Contents

Benefit for using an Infinity Grid Bot

- More trending profit in the bull market

- Don’t have an upper bound; you’ll always holding some base currency when the price pump.

- Get the trending profit and won’t FOMO buy & sell

What’s the difference between Infinity Grid Bot and GRID Bot?

There’re several different aspects between Infinity Grid Bot and the Normal Grid Trading Bot. One of them is the proportion of the Idle Funds.

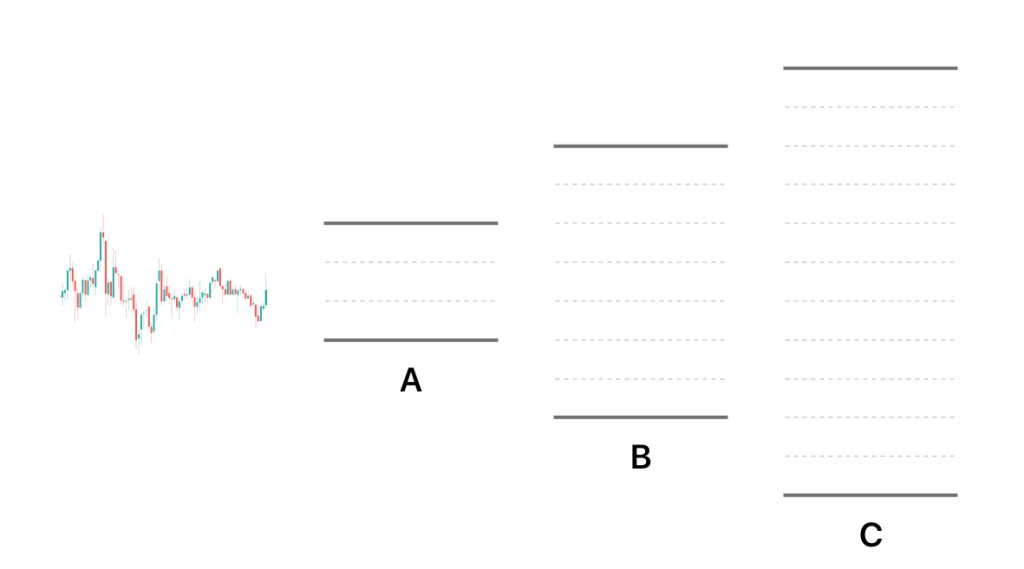

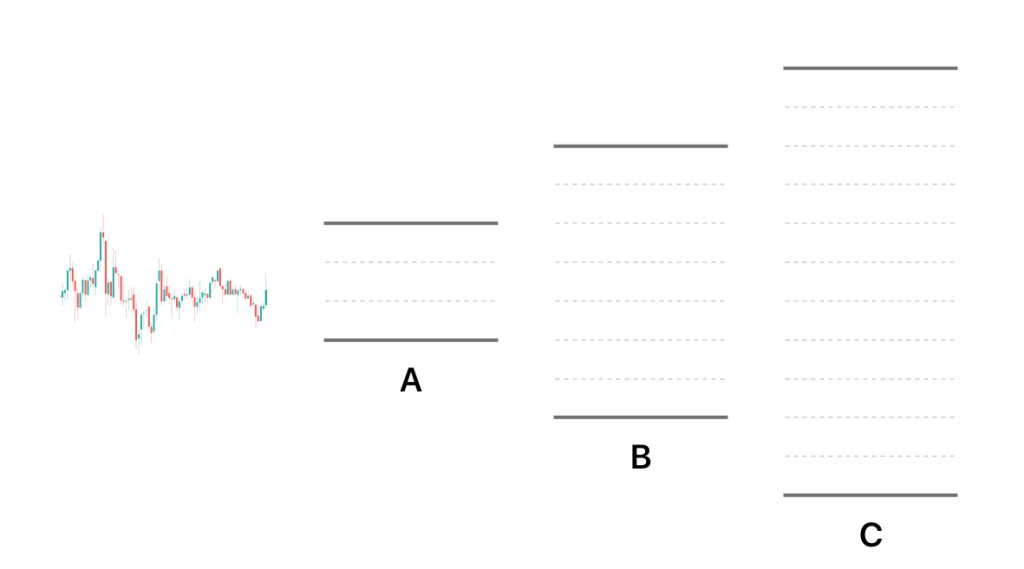

Before digging into it, let’s take a look at the following 3 different sets of configurations with the Grid Bot.

Let’s say all of them have the same amount of total funds in A, B, and C. Here’s a question for you: “If the price keeps fluctuating within a small range, which of the configuration will be the most profitable?“

This is an easy one for an experienced grid bot trader like you; A is the most profitable according to the 3 configurations! When the price fluctuates within that range, Config. A will make more grid profit because of the amount per grid of A is larger than C. In other words, the “Idle Funds” of C is lager than A.

Trade-off: a smaller range helps you to profit from the fluctuation in the short term, while a larger range helps you to seize the trending profit.

Although A is the most profitable one, it’s also easy to exceed its price range. On the contrary, C doesn’t have to worry about the price exceeds its price range compare to A. Especially in the bull run, we don’t want the price to exceed our range and sell everything before the huge pump.

Infinity Grids Bot is one of the perfect strategies in the bull market.

The mechanism behind Infinity Grid Bot is that it doesn’t have an upper limit, but the proportion of its Idle Funds is more than a typical GRID Bot.

When should I use Infinity Grid Bot instead of the typical GRID Bot?

