Cryptocurrency is widely hailed as the next big thing, just like the internet before it. Nowadays, more and more people are buying, selling, and trading these tokens that are considered digital assets. Due to it’s relatively new nature and volatile price movements, savvy traders can make a lot of money buying and selling the right tokens at the right time.

However, most traders are unable to turn a profit and execute their perfect strategy due to the emotional stress of trading cryptocurrency tokens. The wide price movements and swings frequently cause traders to buy high and sell low due to fear or greed.

Because of that, many traders now use trading bots to automate their trading strategies. This removes the emotional aspect from their trades and ensures that they’ll always buy low and sell high, thereby creating a tidy profit.

To capitalize on this trend, many firms over the years have built their own trading bot softwares to help traders overcome emotions and execute the perfect trading strategy. In this article, we will discuss one of the leading trading bots on the market today, Shrimpy.io.

Contents

What is Shrimpy?

Shrimpy was founded back in 2018 by Michal McCarty and Matthew Wesly in San Francisco under the name Benthos Lab Inc. The pair wanted to help the global crypto trading community by offering a safe and quick cross-exchange crypto portfolio management platform.

Because of that, Shrimpy was born as a quick and easy way to connect between your favorite exchanges and wallets. Currently, Shrimpy has over 30 integrations with nearly all of the leading cryptocurrency exchange platforms and crypto wallet providers.

If you’re interested in learning more about this nifty trading bot and portfolio management platform, read on!

Shrimpy Features

Shrimpy has 3 main features which include portfolio management, automation, and social trading. We will delve deeper into each feature so that you can get a grasp of what they’re offering.

Shrimpy Portfolio Management

Shrimpy portfolio management is split into two parts, performance tracking and indexing. Shrimpy also has a nifty automation feature but it’s pretty unique so we willl discuss it in depth after this.

Cryptocurrency indexes are simply a set of digital assets, in this case cryptocurrency, that is used to spread out your wealth and reduce risk. Because of the volatility of crypto, indexing is becoming more important for long term traders and investors.

Shrimpy allows you to develop a custom crypto index by choosing the component assets for the index. The weighting of each asset is also very important in determining its resiliency and also its market performance. You can do this by using the in-built tools or choose an automatic weighting in the Shrimpy software.

Now that you have a crypto index, you’ll probably want to track the performance of that index right? Luckily, Shrimpy has a great all-in-one dashboard that you can use to view all of your assets and indexes in your portfolio. This dashboard allows you to stay informed on all of the price movements and appreciation/depreciation of your assets.

The dashboard also allows you to view the historical performance of your portfolio so that you can compare it with your friends or other leading indices. Because of that, you won’t have any problem tracking and maintaining your portfolio.

Shrimpy Automation Features

As we’ve said before, shrimpy has an excellent portfolio management tool. However, what makes it truly excellent is the degree of automation that you can do to your portfolio. If you want to be a hands off investor, Shrimpy allows you to do that. You don’t even have to lift a finger to manage the portfolio after you’ve set up all of the parameters.

In general there are 3 main automation features that shrimpy offers, asset allocation, rebalancing, and backtesting.

Asset allocation for your portfolio is done by picking which crypto assets you want to add to your portfolio and setting its desired allocation. After that, you’re good to go, just don’t forget to set up the rebalancing rules.

Rebalancing is the core of Shrimpy’s portfolio automation. It’s a procedure of modifying your crypto portfolio to respond to market movements, thus maintaining stability and ensuring long term growth.

This rebalancing act is done by making sure that your portfolio weightings match with your preferred asset allocations. If an asset becomes larger compared to the preferred asset allocation (overweight), then Shrimpy will automatically sell them and buy the underweight asset class. This ensures that you’ll always buy low and sell high and maintain a steady stream of profit.

