Contents

Abstract

- 7-day Volatility reverts back 28% as Bitcoin consolidates after the large move last week.

- Technical levels coming up $23,000 and next $20,000.Despite multiple positive factors since June, the cryptocurrency market hasn’t seen improved liquidity, resulting in a restructuring of key participants.

- SF fed released paper on consumer strength and it seems it might be coming to an end soon. Link

- The positive outcome of the grayscale ETF case proves it will be hard for the SEC to keep rejecting applications, but this also means they will not contradict themselves and approve. We still expect the SEC to delay the ruling until next year.

- The SEC will make a decision on six spot bitcoin ETF applications this weekend. We expect to face further delays at this time.

Foreword

We had started writing our research before the release of the news of the Grayscale win against SEC in court. Consequently, we will maintain some content that was finalized before this development, while also incorporating updates. This illustrates the rapidity with which situations can shift due to news or shifts in narrative, a point we’ve previously highlighted to our readers. Please continue reading for our insights on the Grayscale win and the potential scenarios surrounding Friday’s ETF decisions.

Our View

The 2023 market trades in a very small range most of the time, many traders’ patience was worn down by the long consolidation. Low volatility has become the new norm this year, and extremely low volatility often predicts that a big move is brewing, so the big rises and falls after consolidation also became the norm. This in turn makes it harder to trade and caught many traders off guard, making 2023 a less attractive trading environment than previous years. Market liquidity has also been on the decline as stable coins supply continues to shrink, and a uncertain regulatory environment forces market makers to leave, implying that liquidity may be further drained. Therefore, we suggest you to stay away from over-leverage positions. We think the current price is cheap enough to build long-term (1 – 3 year) positions.

Fundamental Analysis

Hodlers Are Doubling Down

BTC’s net transfer volume from/to exchanges shows very positive data. The data shows a net outflow and gradually increasing trend in recent days, meaning that people are taking Bitcoin out of the exchanges. Investors withdrawing Bitcoin from exchanges means an increase in long-term holding demand and a potential decline in selling pressure, which is good for the market that desperately needs to find a bottom.

Gray Scale Win and ETF Decisions

This week, the SEC is set to make decisions on six spot Bitcoin ETF applications, including one from BlackRock. We anticipate that the decision is likely to face further delays, leading us to maintain our stance that the approval of a spot Bitcoin ETF will probably not materialize until January or February of the following year. With positive news remaining scarce, fundamental factors are poised to play a crucial role in driving the market during the latter half of this year.

The positive outcome of the Grayscale ETF case signals support and has reduced our expectation of an ETF rejection by the SEC. However, it’s important to note that this doesn’t guarantee approval, and we continue to anticipate SEC delays, pushing any potential approvals to the upcoming year. Considering the SEC’s perspective, it would be quite contradictory to first oppose a BTC ETF and then lose in court, only to immediately approve another BTC ETF. Such a scenario appears unlikely to us.

An approval on the deadlines this week would mean just go long we will likely reach $36,000 – $40,000 on such an event.

Rejection just short we are likely going to $20,000 or under. However, the SEC would likely be sued.

Delay the most likely outcome would highly likely result in a rejection at the current resistance and slight sell-off back to $25,000 support. The delay will likely dampen investors mood and hopes for a quick approval following the Grayscale win.

Technical Analysis

BTC

As anticipated, Bitcoin experienced a period of consolidation during the past week, following the clearing of excessive leverage. Our strategy to sell volatility through covered gains while premiums were elevated turned out to be accurate, as the 7/30-day Implied Volatility (IV) has nearly reverted to levels seen prior to the liquidation events. However, following the favorable outcome of the Grayscale case in court, the implied volatility has begun to climb once more. It’s worth noting that despite the increase, it remains below the levels observed one week earlier, indicating that all gains from the covered positions should still be in profitable territory.

Regarding price action, there were no significant developments during the past week, in line with our expectations and as discussed in our previous edition. We anticipate a similar scenario to unfold this week, potentially including a test of either $25,000 or $28,000, which we got before publishing due to the Grayscale news. However, we maintain the belief that Bitcoin is unlikely to make a substantial move without additional support from a full ETF approval. We project that the upcoming ETF decision dates will most likely result in an 80% chance of delay, a 10% chance of approval, and a 10% chance of denial for the upcoming decision dates as listed in the fundamental section. So even with the excitement over the Grayscale win over the SEC we don’t really see this having a deep narrative change as ultimately they are just sending the case back to court where the SEC is likely to delay.

