Contents

Abstract

- Celsius transferred Altcoins to FalconX and OKX in preparation for selling

- SEC appeals judges decision in Ripple case

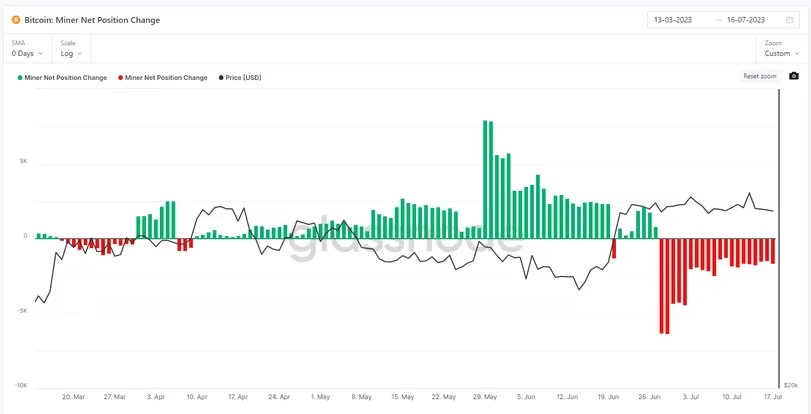

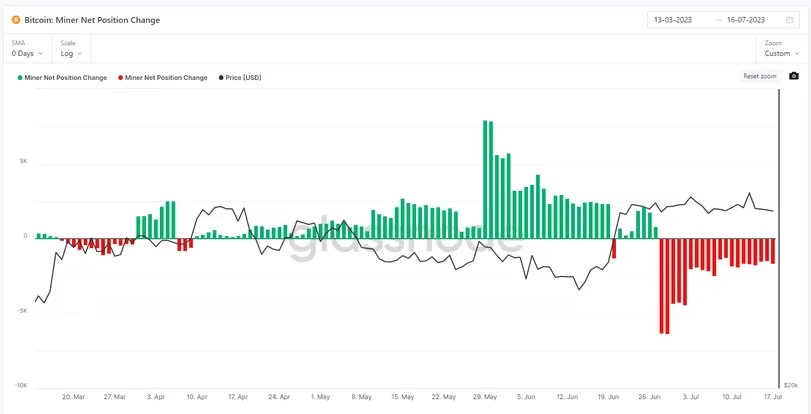

- Miners selling off Bitcoin in the past month compared to strong accumulation in the month prior.

- US tech stocks, especially AI concepts, have faced significant declines.

- Bitcoin and Ethereum are currently reaching yearly highs but experiencing declining trading volumes. The market expects new narratives to boost sentiment and attract more funds.

- The premium of Bitcoin trusts over Bitcoin spot has been steadily increasing in recent months, indicating continued optimism among institutional investors.

News

Celsius Transfers Altcoins

We know that Celsius will be converting Altcoins into BTC and ETH sometime in the future. It seems like that time might have come. Twitter users have been monitoring Celsius addresses on Dune and Blockworks and recently reported that Celsius conducted on-chain transactions with some of its altcoins last week. The tokens were transferred to wallets associated with FalconX and OKX exchanges. Below are the details of the on-chain transactions to FalconX:

Initial reactions to the transfers have been quiet, and most of the altcoins showed consolidation in the following days. The selling of these tokens may not have a significant impact on prices for two main reasons:

- OTC Selling: The selling might have been done over the counter (OTC), meaning it occurred outside traditional exchanges. OTC trades usually involve large volumes and are direct transactions between parties, so they won’t immediately affect market prices. OTC trades are often more discreet and may not cause visible price fluctuations on public exchanges.

- Liquidity: Out of the 14 coins transferred, only 3 have a substantial size that could potentially impact the market compared to their liquidity on exchanges. This implies that the majority of the transferred tokens may not have enough volume or market influence to create significant price movements.

However, it’s important to note that despite the limited immediate impact, the transfer news could still be used as FUD (Fear, Uncertainty, Doubt) to influence market sentiment. The narrative of selling pressure on the markets might be exaggerated, leading to overreactions from traders and investors.

SEC Appeals Judge Decision in XRP Ruling

- The SEC’s appeal to the Ripple ruling resulted in a slight selloff in altcoin prices, which temporarily dampened the altcoin hype. However, it’s important to note that it will likely take a few more years for the 2nd circuit to reach a final judgment. In the meantime, the current ruling is expected to stand, and it is unlikely to halt the ongoing altcoin rally.

- Unlike altcoins, BTC was not significantly affected by the ruling, as it will have no direct impact on its market dynamics. While BTC’s price is anticipated to continue ranging and possibly drift lower, there is a likelihood that BTC dominance will break its recent uptrend and decrease once again, at least until the BTC physical ETF decision or until macro factors regain dominance.

- Looking at the macro calendar, the FOMC meeting and decision are scheduled for this week on the 27th. However, it is widely expected that a 25bp rate hike is already locked in, and there are no foreseeable events on the calendar that could significantly affect the markets.

