Contents

Abstract

- The SEC’s delay in approving the Bitcoin ETF was to be expected; a conservative estimate suggests that it may still take 6-8 months for the Bitcoin ETF to be approved.

- Inflation and the Federal Reserve are no longer the hottest topics in the market; fundamental factors are becoming the primary driving force behind the cryptocurrency market.

- Ethereum and Bitcoin volatility has reached a historic low, and in the near future, we expect a volatility expansion.

- Bitcoin is in its 8th week of consolidation. Last rally/consolidation cycle we had 12 weeks of consolidation before volatility came back.

Macro Analysis

Bitcoin ETF Further Postponed

The U.S. Securities and Exchange Commission (SEC) has extended the review of the Ark 21Shares Bitcoin ETF application by Ark Invest until the final deadline of August 13th, while continuing to review applications from traditional financial giants like BlackRock and Fidelity. The SEC indicated on Friday that it is soliciting public opinions on an amendment in the exchange-traded fund application and has postponed the decision date requiring approval, potentially pushing the overall process into 2024.

The Ark 21Shares fund is considered the first Bitcoin ETF likely to be approved. However, if the SEC does decide to approve, it may choose to approve many funds around the same time. Cathie Wood, CEO of Ark Invest, told Bloomberg News that she expects the SEC to make decisions on multiple funds simultaneously.

The regulatory authority has provided the public with three weeks to weigh the Ark 21Shares ETF proposal itself, while outlining four reasons for non-approval, including:

- Whether a Bitcoin spot ETF could be easily manipulated.

- Whether CME Bitcoin futures are sufficient.

- Is the Bitcoin market resistant to price manipulation?

- Does the agreement with Coinbase contribute to preventing manipulation, and so on.

Bloomberg’s Senior ETF Analyst, Eric Balchunas, pointed out that the SEC’s delay in seeking opinions is a very common occurrence and not an unusual measure, so there is no need to panic. We believe that based on numerous market indications, with a conservative estimate, it might still take 4-6 months for the Bitcoin ETF to be approved.

The next few short-term catalysts we see coming up on the crypto calendar include, Mt. Gox, GBTC, and SEC’s decision on Blackrock/Fidelity ETF application. We think on the ETF decision end it’ll be the same as ARK’s but nonetheless could contribute to an increase in volatility.