Considering the downside, the likelihood of a break below $25,000 has decreased due to positive price action. As we discussed last week, a more plausible scenario involves a period of choppy consolidation, illustrated in the chart below. Momentum remains skewed to the downside, given that Bitcoin has breached its structural uptrend and a crucial bullish divergence indicator – the 200-day Moving Average (MA). Nonetheless, with the recent bullish movement, we now sit just below the $28,000 resistance level. However, until we regain $28,500, we maintain a sideways perspective. As indicated in the chart below, a reclaim of $28,500 would position us back above key resistance, signaling a return to a technically bullish market. Trading within the range of $25,000 to $28,000 is likely to be challenging and may result in a choppy market environment.

SPY

Analyzing recent data, it’s evident that the correlation between equities and cryptocurrencies has once again grown stronger. The S&P 500, for instance, now exhibits a correlation coefficient of 0.8 with Bitcoin, while the Nasdaq has a coefficient of 0.7. However, even though the data suggests this correlation, the familiar trading signals that often accompany such correlations have not returned. Examining the actual extent of price movement, we observe that equity markets have experienced typical levels of volatility, characterized by more consistent trends. In contrast, Bitcoin has undergone significant downward movements followed by periods of tight consolidation. While the S&P 500 might exhibit a clear direction, Bitcoin remains largely challenging to trade amidst this volatile and choppy environment.

