Contents

Abstract

- The Federal Reserve meeting has signaled an upward adjustment in the interest rate target, indicating the likelihood of at least two more rate hikes and no rate cuts for at least two years.

- Faced with regulatory crises and liquidity issues, we continue to recommend using a portion of our holdings in altcoins to buy Bitcoin on dips.

- The current on-chain Net Unrealized Profit/Loss (NUPL) value has dropped into the accumulation zone, suggesting a buying opportunity starting from $25,000, and we advise gradually accumulating Bitcoin at this level.

- Blackrock files for Bitcoin ETF.

- Celsius debtors intend to convert altcoin holdings into BTC and ETH, resulting in passive buying pressure on the top 2 digital assets. Link

- Robhinhood delists 3 coins in connection with the SEC lawsuit. Link

Macro Analysis

Unexpected Hawkishness from the Federal Reserve

During the June meeting, the Federal Reserve sent a significant signal by adjusting the median interest rate forecast on the dot plot. The new projection for the end of this year is 5.625%, which is notably higher than the previous estimate of 5.1%. This indicates that the Federal Reserve plans to implement an additional 50 basis points increase in interest rates in 2023. Initially, the market anticipated only one rate hike, but the dot plot reveals that there will be two more rate hikes.

Among the 18 policymakers, 12 foresee interest rates reaching the range of 5.5% to 5.75% or even higher. Furthermore, three policymakers anticipate raising rates by an additional 50 basis points beyond the median forecast by the end of the year. This consensus among the majority of policymakers highlights their shared belief in the necessity of further tightening monetary policy to address inflationary pressures.

Interest rate cuts are further delayed.

During the meeting, Federal Reserve officials unanimously raised their 2023 economic growth expectations, indicating a more positive outlook. The forecast for GDP growth increased from 0.4% to 1%, while the projected PCE growth rate for 2023 was revised from 3.2% to 3.3%. Additionally, the average unemployment rate for Q4 was lowered from 4.5% to 4.1%. These upward revisions suggest a potential delay in implementing interest rate cuts as a means of stimulating the economy.

The market’s focus is shifting towards core CPI/PCE, which will play a crucial role in influencing future market trends. In May, core CPI surpassed expectations, rising by 5.3% compared to the previous year, indicating elevated inflation levels. The Federal Reserve Chair has indicated that interest rate cuts would be appropriate when inflation significantly declines. The current discussion revolves around initiating rate cuts two years from now, which has notably reduced market expectations for rate reductions. As economic conditions and policies continue to evolve, it is essential to stay informed about the latest developments to make well-informed financial decisions.

Capital Outflows in the Crypto Market

Over the weekend, the crypto market experienced a significant reduction in liquidity as market makers collectively withdrew, leading to a major sell-off in altcoins. Meanwhile, the US stock market, fueled by AI concepts, continues to thrive and drain liquidity from the crypto market, creating a growing disconnection between the two. This exacerbates the liquidity deterioration in the crypto market, making the current market conditions challenging.

The decline in the crypto market is both the cause and the result of the current situation. Without the ability to generate profits, funds are not being attracted, further worsening the liquidity environment. However, generating profits relies on positive factors such as strong fundamentals, favorable capital conditions, and positive market sentiment. While the crypto market has its own narratives, the stock market, particularly the AI industry, benefits from both narratives and solid profitability. These narratives increase valuation, while improved profitability enhances performance, leading to natural price increases known as the “Davis Double-Killing effect” in stocks.

In contrast, the crypto market lacks substantial performance support and relies mainly on consensus driven by narratives for price increases. When there is a lack of compelling narrative content, combined with capital seeking higher returns in the stock market and regulatory crackdowns, capital easily flows out of the crypto market. This results in a loss of the profit-generating effect. In the absence of significant liquidity relief, our strategy remains focused on reallocating a portion of our altcoin positions to Bitcoin and engaging in opportunistic bottom fishing at suitable levels. We anticipate improved liquidity and a slight improvement in sentiment as prerequisites for a more favorable market environment.

