Contents

Abstract

- Strong macroeconomic fundamentals provide some support for a more aggressive path of interest rate hikes, which strengthens the short-term upward momentum of Bitcoin.

- The impact of the Federal Reserve on the cryptocurrency market is expected to gradually diminish, and the target range of $35,000 to $36,000 remains promising.

- XRP’s Partial Legal Victory Sparks Expectation of Altcoin Rally, Opening the Door to a Flourishing New Bull Market Era.

- Regarding the Ethereum/Bitcoin currency pair, the 0.061 level is nearing the bottom, making future grid bots a great tool to consider.

Macro Analysis

CPI Reports Extremely Positive News

The highlight of this week undoubtedly goes to the highly anticipated U.S. Consumer Price Index (CPI) data:

- In June, the CPI increased by 3% year-on-year, which is lower than the market’s expectations of 3.1% and the previous reading of 4.0%, marking the lowest level in the past two years.

- The month-on-month CPI for June rose by 0.2%, falling below the market’s forecast of 0.3% and the previous reading of 0.1%.

- The core CPI for June increased by 4.8% year-on-year, also lower than the market’s expectations of 5.0% and the previous reading of 5.3%. The U.S. Bureau of Labor Statistics predicts that core inflation will continue to decline in the coming months.

After the data was released, the U.S. Dollar Index (DXY) continued its decline, witnessing the most significant single-day drop since January 2023. Concurrently, U.S. Treasury bonds, gold, crude oil, and the U.S. stock market all experienced gains simultaneously. We believe that the unexpectedly subdued CPI data has led to reduced expectations of further tightening by the Federal Reserve. As a result, this has bolstered the short-term upward momentum of cryptocurrencies.

XRP is Not a Security

As we discussed last week, it seemed that the timing of a potential crypto breakout was approaching, given the historical price action. Confirming these expectations, Ripple achieved a significant victory on Thursday in its case against the SEC, as the judge ruled that XRP is not considered a security. This development has become a robust fundamental catalyst, driving up prices, especially in the altcoin sector, as the news directly pertains to the security status of altcoins.

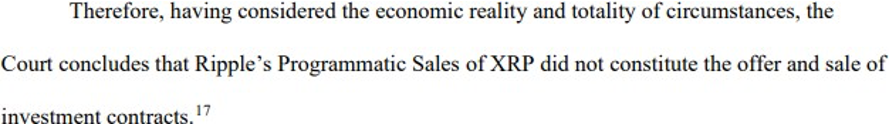

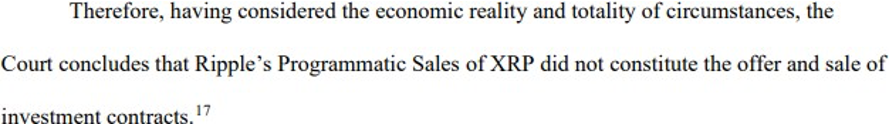

In a brief summary of the case, Judge Analisa Torres concluded that the programmatic sale on exchanges did not fulfill the third prong of the Howey test. Sales to users via exchanges are deemed acceptable as long as they occur through an order book system and not on platforms similar to ICO/Launchpad.

This has significant importance for Altcoin, as XRP was known for being built on a more centralized foundation, which granted them complete control over the XRP network. With XRP now not considered a security, it becomes highly likely that many other assets, which were previously labeled as securities by the SEC just a month ago, might no longer fall into that category. As a result, we may witness exchanges in the United States relisting those altcoins.

In fact, we can already observe several altcoins recovering from the sell-off that was prompted by the SEC lawsuit. For instance, Ada has surged by 20%, MATIC has increased by 20%, SOL has risen by 17%, and more. There is a strong possibility that these assets will reverse back to their pre-securities label prices as the market adjusts to this new development.

Technical Analysis

Bitcoin

After the positive outcome of the XRP lawsuit, Bitcoin experienced a sympathy rally. However, this rally failed to sustain itself, which is raising concerns. Currently, we are in the third week of Bitcoin’s consolidation range, as mentioned in our previous update. Historically, Bitcoin tends to break out of such ranges after 2 to 3 weeks. However, this time, the direction remains uncertain. To gain clarity, we need to monitor whether Bitcoin can surpass the $31,500 level and maintain its position above it. If it achieves this, there’s a strong likelihood of further upward movement, and I anticipate a target range of $33,000 to $34,000 for this rally.

The recent news-driven rally in Bitcoin is raising concerns due to its lack of strength. Normally, we expect clear positive momentum when positive developments occur in the crypto market. However, the rally showed weakness, as evidenced by the significant sell-off that followed the news. This has us worried about the strength of buyers in both Bitcoin and Altcoins.

Currently, our focus is on the crucial $30,000 level, which is a significant whole number that initiated the previous rally and also served as support within the trading range. If we fail to hold this level, there’s a high probability that prices will continue to decline. Such a scenario, where positive news fails to sustain the rally and leads to a breakdown of the level where the rally began, would be a notable sign of weakness. In that case, we need to be cautious, as the next significant support level would be around $28,500.

Ethereum

ETH has outperformed Bitcoin significantly, mainly because Bitcoin was already determined not to be a security, whereas ETH had some uncertainty surrounding its classification. However, with the recent XRP judgment, the likelihood of ETH being labeled as a security has diminished considerably.

As we mentioned last week, our preference was to witness a higher low formation around the $1,830 level, and that is precisely what occurred. The ETH chart looked picture-perfect as it retraced to the critical $1,830 zone, establishing a higher low and subsequently breaking over the previous high to create a higher high.