Technical Analysis

BTC

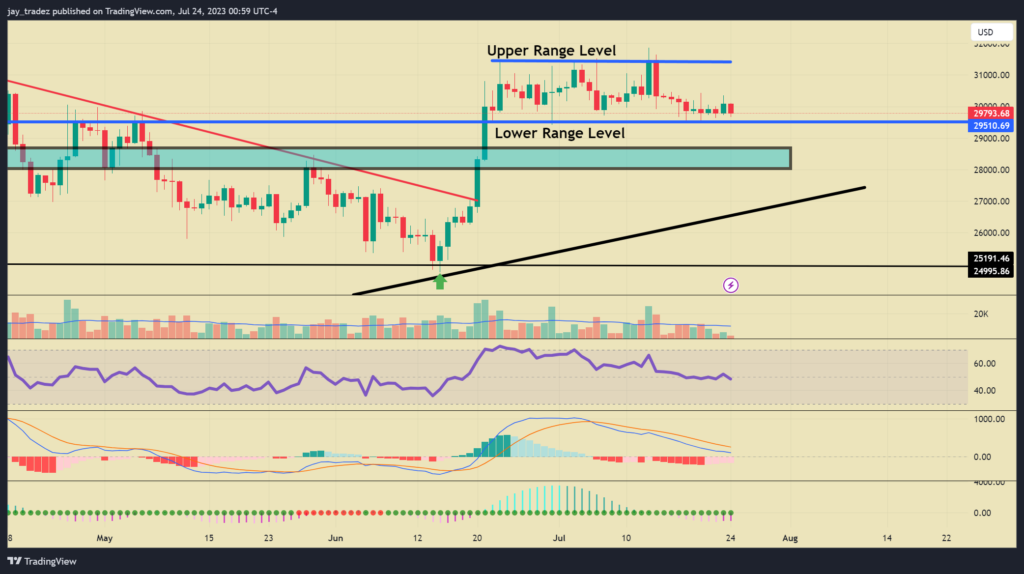

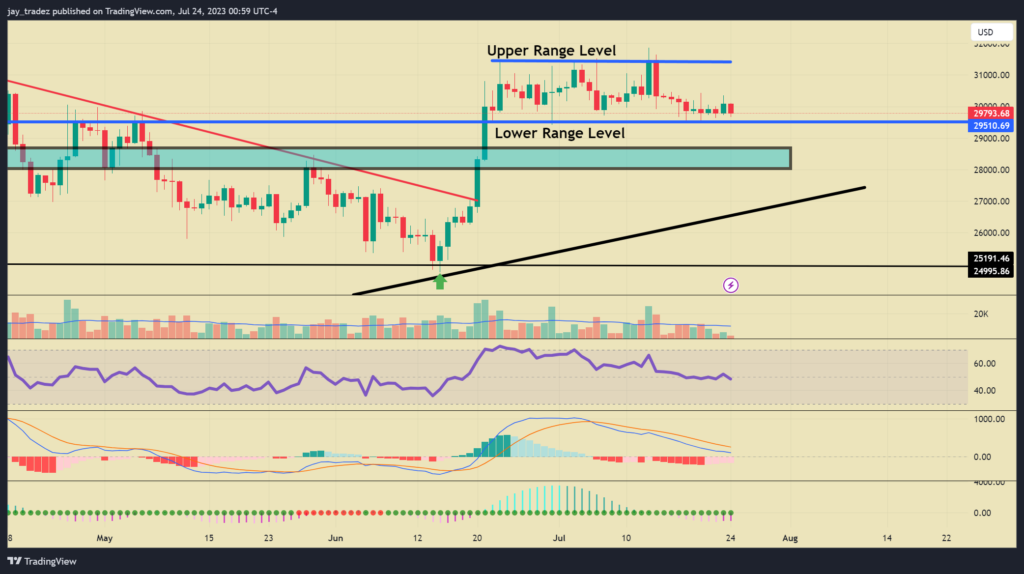

BTC’s recent price action has been uneventful, even amidst positive market sentiment from XRP’s legal win and discussions about BTC on CNBC. However, the cryptocurrency remains anchored near its lower support at $29,500, indicating weakness in the market. The current state of equilibrium between buyers and sellers suggests a cautious and uncertain sentiment, as positive news fails to drive significant price increases. Investors should exercise caution and carefully consider the potential for further downward movement or a potential rebound from the support level, as the market continues to show signs of indecisiveness.

On the weekly time frame, there are significant levels to consider within the weekly cluster: $29,200 and $27,500, which have been frequently tested. Between these levels, there’s a crucial $28,000 whole number level that may attract buyer interest. In the event of a breakdown, it’s advisable to wait for a clear failed breakdown of support or observe how the market reacts at the deeper levels, namely $28,000 or $27,500. Currently, it’s more prudent to wait for a range expansion rather than trading within the range itself. While awaiting the expansion, it’s recommended to set dual investment orders at those deeper support levels to capitalize on potential opportunities.

