30% premium we have a signal that we are breaking out of the range and showing bullish momentum.

News of the Week

MicroStrategy Reinforces Position in Bitcoin

On November 30th, MicroStrategy once again purchased approximately 16,130 Bitcoins for approximately $593.3 Million in cash, at an average price of $36,785 per BTC. MicroStrategy now owns 174,530 Bitcoins, valued at approximately $5.4 billion, at an average price of $30,252 per BTC.

SEC Meets with 8 Bitcoin Spot ETF Applicants

According to information disclosed by the U.S. Securities and Exchange Commission (SEC), the agency met with Bitwise, VanEck, Fidelity and Invesco at the end of November regarding their respective bitcoin spot ETF applications. Meanwhile, the SEC also met with Ark Invest’s bitcoin spot ETF application and 21Shares in late November. As previously announced, the SEC has met with Grayscale, BlackRock and Hashdex on Bitcoin spot ETF applications.

Cristiano Ronaldo Hit With Class Action Lawsuit for Promoting Coin Security

On November 29, soccer superstar Cristiano Ronaldo was hit with a class action lawsuit filed by plaintiffs over his promotion of cryptocurrency. According to documents filed in Florida District Court, the plaintiffs allege that Crow, in collaboration with Cryptocurrency, promoted, facilitated and/or actively participated in the issuance and sale of unregistered cryptocurrency securities, and that they suffered damages as a result. CoinSecure entered into a long-term exclusive partnership with Crow last year and issued the Crow NFT series of products.

