Contents

What is Quadency?

Quadency is a cryptocurrency platform that enables its users to have all-in-one crypto portfolio manager for investors of all level. Founded in early 2018 based in New York, Quadency platform already support huge range of exchanges, including popular exchanges such as CoinBase , BitFinex, and many more.

One big thing to note, quadency is not an exchange. It is simply a platform that connects your account across multiple exchanges into one trading platform named Quadency. You can trade in any exchanges that you have account, connect it into Quadency, and you can manage your trading and portfolio through Quadency.

Quadency Feature Review

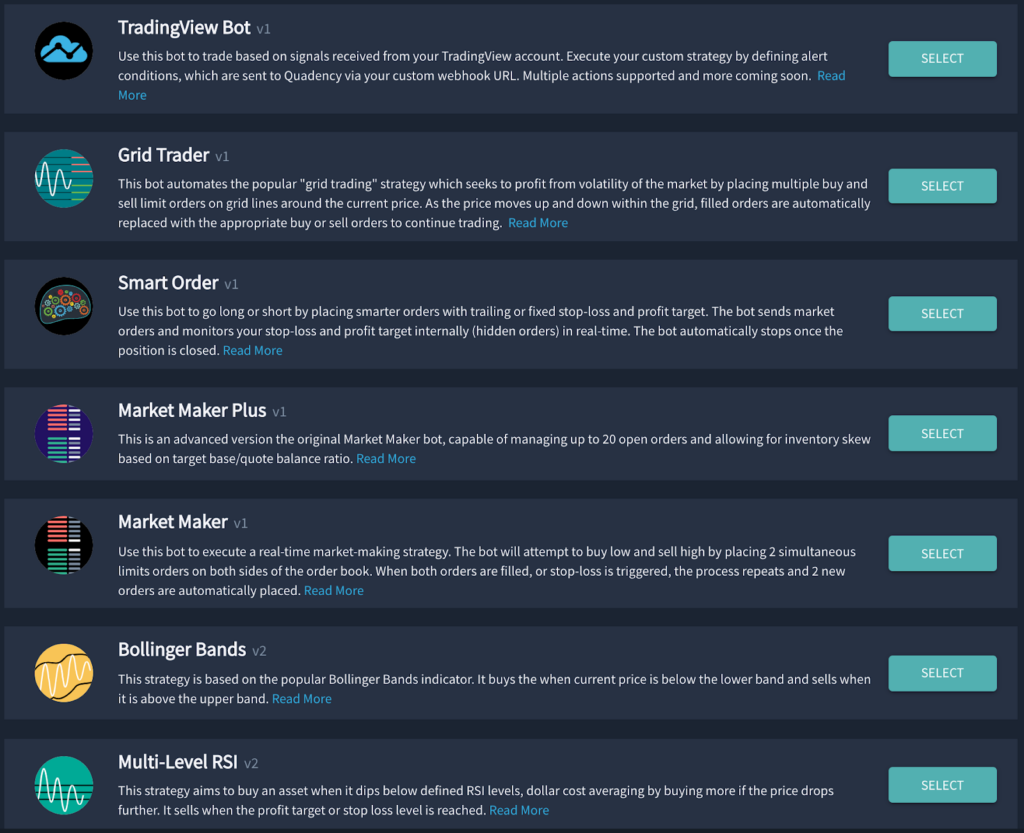

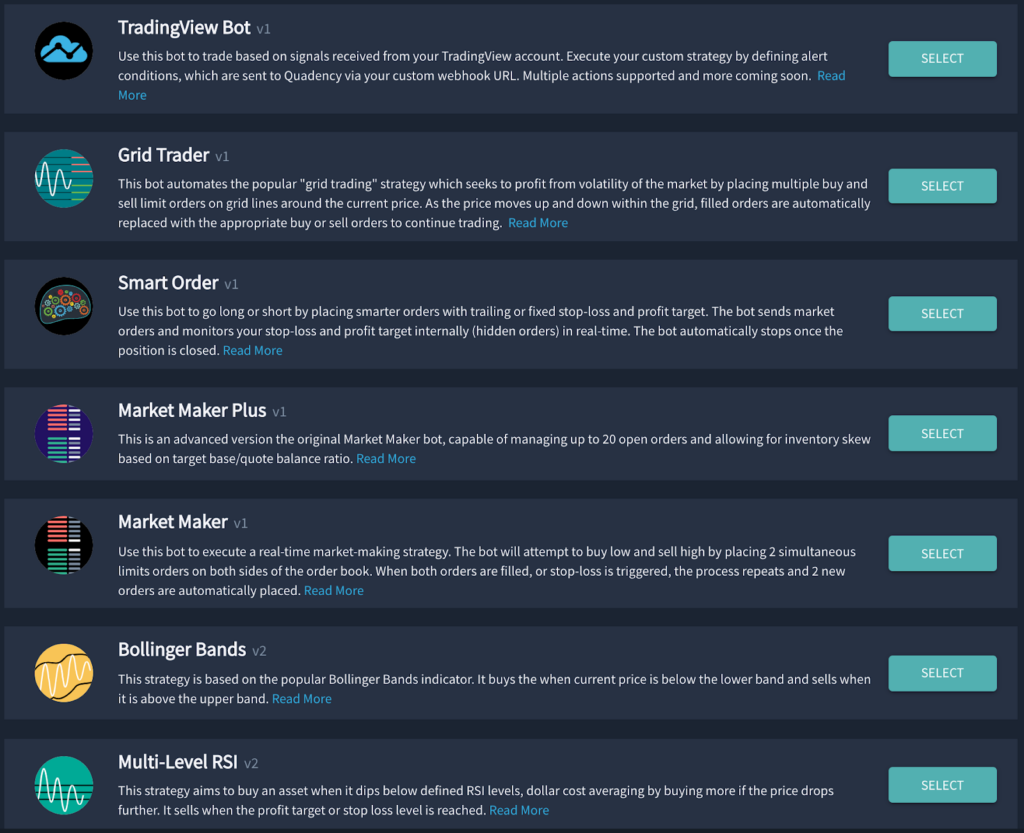

There are 10+ trading bots and strategies that is available for Quadency users to utilize. 5 of them is the most popular being used : Accumulator , Grid Trader , Portfolio Rebalancer, Market Maker, and Smart Order

Quadency Grid Trader

The most popular bot used inside Quadency is Grid Trader. Grid Trader utilize a simple volatility price action of the market to consistently buy and sell in a grid fashion. This will enable trader to catch volatility by buying low and selling 1 grid higher. The more volatility in the market, the more effective this strategy is to catch profits. In a tight distance per grid, it can reach up to 500 transaction per day, which is very huge for a retail traders.

Grid bot mechanism is to trade in a certain range, and then divide this range into several grid. Everytime price crossing this grid, the bot will buy or sell. If price fluctuates a lot, more grid will be crossed , thus leading to more profits for the bot.

Some variables you need to put on to run Grid Bot :

Upper limit price : The last price of your trading range. Usually using resistance