Trading Recommendation

Bitcoin

Hopefully everyone took our advice on taking profits on part of your position for Bitcoin. We saw a break of the lower range today and could see continuation down. We recommend continuning to sell covered calls to generate BTC and the probability of price increasing is low. You can choose a product with an expiration date of 3 days and a target price of $31,000, which can offer an annualized return of 10%.

With this drop we are now able to use structured products to buy-the-dip and receive high yields while waiting for it to reach our entry price. The orders we are placing are $28,000 strike 2-day expiry products with an annualized return of 10%. We do not recommend the 3-day expiry ones due to FOMC meeting coming up Wednesday.

ETH/BTC

On the ETH/BTC pair we believe we are likely to continue moving sideways with a biased to violent moves to the upside. As we talked about earlier our view is that Bitcoin dominance will continue to slide until further spot ETF news comes out. So what we would recommend is using the ETH/BTC flying wheel.

The parameters we would use are 1% decline for Buy-the-dip and 2% raise for Covered Gain. This would give a good chance to both generate interest while price moves sideways and capture gains from ETH outperformance when we get that spike in price.

Macro Analysis

The Uncertainty May Lead to Market Volatility Again

Last week, the unexpected drop in US initial jobless claims indicated the US economy’s continued resilience, reigniting speculations about the Federal Reserve may raise interest rates twice.

The US stock market exhibited divergent trends this week. The Dow Jones Index repeatedly reached new highs, but on Thursday, the Nasdaq Index experienced a sharp drop of over 2%, and triggering a downturn in the cryptocurrency market. This is the first time such a situation has occurred since the banking crisis in March. The recent decline may not seem significant compared to the previous substantial gains, but it indicates highly unstable market sentiment. This could potentially lead to significant market volatility.

Next week, the Federal Reserve will announce its interest rate decision for July. A 25-basis-point rate hike is almost certain, but there might still be another rate hike awaiting us.

The current interest rate is at 500 to 525 bps, and the market has already fully priced in a 25 bps hike for next week with a probability of 99.8%.

Major Alerts

- Next week, the Federal Reserve will announce its interest rate decision for July, and we will closely monitor the tone and communication of Fed officials.

- US tech stocks, especially AI concepts, have experienced significant declines at high levels. We are concerned about potential shifts in fund flows, which may impact the overall market’s risk appetite.

- BTC and ETH are currently at relative highs for the year, but facing decreasing trading volumes. The market awaits new catalysts to drive both sentiment and fund inflows upward.

Fundamental Analysis

Altcoins Are Performing Strongly

This week, XRP continued to benefit from favorable rulings in regulatory disputes, leading to several exchanges such as Coinbase, Kraken, and Bitstamp reinstating XRP trading. The trading volume and open interest of XRP futures contracts have seen a substantial increase as well. The recent bullish sentiment also spread to other tokens like COMP, XLM, ADA, SOL, etc. According to TradingView data, the Bitcoin Dominance Index, which measures Bitcoin’s share in the total cryptocurrency market cap, dropped from a high of 52% at the end of June to 49.8%, nearing its lowest level in almost a month.

BTC Dominance Index

Considering the noticeable decline in inflation rates, the market expects two more interest rate hikes. The overall macro environment also appears to be more favorable for risk assets. BTC price remains relatively stable around $30,000. ETH, the second-largest cryptocurrency by market cap, has recently maintained a low price of $1,900. As BTC and ETH show little movement, altcoins are performing strongly, indicating that cryptocurrency investors are shifting their focus towards smaller and riskier tokens.

Institutional Investors Remain Bullish

The premium of Bitcoin trusts over Bitcoin spot has been steadily increasing in the past few months.

According to the latest analysis by Woominkyu, an analyst from cryptoquant.com, the premium is essentially an indicator of the extent to which the market price of Bitcoin trusts exceeds the actual value of the assets they hold, known as Net Asset Value (NAV). The ongoing increase in the Bitcoin trust premium since January 2023 indicates a growing eagerness among investors to acquire this fund. In simpler terms, the demand for Bitcoin in the market is continuously increasing. As the premium rises, the difference between the market price of Bitcoin trusts and the actual market price of Bitcoin reduces. This suggests that investors maintain a highly optimistic perspective on Bitcoin.

Miners Selling

Since late June, miners have been consistently selling off their positions, which is a notable departure from the accumulation observed in the previous two months. This trend raises questions about whether miners believe the BTC market is approaching a turning point amid the surge of positive headlines. It’s possible that the change in behavior reflects a shift in sentiment or could simply be a result of cash-strapped miners selling into the market’s strength to fund their operations. The answer likely lies in a combination of both factors.

Despite the selling activity, the overall balance of bitcoin held by miners has remained unchanged since the beginning of the year. This suggests that the accumulation and distribution periods merely represent strategic selling to strengthen their cash position without fundamentally altering their long-term stance on bitcoin. In summary, the recent selling by miners is likely a mix of reacting to market conditions and fulfilling financial needs, rather than a significant shift in their overall belief in the cryptocurrency.