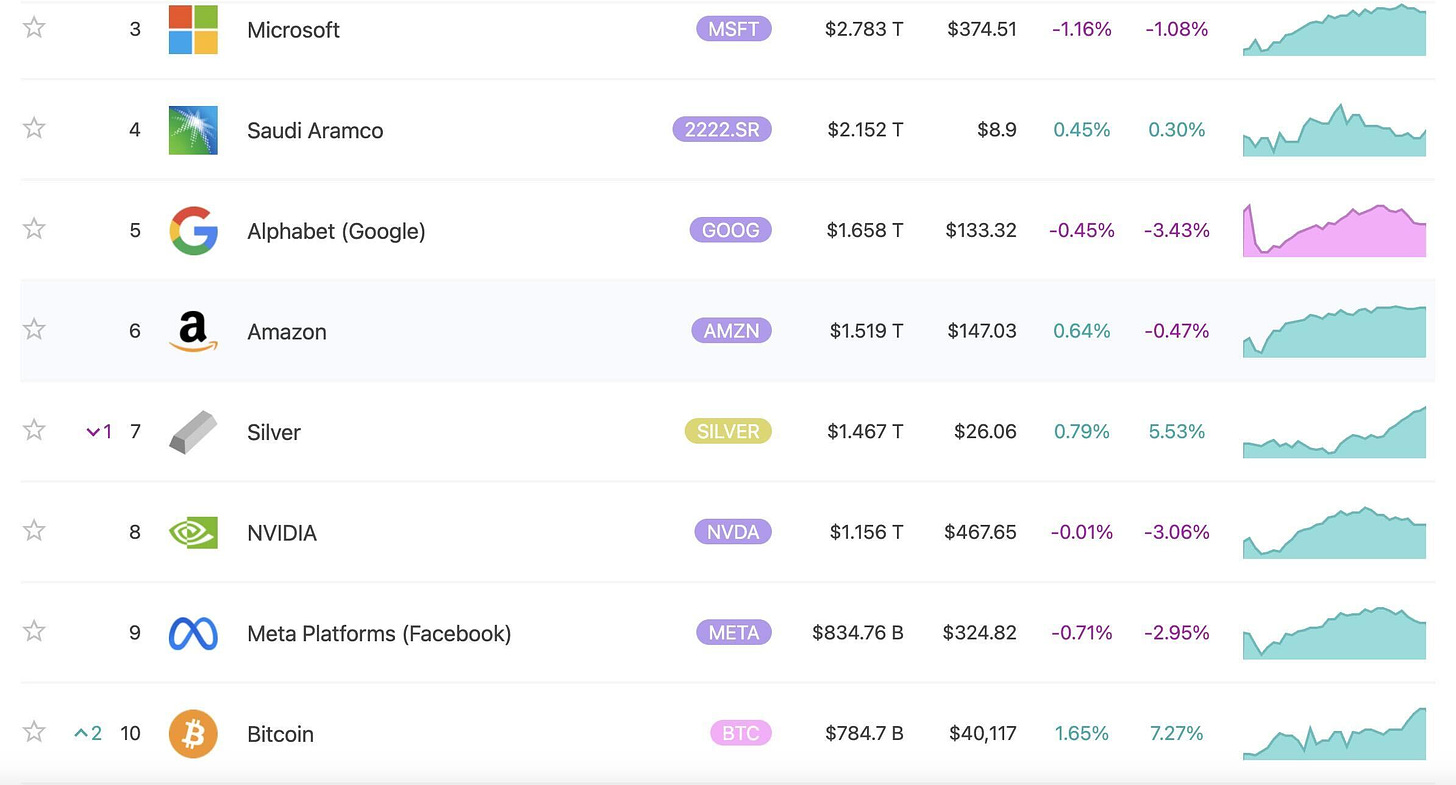

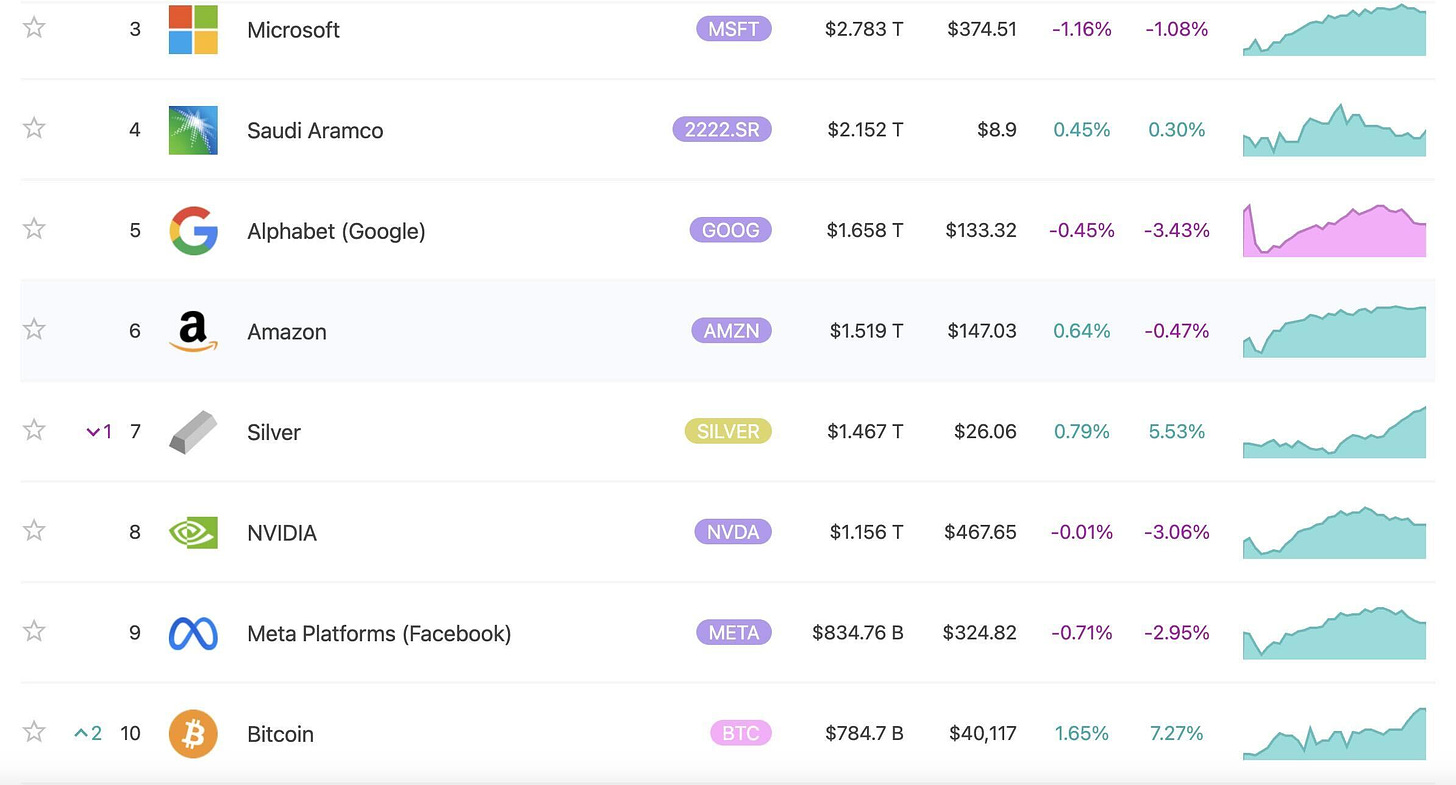

Bitcoin Overtaking Berkshire Hathaway, Bitcoin Returns to Top 10 Global Market Capitalization

Bitcoin has overtaken Berkshire Hathaway to return to the top 10 global assets/companies by market capitalization, according to the latest data from 8marketcap on December 4. As the price has risen above $40,000, Bitcoin’s market capitalization has risen to $784 billion, which puts it at No. 10 in the global asset market capitalization rankings.

Macro Analysis

U.S. bond yields accelerated downward, boosting gold and Bitcoins.

What to watch this week:

- 10-year U.S. bond yields fell to 4.1%.

- US dollar index fell for three consecutive weeks.

- Gold price hit record high.

- WTI oil price lost $70.

On December 3rd, the spot gold price surged 3% to $2,135.39, surpassing the record high set during the pandemic. The international gold price continued to reach new highs, mainly due to the impact of the sharp decline in the yield of the 10-year U.S. treasuries. The market has priced in increasing risk of recession next year in the U.S., which has led to an increase in rate cuts expectations.

Fed Chairman Bauer on Friday tried to correct the market’s expectation on rate cuts, but Wall Street did not believe the narrative and instead priced in a high probability of cuts. Gold futures on the New York Mercantile Exchange (Comex) hit record highs after Bauer’s remarks. We think the market is clearly at odds with the Fed, which is now expecting a rate cut too aggressively. The Fed may be forced to correct the market in a aggressive way to gain back trust in their decisions.

Fundamental analysis

According to Glassnode’s data, the number of Bitcoin addresses holding more than 0.01 BTC continues to hit a record high of 12.57 million, representing a large number of new investors buying Bitcoin. The indicator has been growing for more than a decade, with significant declines at the top of bull markets.