Fundamental Analysis

Net Unrealized Profit/Loss (NUPL) can be interpreted as the ratio of profitable investors. A ratio greater than 0 indicates that investors are in profit, and an increasing trend in the ratio suggests that more investors are becoming profitable. However, the current price phase indicates an increasing number of investors taking profits, leading to an increase in selling pressure and a decline in the ratio.

The current data of NUPL has dropped back into the green zone, which is considered the bottom-fishing zone of the indicator. This validates our previous recommendation within the range of $24,000 to $25,000. The NUPL indicator turns blue only at the true 100% profitable bottom-fishing opportunity, corresponding to Bitcoin falling below $20,000. The three opportunities in 2022 proved to be highly accurate. However, we do not believe that this time it is necessary to fall back into the blue zone. Therefore, we suggest starting to accumulate positions gradually from the bottom-fishing opportunity at $25,000.

Technical Analysis

BTC

After the FOMC meeting on Wednesday, we witnessed a significant amount of selling pressure. Prices dropped below the $25,500 mark for the first time in three months, since the onset of the banking crisis. Initially, this appeared highly bearish, but there was a glimmer of hope provided by the key support level at $25,000 that we had been closely monitoring for the past month. In technical analysis, $25,000 is considered a crucial level of support as it represents a previous high in price. Moreover, being a whole number, it also holds psychological significance.

Analyzing the hourly chart’s price action, we can observe that the price deviated by approximately $200 from the $25,000 support level before bouncing back. Subsequently, we tested this support level again, but buyers intervened and supported the price, resulting in a long wick on the chart. Additionally, we noticed an increase in futures open interest following the drop, indicating the opening of both long and short positions. However, shorts were quickly liquidated, evident by the subsequent decrease shortly after successfully defending the $25,000 low.

While Bitcoin broke the $25,000 mark, the market was testing how much liquidity was below the level. Because prices failed to move lower, it indicates that sellers did not have enough pressure to push prices lower. Consequently, buyers stepped in, leading to a bounce off the support level. Throughout the weekend, the upward movement has persisted, although we are currently encountering resistance at $26,500. This level served as support last month and coincides with a downtrend line where Bitcoin has been rejected four times already.

Our next expectation is for a reclaim of the $26,500 to $27,000 range. If bulls can achieve this, it is likely that the price will hold above this level and not revisit the sub-$25,000 range in the short term, specifically over the next one to two months. It is worth noting that starting from July 1st, Celsius will allow creditors to convert their altcoins into BTC and ETH. This development serves as a positive catalyst for BTC and ETH but may have a negative impact on altcoins, as we discussed earlier.

It is interesting to note that the negative cumulative volume delta (CVD) indicates that there are still more traders selling in the market. This is evident on both Binance and Coinbase spot markets, where we observe a higher number of sellers hitting the bid, as indicated by the CVD. However, on Binance and Bybit futures, we are starting to witness some buyers stepping in and hitting the ask, which is reflected in the CVD.

It is important to highlight that we do not observe an extreme one-sided flow in the market. Therefore, if you have taken long positions from the $25,000 support level, it is advisable to have stops in place to manage your positions effectively.

Flows from Binance

There has been speculation on Twitter regarding whether Binance is selling BTC on the spot market to support BNB prices and prevent the liquidation level of $220 for long-term holders. According to this theory, CZ (Changpeng Zhao), in an effort to avoid liquidation, has allegedly sold off BTC for USDT in order to stabilize the price of BNB. Examining the chart below, we can observe a consistent decrease in cumulative delta, indicating a higher number of active sellers (market orders) compared to buyers.

However, it is noteworthy that on the BNBUSDT chart on Binance, we observe a positive cumulative delta, which is unusual considering the negative news surrounding Binance and altcoins. Conversely, when we look at the BNBUSDT pair on KuCoin, the cumulative delta is negative. This raises the question of whether Binance is indeed selling BTC to support the price of BNB.