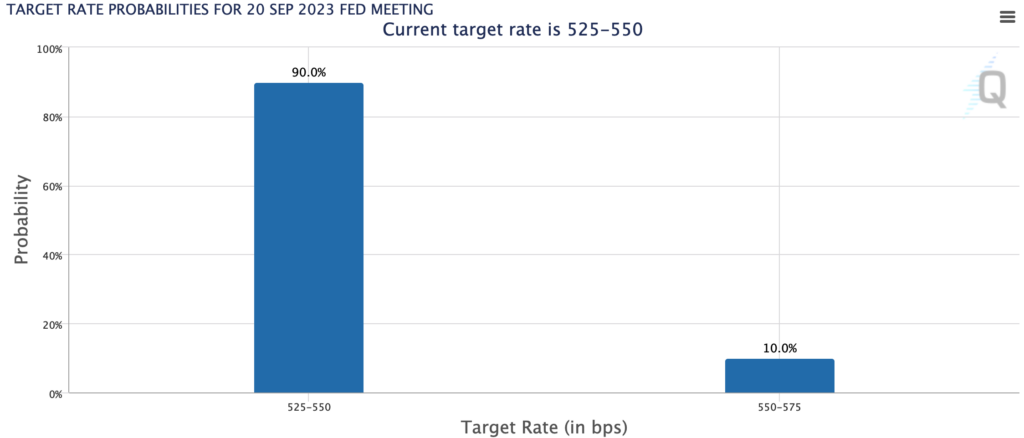

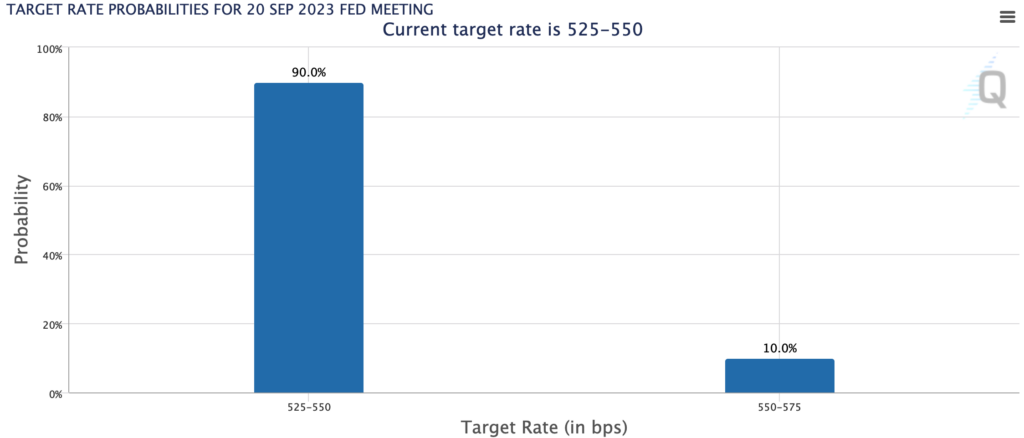

Continued Decrease in CPI

The annualized CPI for the U.S. in July was 3.2%, slightly below the expected 3.3%. Notably, the core CPI had an annualized rate of 4.7%, lower than the expected 4.8%. This marks the lowest level since October 2021. According to CME data, the probability of the Federal Reserve refraining from raising interest rates at its September 20th meeting stands at 90%. We hold a similar view as inflation has been on a steady downtrend with the headline CPI close to 2%. This month’s increase in CPI was focused on the cost of shelter a lagging and sticky factor to inflation. However, according to investment bank Goldman Sachs the increase in shelter prices should be resolving to the downside in the next couple of months and into 2024.

We believe that inflation and the Federal Reserve are no longer the hottest topics in the market. As the progress of Bitcoin and Ethereum ETF applications becomes clearer in the second half of the year, coupled with Ethereum’s technical upgrades and iterations, fundamental factors will continue to be the primary driving force behind the cryptocurrency market.

Fundamental Analysis

Historically Low Volatility of ETH

The volatility of ETH has shown an overall downward trend, and the current level of volatility has hit a record low. Higher volatility is typically accompanied by significant price fluctuations, whereas such low-volatility periods usually do not persist for more than 3 months. We believe that the current pattern indicates the possibility of more volatile price movements in the near future. To take advantage of the current low volatility we would recommend buying volatility aka using lottos.

Technical Analysis

BTC

Given the historically low volatility, our strategy of trading failed breakout reversals within the Bitcoin range has shown itself to be profitable. As we’ve highlighted over the past month, any unsuccessful breakouts or breakdowns at $29,000 and $30,000 could be capitalized upon through short-term reversal trades (Link).

In the previous week, we observed the price reclaiming $29,000, resulting in a swift 3% profit with the take profit set at $30,000. Subsequently, there was a clear failed breakout at $30,000, and if the short trade from the mentioned plan was executed, it would currently yield a 2.44% profit without leveraging. This demonstrates the effectiveness of our approach in these market conditions.

We are now entering our eighth week of consolidation. In the previous cycle, we experienced approximately 12 weeks of consolidation before a fresh narrative emerged, breaking us out of this phase. A comparison between today’s and last week’s charts reveals a striking similarity. Both show a rally toward the $30,000 resistance, followed by a failed breakout and a gradual descent toward the $29,000 support.

Nevertheless, if we manage to maintain a position above $29,000, this could signify a short-term higher-low, which is generally a bullish indicator for Bitcoin. However, it’s important to note that this is not yet confirmed, and we require additional evidence and sustained time above the $29,000 level to solidify this perspective.

In such times of consolidation, it becomes progressively more challenging to engage in short-term technical trading, as the market tends to exhibit erratic movements within the consolidation pattern. This can result in traders being easily caught in the midst of this consolidation activity.

ETH

ETH has been showing weaker performance compared to BTC. In the most recent rally, it failed to surpass the previous high, unlike BTC, which managed to do so. Both cryptocurrencies were rejected at the 50-day MA, but BTC displayed signs of potential breakthrough, while ETH lacked the same momentum. One positive aspect is that we are still maintaining a position above the $1,800 support level, which is acting as a higher-low.

When examining ETH’s technical outlook, it appears to be even more unfavorable than BTC’s. While there’s at least a trading range visible on BTC, ETH’s chart displays a messy consolidation with no distinct levels. Given this situation, we advise refraining from engaging in any short-term technical trading on ETH. Instead, it’s recommended to utilize structured products to establish a position around the $1,800 mark. This approach can offer more stability and a strategic way to navigate the current market conditions.

Trading Recommendations

BTC

If you followed our recommendations, either the aggressive or conservative approach, both turned out to be successful as they concluded without any execution. In the case of the $29,000 strike buy-the-dip strategy, an impressive 46% Annual Percentage Yield (APY) was attained, and the process concluded smoothly without encountering any problems.

For aggressive traders this week, our recommendation remains the BTC Buy-the-Dip at $29,000, carrying a duration of 3 to 4 days and yielding 34%. While this yield is slightly lower compared to last week, we still consider it a favorable risk-to-reward opportunity. Nevertheless, it’s important to note that we anticipate increased volatility in the upcoming weeks, and thus we advise approaching this opportunity with caution.

For traders adopting a more conservative stance, our suggestion is to consider the BTC Buy-the-Dip approach at $28,000, spanning a timeframe of 6 to 13 days and offering an annualized return rate ranging between 7% and 13%. Should the Bitcoin price exhibit further decline, we will also contemplate potential purchases within the $27,000 to $27,500 range. This approach seeks to balance cautiousness with the potential for favorable returns.

ETH

Regarding Ethereum, we recommend utilizing a position size of 10% to 20%, purchasing the ETH Buy-the-Dip at a price of $1,800 with a duration of 4 – 13 days, yielding an annual return rate of 18%-24%.