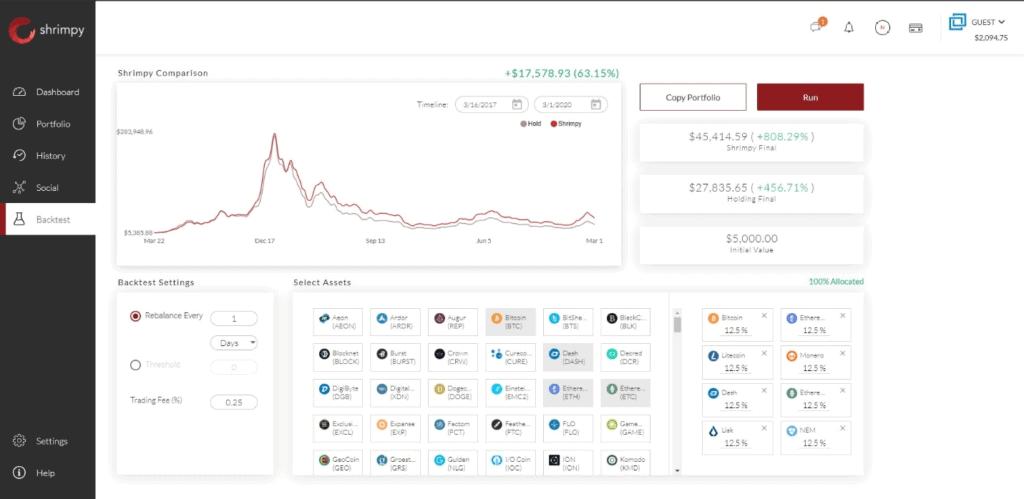

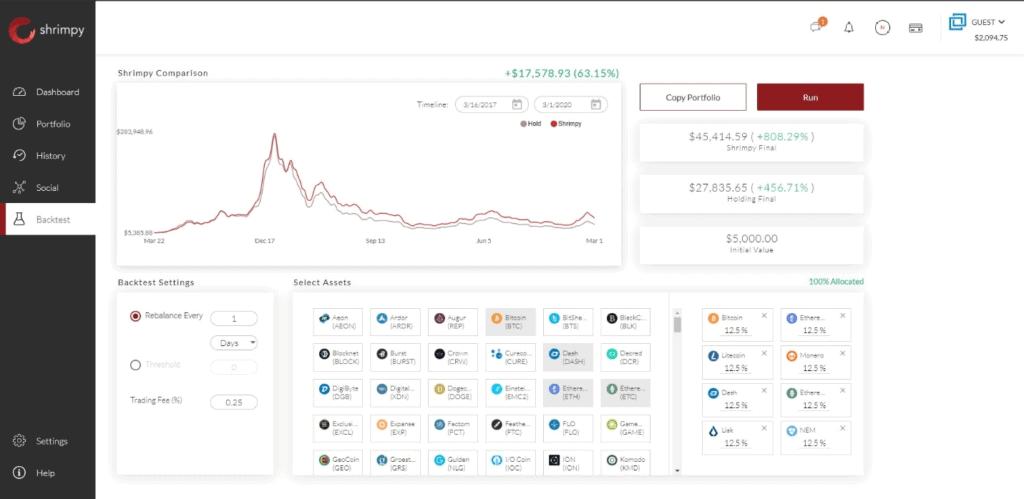

If you’re a serious trader and investor, you wouldn’t want to develop custom trading portfolios and strategies without any prior research right? Shrimpy covers that by offering a backtesting feature. This tool allows you to backtest your preferred asset allocation index with previous market data to ensure it works properly.

Although backtesting can’t predict the future, if you’re a proponent of the efficient market theory, the future will always mirror the past unless there is a force majeure right?