If you’re good at Technical Analysis and a day trader, you could use GRID Bot to catch every fluctuation. But if you’re not a day trader and don’t have that much time on trading, create an Infinity Grid Bot, and waiting for the bull run will be one of the best strategies to deal with your crypto assets.

The use case for Infinity Grids Bot

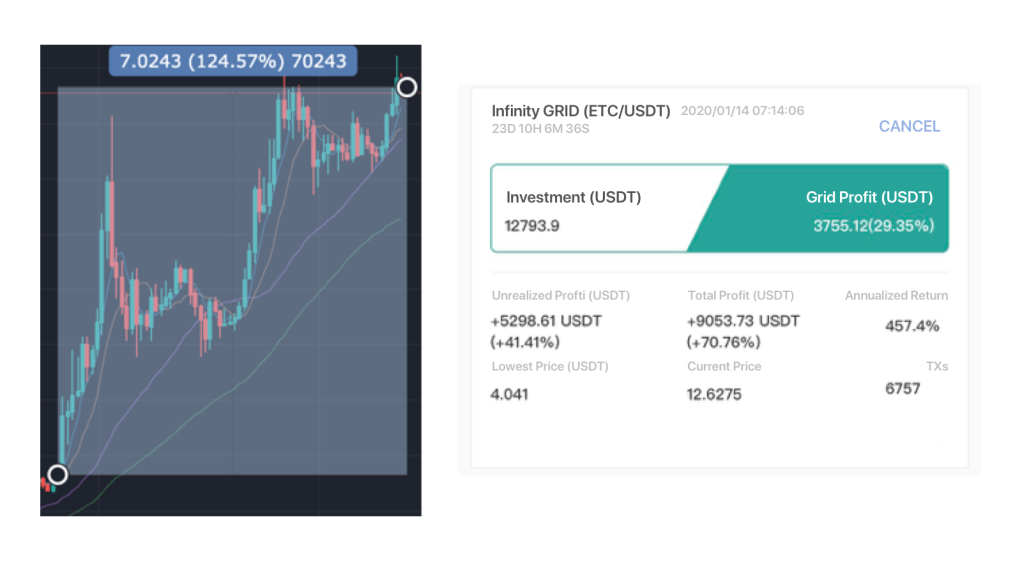

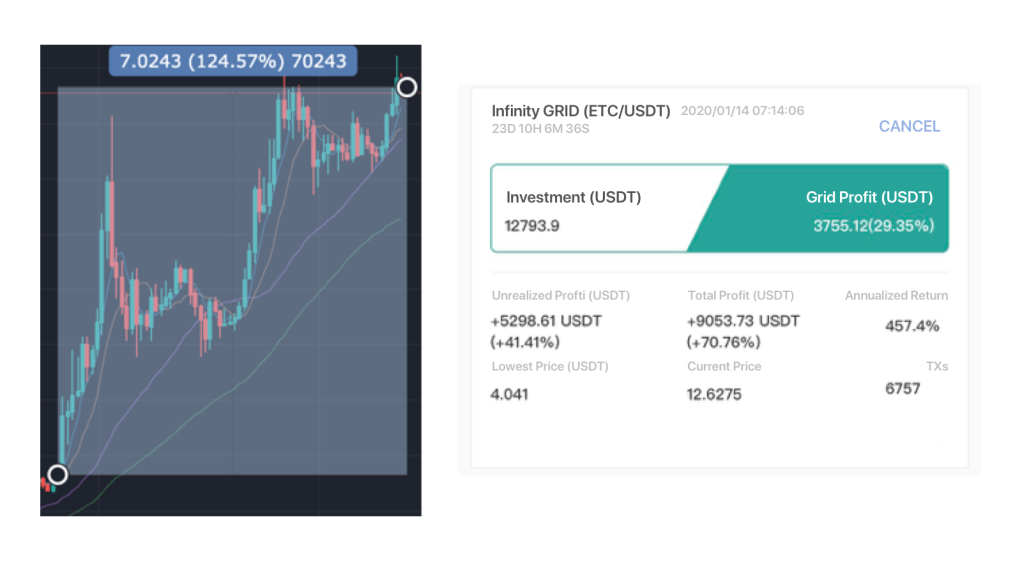

At the beginning of 2020, everyone is talking about halving on several coins. ETC is one of the halving coins, and we have made a good profit with the Infinity Grid Bot on ETC/USDT pair.

As you can see, the price rises 124.57% since the order created. The Infinity Grid Bot made a decent 70.76% total profit by small swing trade and took profit while the price was fluctuating and pumping.

Most of the people might already have FOMO sell while the price pullback, and can’t enjoy the whole trending profit. But with Infinity Grid Bot, our emotion won’t affect that much on our trading cause the bot do all the work for us.

Why should I use Infinity Grid Bot rather than HODL?

Some of you might think that what if I manually bought some Bitcoin to sell them later at a higher price? Then I’d have more profit than by using the Grid Trading Bot Tool. Yes, you can always make more profit if you’re able to buy at the bottom and sell at the top. But in practice, even the very best traders won’t figure out where the lowest and highest prices would be, so it’s unrealistic to think you can easily do that.

Using the Grid Trading Bot helps you to control your risk. It enables you to passively buy small portions when the price goes down and sell small portions when the price goes up. This will make many small, but low-risk profits, compared to the buy at the bottom and sell at top tactic, which can backfire if you guessed wrong.

👉 Start your Infinity Grid Bot on Pionex

👉 Pionex Telegram Group: https://t.me/pionexen