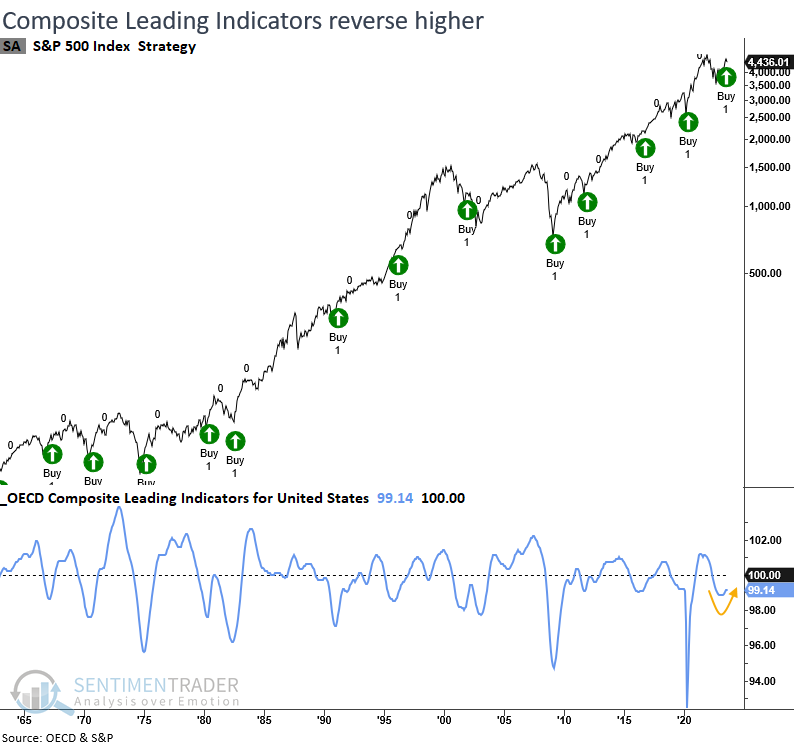

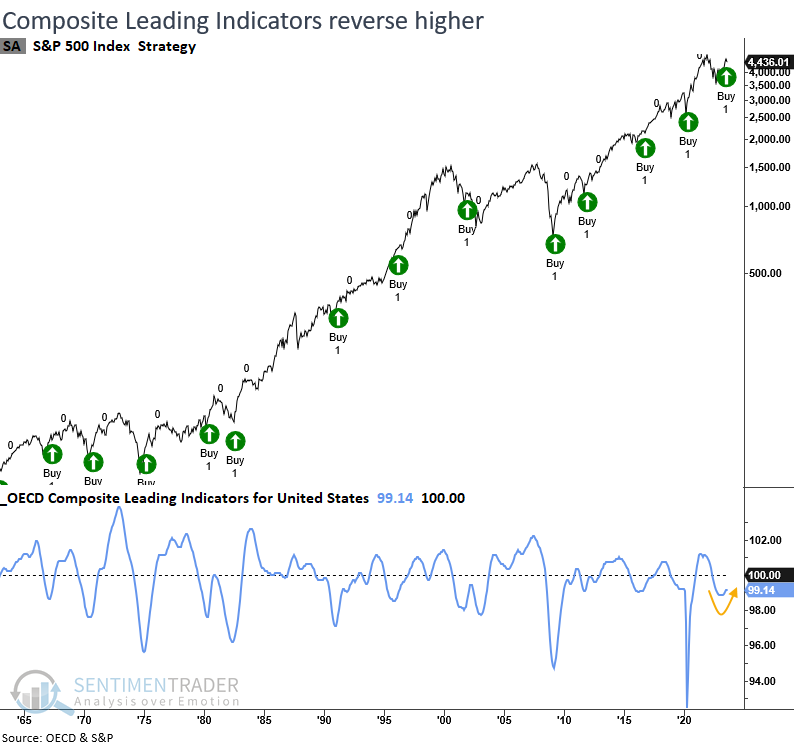

Despite the current lack of a clear short-term correlation, it’s worth conducting a brief analysis of the equities market since Bitcoin often aligns with the broader trends in equities over the long term. Despite the presence of several negative economic indicators suggesting a lack of strength in the U.S. economy, as highlighted in the fundamental section, the OCED’s leading indicators indicate that the economy has recently emerged from contraction territory. This recent pullback is likely a routine correction rather than a signal of significant economic downturn.

Macro Analysis

A Sigh of Relief from Jackson Hole

At the Jackson Hole Symposium, Fed Chairman Jerome Powell delivered a cautious speech, indicating a prudent attitude towards the current economic situation. Powell believes that the economic growth is not as robust as expected, monitory tightening is still on its way, and the Fed is committed to controlling inflation. Future data will continue to guide the Fed’s decisions.

The Federal Open Market Committee forecasts the Federal Reserve will maintain interest rates at its September meeting, but may raise rates by 25 basis points in the fourth quarter of 2023. After that, we expect interest rates to remain stable until mid-2024, when the Federal Reserve will gradually start to relax policy as inflation continues to decline. However, by the end of 2024, interest rates will remain in the restrictive range, with the CPI gradually reducing to its annual target of 2%.

The U.S. stocks and crypto market closed roughly flat, but the market sentiment remains fragile. Morgan Stanley strategist Michael Wilson believes that the US stock market rally has ended. Bank of America’s Hartnett agrees with Wilson, thinking that the boost of AI on the stock market will fade in the second half of 2023. Thus, investors need to be vigilant and keep tabs on market changes. We believe that due to the overheating AI theme, a considerable part of the liquidity in the crypto market has been taken away by US stocks. If the AI fades, it could be more positive for different themes in the crypto space. We will also closely observe the movement of funds and make reasonable forecasts.

Treasuries pull back with Macro Risk

Consumers appear to be financially stretched, as indicated by executives from Walmart, Target, and Home Depot who have cautioned that consumer spending is primarily directed toward essential items, while discretionary spending remains low. They further emphasized that these trends, coupled with elevated interest rates, are likely to impact sales in the latter half of the year. This observation aligns with recent research from the San Francisco Fed, which forecasts that the excessive consumer saving observed should diminish by the third quarter of this year. Given that interest rate impacts often exhibit a lag, the full effects of the current 5.25% rates are projected to be experienced by the economy around the fourth quarter of 2023 or the beginning of 2024.

Nevertheless, the primary drivers fueling the recent surge in bond yields have yet to dissipate. A substantial influx of treasuries is slated to enter the market within the upcoming months, while foreign investors such as China and Japan have thei rown issues to deal with. Concurrently, the budget deficit continues to expand. During the Jackson Hole conference, Powell indicated that additional rate hikes might be necessary due to the robustness of the U.S. economy. However, based on the data outlined above, our perspective is that the economy is actually showing signs of weakening. If another rate hike were to occur, there’s a potential risk of over-tightening the monetary policy. Below in the technical section we have include opposing data from OCED to show different points of view.

Trading Recommendation

BTC

As volatility and price both drop dramatically, we suggest considering a Buy-the-Dip for BTC at $26,000 with a duration of 2 days, aiming for an annualized return of 12%.

Our orders of Buy-The-Dip were executed at $28,000 due to the rapid decline. For those that followed our recommendation we would now recommend using longer-termed covered-gains to lock in yields while volatility is high. We recommend 2D $28,000 with 39.6% APY. We expect volatility to decrease once again as that has been the trend for the crypto market overall, sudden spike in vol and gradual fade. So locking in a good yield right now seems like the best path of action.

ETH

We recommend considering a Buy-the-Dip for ETH at $1600 with a duration of 1~ 2 days, targeting an annualized return of 13%+.