Shrimpy Social Trading & Portfolio Management

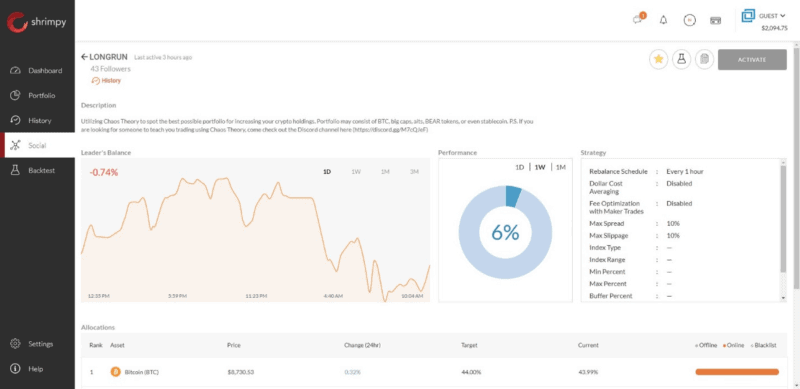

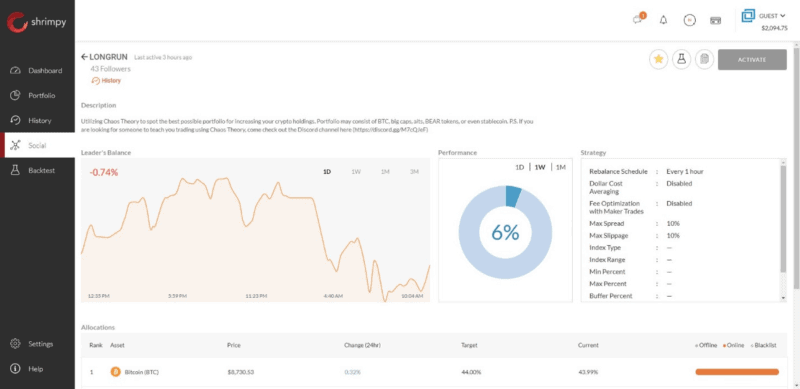

Social trading is a popular concept among crypto traders and investors. This method allows traders to monitor and automatically copy the trading strategies of other (hopefully) more experienced traders. Shrimpy takes this up a notch by offering social portfolio management where you can closely mirror the portfolio composition and trades of the leader.

You can choose from a pool of verified leaders along with their performance history and trading/portfolio management breakdown. When choosing the leader to follow, check their performance history and strategies beforehand. Make sure it aligns with your needs and investment style.

We think this feature is excellent to get newer traders involved and acclimatize them to the strategies used by the pro’s. By watching and seeing them trade and manage the portfolio, you can learn from their strategies and even their mistakes.

However, if you’re a pro trader yourself, you might not need them. Heck, you can even apply to become one of the leaders in Shrimpy if you’re sure enough of your strategy.

Shrimpy Integrations

As we’ve said before, Shrimpy has lots of integrations (really) with leading crypto exchanges and wallet providers. Currently, they have over 30 integrations that allow you to manage your crypto portfolio from anywhere in the world on nearly all of the large exchanges and wallets.

Exchanges Supported by Shrimpy

Shrimpy supports 17 of the largest exchanges in the world which will allow you to easily trade and leverage your crypto assets anywhere and using any exchange. Currently, these are the the exchanges that are supported by Shrimpy

- Bibox

- BitFinex

- BitMart

- BitStamp

- Bittrex & Bittrex Global

- Cex.io

- Coinbase Pro

- FTX & FTX US

- Gate.io

- Gemini

- HitBTC

- Kraken

- KuCoin

- Okex

- Poloniex

Wallets Supported by Shrimpy

Shrimpy also has extensive support and integration with 13 of the largest crypto wallet providers which include

- 1Inch Wallet

- Coinomi

- Ellipal

- Guarda

- Julwallet

- Ledger live

- Metamask

- Rainbow

- SafePa

- Spatium

- TokenPocket

- Unstoppable

How to Use Shrimpy

Using shrimpy is very simple, firstly you just need to sign up and enter the required information to create a Shrimpy account.