Trading Recommendation

Derivatives

Our recommended Buy-The-Dip orders were NOT executed this past Friday as prices bounced strongly before reaching expiry. This could be a good thing or a bad thing, depending on what your trading plan was. For us at Pionex we rather have gotten filled because, as we had mentioned repeatedly, $25,000 is a value level both from a technical point of view and fundamental in terms of the cost of producing a Bitcoin. However, we will also gladly take our 15% – 25% annualized interest while waiting for our fills.

One of our traders used the Pionex futures to gain exposure to the position when buyers were stepping in after the double bottom near $25,000. We would suggest putting 20% – 25% of the portfolio into Bitcoin, around $25,000. Leaving the rest for further Buy-The-Dip orders at lower prices of $23,500 and $22,000.

Based on the current data showing NUPL returning to the bottom-fishing zone, it confirms our previous recommendation within the range of $24,000 to $25,000. Our past advice has always focused on trading only ETH and BTC, as they are the strongest trading pairs with the best future prospects. Now, we can see that our emphasis on quality and risk has been proven to be the correct framework.

Since our previous order was not filled, we recommend investing in BTC buying opportunities with a purchase parameter of $25,000, providing a 5-day investment with an annualized return rate of 17%. If the price of Bitcoin continues to decline, we will place more orders at $22,000 and $23,500.

Trading Bot

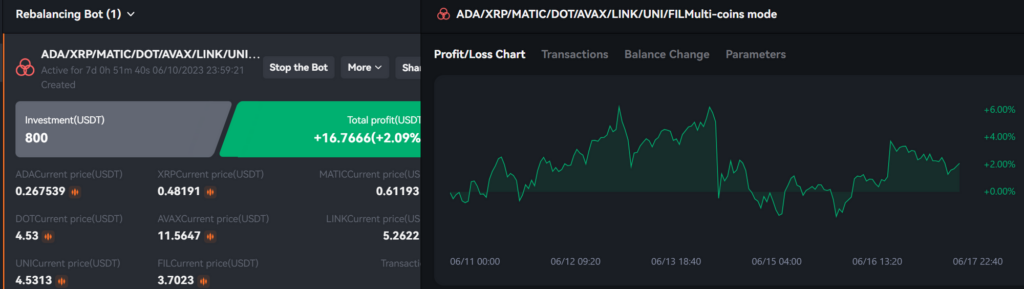

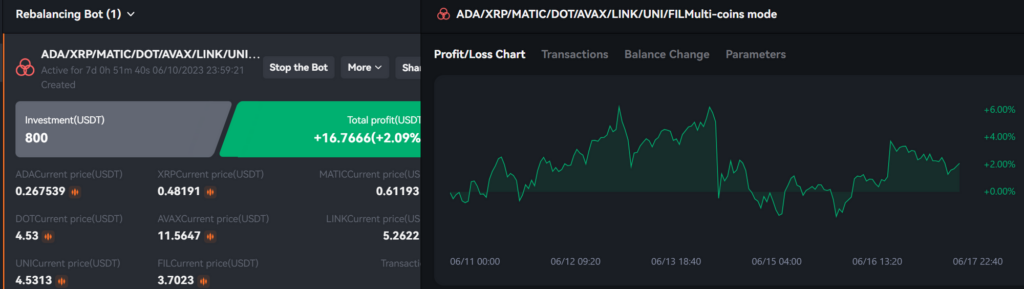

From our perspective, Altcoins appear to be entering a buy zone as they have experienced significant drops in the past week. Specifically, last Saturday saw a 25% drop in Matic and ADA in just one day, with a 50% overall decline since the SEC targeted Coinbase and Binance, classifying several Altcoins as securities. It is important to acknowledge the increasing pressure from regulatory bodies and sell pressure caused by Celsius debtors, as these are factors we consider.

Despite these challenges, we believe that it may not be a bad time to gradually increase exposure to your preferred top 20 Altcoins. To do this, we have used the rebalance bot with equal distributions among our top 8 coins. However, it is crucial to note that there is still a significant possibility of experiencing another 50% drop before reaching the true bottom. As a risk disclosure, we recommend adding only 10% to 20% of your total Altcoin allocation at this moment.