The indicator is still growing rapidly, which means that both the number of users and the volume of bitcoin transactions continue to expand. This also means that the price of Bitcoin still has the potential to rise significantly. In the future, when the growth rate starts to slow down significantly, it may indicate that Bitcoin has matured and the price will gradually stabilize.

It’s still a good time to invest in Altcoins

According to www.blockchaincenter.net, it is still a good time to invest in Altcoins, according to the Crypto Quarterly Index. The Alt-season Index is a tool that tracks the performance of Bitcoin against the top 50 coins by market capitalization over a 90-day period. The index shows that when 75% of the current top 50 coins are outperforming Bitcoin. For this index that means Alt-season has begun and you can expect outsized gains when trading these coins.

It is worth noting that only 37% of coins have outperformed Bitcoin over a 90-day period. This suggests that the market is still some way off from the Alt-season, especially considering the uncertainty of when the Fed will cut interest rates, and that Wall Street plays an important role for liquidity. We believe that it is still a good time to invest at the bottom of the market as liquidity flows down the capital stack and Bitcoin is within short distance of its all time high.

Trading Recommendations

Bitcoin

Futures | Spot

The short-term swing trade that we entered at $35,500 is $8,000 in profits. It hit our target of $40,000 and shot right through. If you are still holding and didn’t take profits at our initial target feel free to sell. We believe Bitcoin will take a breather in the short-term. Congratulations on the win!

Structured Product

Last week, we suggested a $36,000 buy-the-dip because the $35,000 level is the bottom of the trading range and we believed it is strong support. The trade played out perfectly and expired out of the money, meaning we received full profits. This week as prices moved up by a large margin we suggest covered calls for those who are holding Bitcoin. We believe in the short-term prices might have topped out and need a breather so for those with Bitcoin positions we suggest $47,000 strike, 2 – 5 day duration covered calls.