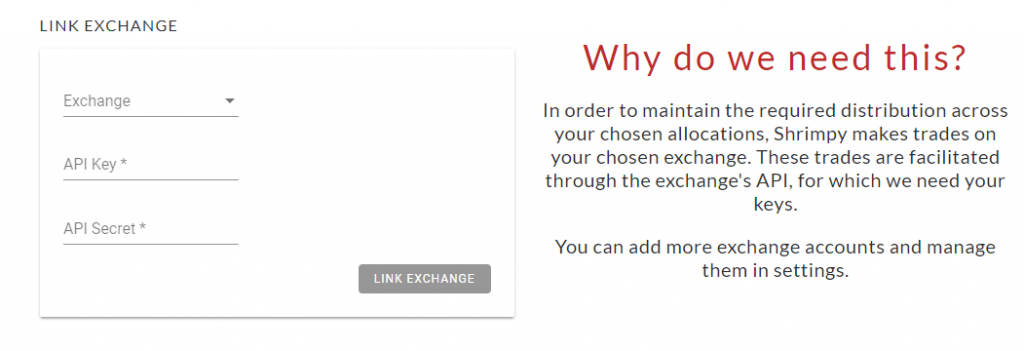

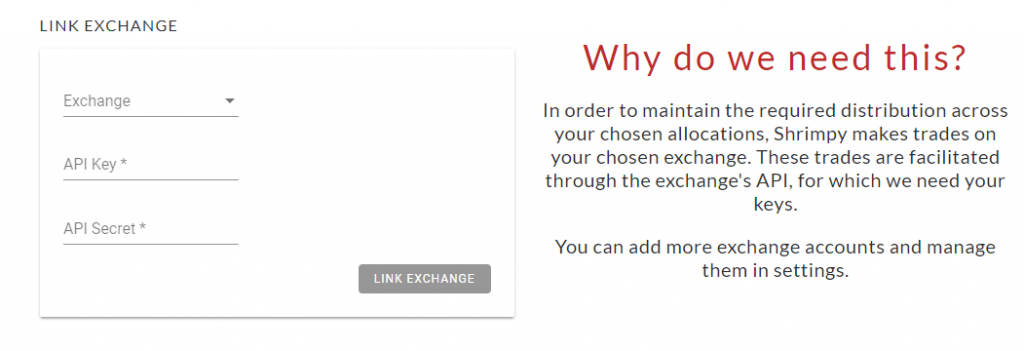

After signing up, you then add your API key for the exchanges that you will use. This is needed so that Shrimpy can make trades on your chosen exchange automatically and is crucial for the automation feature to work properly.

After adding the API key, you can start using Shrimpy as usual. On the dashboard tab to the left, you can get a quick overview of how your portfolio performed over time.

However, the portfolio tab is the most important tab because you can set your portfolio allocation strategy and tell Shrimpy to maintain your allocation at that level. You can include as many coins as you wish and set the allocation according to your choosing.

After that, you can set the rebalancing period for the portfolio. You can tell Shrimpy to rebalance the portfolio on an hourly, daily, or even weekly basis. You can also use threshold rebalancing settings where Shrimpy rebalances after certain market movements. This is a great setting if you hold many volatile coins that quickly rise and fall in price.

If you’re a micromanager, you can even rebalance manually using the Portfolio manager on Shrimpy.

Shrimpy Pricing Scheme

Shrimpy.io has a free version that anyone can use, it also includes a free account/demo account for users to try and get a feel of their crypto trading bots. However, they also have paid membership for following their leaders.

In general, there are 2 types of fees that can be imposed by the leader which are performance fees and AUM (Assets Under Management) fees.

Performance fees are generally tied to the performance of the leader, if they generate good returns, then you’ll pay more money to the leader. This pricing scheme is beneficial because the leader has a big incentive to generate good returns so that they’ll get a larger fee from the followers (that’s you).

Besides leader fees, there is also another pricing method which is the AUM fee. In this pricing scheme, you will pay a flat percentage of your total assets as fees to the leader if you follow them.

This method can result in less fees compared to performance fees, but the incentive for the leaders to outperform the market will be minimal because they will get paid whether they perform well or not.

Besides leader fees, Shrimpy.io will also charge users to follow leaders. That’s right, if you want to follow a leader, you’ll have to pay a flat fee to Shrimpy, and then pay the fees that are set by the leader. Luckily, this fee is usually not expensive and is not recurring, it is simply a one off fee to follow a leader.

Shrimpy Security

Shrimpy offers excellent security for its users. It has a two factor authentication (2FA) and also an API encryption. The tool encrypts all exchange APIs that are currently used, ensuring that if a data breach happens (unlikely), the hacker won’t be able to use the stolen API keys.

However, as we always say, you have to be extra careful when sending or giving anyone access to your API keys, even if it’s a trustworthy institutional platform. You never know when they will be hacked right? Because of that, it’s better safe than sorry

Shrimpy Customer Support

Shrimpy dedicates a small support team to handle customer support and provide quick solutions to the users. You can contact them using email at support@shrimpy.io or simply use their live chat feature. Their response time is quite fast and lots of customers testify that their issues are resolved in a matter of hours after contacting support.

Final Thoughts and Conclusion

All in all, Shrimpy is a great crypto portfolio management software. It can be used by professional and novice traders alike due to its wide breadth of features and easy to use UI/UX design. It also encourages social interaction and learning from experienced traders, although at a cost.

If you want a free alternative that allows you to automate crypto trading but don’t want to pay a fee, take a look at our offering, Pionex! Our trading bots allow you to set up trading bots that automatically execute your trades. You can program them to enact your exact strategy or let them automatically trade using the default settings.

However, if you still need the added authority of a human trader and want to learn more from their trades, Shrimpy is a great crypto portfolio management and trading platform!