ETH appears to be extremely bullish based on the daily and weekly charts, with the pattern playing out favorably. Barring negative news releases, the rally is expected to continue, targeting a break of $2,100 and potentially reaching $2,300. Looking at the ETH options skew, traders anticipate a bullish move in the next week, as call options are priced higher than protective puts. However, caution remains evident in demand for downside protection in one month’s time, indicating a more reserved outlook for the medium term. Overall, while short-term sentiment is positive, potential traders should remain vigilant about any sudden negative developments that could impact market dynamics.

ETH/BTC

As we anticipated, the ETH/BTC pair has outperformed, establishing a higher low and successfully surpassing the previous high. Based on our analysis, we believe that ETH’s outperformance will persist, thereby contributing to the formation of an uptrend for the ETH/BTC pair. This presents an ideal situation for utilizing the futures grid bot on this particular pair.

According to our perspective, we expect to witness bursts of outperformance from ETH, followed by periods of sideways consolidation. This pattern of action aligns perfectly with the grid bot’s strategy, allowing it to execute arbitrage trades effectively.

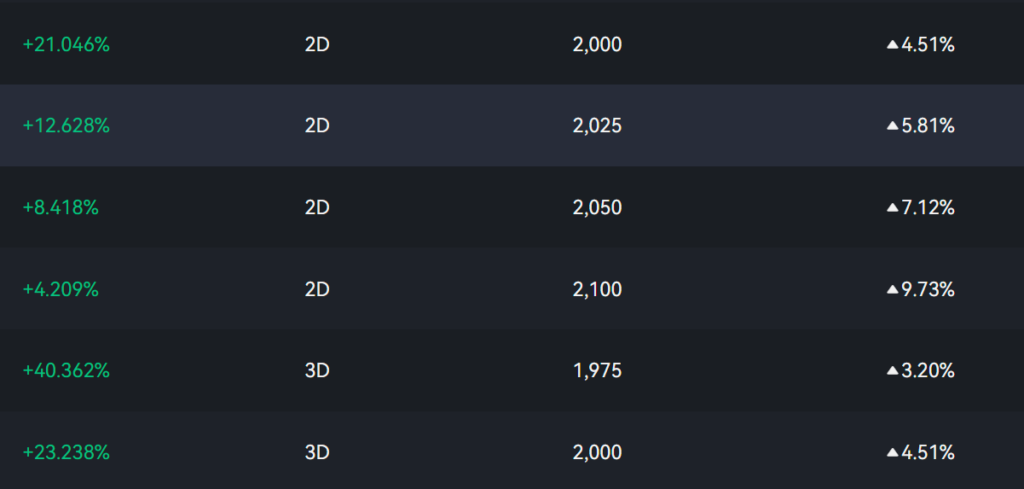

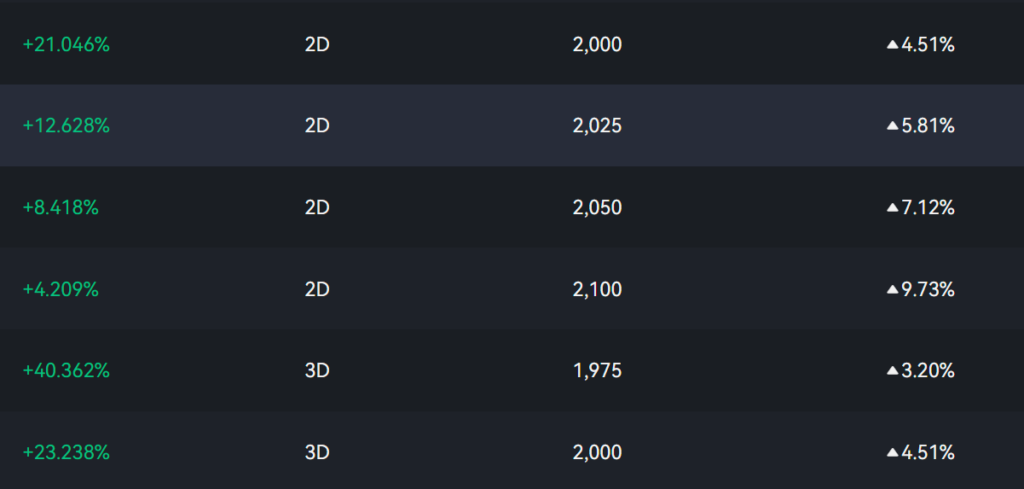

We started our Futures Grid Bot when we mentioned it around 2 weeks ago, as we believed the 0.061 level was nearing the bottom with BTC outperformance waning. Check out the performance below.

Trading Recommendation

Bitcoin

Continuing from our previous advice, consider utilizing the take-profit feature in Pionex’s dual-currency financial products. For Bitcoin, if your position is overweight, it’s advisable to take profits on 10% to 20% of your holdings. You can choose a product with an expiration date of 2 to 3 days and a target price of $31,000, which can offer an annualized return of 27% to 37%.

If you are more willing to hold tokens for higher potential returns and also want to take the opportunity to buy at a lower price, we recommend choosing a product with an expiration date of 6 days and a target price of $32,500. This offers an annualized return rate of over 13% and provides stable and substantial returns in Bitcoin terms.

Ethereum

Regarding Ethereum, due to XRP’s partial legal victory giving us more hope, we recommend adopting a strategy of accumulating tokens and increasing your Ethereum holdings using the ETH take-profit feature.

If you also wish to earn more coins at relatively higher levels and wait for opportunities to buy at lower prices, we suggest selecting a product with a 2-day expiration and a target price of $2,000. This corresponds to an annualized return rate of around 23% and can provide very stable returns in terms of coin accumulation.