Lower limit price : The first price (bottom) of your trading range. Usually using support

Grid Quantity : How much you want to divide the price range to be

Quantity per Grid : How much you want to put on every trade

Amount for bot usage : Total amount that will be used by the bot

Quadency Accumulator

The other bot Quadency provide to its user is Accumulator bot. This bot is utilizing Time Weighted Averaging Strategies, which help you to buy certain tokens and split the buy order in a certain period. This strategy will enables you to have an average buying price from a certain period, because you will consistently buy the token with a fixed interval.

To understand more clearly, a simple example of accumulator trades is when you want to buy $1000 on BTC. Since you does not sure if now is the right time to buy all $1000, you can use Accumulator bot to buy BTC for the next 1 week. Accumulator will divide your trades and split it based on your parameter, for example you will buy $10 per trades, so it will split the buy into 100 order, and divide 1 week period by 100. It will buy every interval of them.

Quadency Trading Strategies

Quadency provide several strategies to be use for automated trading using technical indicator. 2 of the most popular used is using the Bollinger Bands and Relative Strength Index strategy. There is also MACD strategy which is using moving average convergence divergence indicator that shows relationship between 2 moving average.

In bollinger bands, it will buy when the price below the bollinger bands because it is expected to be supported there and the price contraction is within the deviation, and it will sell then the price moving towards upper bollinger. Meanwhile for RSI strategy, it will buy when RSI is below certain number, and it will sell after it moves to certain RSI number.

Quadency Backtesting

Backtesting is a method to simulate your chosen strategy’s performance before using real money to trades. Backtesting is using historical data, it means it simulates your trading strategy if it was runs a certain period ago, lets say 3 months ago up until now. Backtesting will simulate the estimation of your strategy earning if you run it 3 months before. If it shows a good result in the past, there’s usually a possibility that it will also works in the future as long as the market behaves similar.

Quadency Supported Exchanges

13 exchanges is supported for trading in Quadency Platform.

- AAX

- Bitfinex

- Bittrex

- Coinbase Pro

- Gemini

- HitBTC

- Kraken

- Kucoin

- Liquid

- OKEx

- Poloniex

Quadency Interface

Quadency user interface is quite solid. It covers most of all basic needs for trader to trade. They focused on simplification of trading across your multiple exchange account in one single platform. With built-in price chart provided by TradingView, it has pleasant interface to use for daily trading.

Pricing at Quadency

Up until this article is written, Quadency platform still free to use. You can explore and maximize this opportunity to use their free subscription plan. Even so, they claim will have some monthly subscription in the coming months. Until then, the platform is still free to use !

Comparing Quadency vs Pionex

Pionex

Pionex, known popularly as Crypto Trading Bot Exchanges, is an exchange with 16+ free trading bot provided to its user to help them automize their trades and plans their trade better. Pionex is licensed by U.S. FinCen and Singapore MSB license, making it a trustworthy exchange to trade on. Backed by investors from Gaorong Capital, ShunWei Capital, and ZhenFund with more than 10 million USD in investments.

Fees and Pricing

Quadency is connecting exchanges into their platform. Consequently, the trading fees is following the exchanges, which is around 0.1%-0.3% across multiple exchanges.

Aside from trading fees, Quadency will charge monthly plan in the coming months, so you will have extra “fees” for subscription to the platform.

Pionex has 0.05% trading fees in all market pair. This trading fee is 50% cheaper than the cheapest trading fee on 3Commas. Since trading bot will use a lot of transaction, trading fees is one of the most crucial part if you are trading with high frequency.

Pionex doesnt cost any monthly subscription fees. The platform is totally free. The only fees you pay is for the trading fee, which is already 50% more cheaper than most common exchanges.

Interface and Platform support

Pionex is available in Mobile platform (iOS and Android) and Web version. Meanwhile, Quadency is only available in web version through their website. For some retail traders , most of them preferably use mobile platform right for the ease of access in daily life.

One of difference between them is the updates. Pionex has much more frequents updates into their platform, making better and better User Interface and User Experience. Meanwhile, there isn’t many major updates on Quadency UI/UX. Although interface is personalized experience (every people has different opinion about it), but regular updates is showing how much resources and attention the team put into their business.

Bots and Feature

Grid Trader

You can learn the details about every feature or bots both platform provide in their blogs. This is some overview about what feature and what kind of bots that they provide

Quadency:

Accumulator

Smart Trades

Portfolio Tracker

Backtesting

Pionex :

GridBot

DCA Bot

Rebalancing Bot

MoonBot

Infinity Grid Bot

Leveraged Grid Bot

Margin Grid Bot

Reverse Grid Bot

Leveraged Reverse Grid Bot

Smart Trades

Trailing buy and sell

TWAP Bot

Arbitrage Bot

Martingale Bot (Coming soon)

Bottom line

Quadency

Quadency is a trading and portfolio management platform that enables you to trades and track your account across several exchanges in one single platform. Quadency also provides you with several trading tools such as trading bots, portfolio tracker, and even back-testing tools to check your chosen strategy before you go trade with real money. Keep in mind, connecting your exchanges into 3rd party platform will requires an API Key, which is similar with the key to your house. You need to keep the API Key secret and never give it to anyone else besides yourself.

Pionex is an exchanges with license from US and Singapore. This means that if you want to trade, you need to move the fund into Pionex platform.

Pionex provide 13+ bots with very low exchanges compared to most popular exchanges (50% cheaper than them), making it the most efficient for using trading bot. If you are looking for exchanges with complete feature, Pionex is way to go.