Contents

Summary:

- Rising oil prices for two consecutive weeks have exacerbated concerns about inflation, pushing up US bond yields and further boosting the dollar to its highest level in nearly six months

- We still believe that the Cancun upgrade at the end of the year and significant improvements in the fundamentals will be the focus of the market before the approval of the ETF

- On-chain data NUPL shows that the current price is suitable for initiating spot dollar-cost averaging, gradually reducing costs

- Bitcoin has relative strength over Ethereum and we recommend focusing on trading it instead of Ethereum.

- The crypto market is quiet except for rotating altcoin pump and dump manipulation.

Our View: Crypto is Under Pressure in the Short-Term

U.S. government bonds soared, with both short-term and long-term yields rising sharply. Specifically, in August, yields on 10-year and 30-year U.S. government bonds reached their highest levels since 2007 and 2011, respectively. Interest rates on short-term bonds, including 1-year, 2-year, and 5-year notes, also remained elevated after months of stagnation. In addition, bond yields in other countries, such as Japan and Germany, also remained elevated. Such high risk-free yields will definitely take away a large amount of risk capital, and considering that the ETF may take some time to pass, the crypto circle’s total returns are still low, and it will still take time for financial prosperity, so crypto assets are under pressure in the short term.

Bitcoin is experiencing historically low levels of volatility and trading volume. This has resulted in a sluggish price performance. On August 15, the Pan-European Exchange launched the Bitcoin Spot ETF, but there was little market reaction to the news. The negative price reaction to positive news indicates that a bottom has not yet been reached. When Bitcoin crossed $30,000 in the midst of the Blackrock ETF story, we recognized it as a weakness. Bitcoin failed to rally despite the most positive news we had this year. The same thing is happening now: We had a good win in the Grayscale court case, but due to the disappointing news of delays from the SEC, we gave back the entire run-up. The delay news should have been priced in, but we still had a dump, which reflects a weak market. This is in line with our belief that the U.S. Treasury market is also putting pressure on the crypto markets.

Fundamental analysis

Good Time to Invest

The NUPL data on-chain indicates that the price of Bitcoin has not yet hit rock bottom, but it is an opportune time to open a spot position for the long term.

Net Unrealized Profit/Loss (NUPL) is the difference between the unrealized profit and the unrealized loss determined by assessing if the investment in the current market results in a profit or loss based on the timing of trades on-chain. A smaller NUPL value indicates a safer time to buy Bitcoin, while a larger NUPL value implies more risk associated with buying Bitcoin. Combining the graphs reveals that the NUPL value’s low point often coincides with the low stage of Bitcoin price, while the high point of NUPL value often aligns with the high stage of Bitcoin price. Buying the bottom is possible when the NUPL reaches the red zone, whereas selling becomes more favorable when the index reaches the blue zone. The other colors represent values within the range. Currently, the index has dropped back down to the orange zone. Based on past trends, it’s likely that Bitcoin’s price will remain in the orange zone before eventually rising to the yellow zone. Therefore, while it may not be the best time to buy at the absolute bottom, according to NUPL, the current price is already very attractive for investment.

Macroeconomic Analysis

Inflation Expectations Strike Again

OPEC+ members Russia and Saudi Arabia have decided to extend production cuts to stabilize oil prices. Oil prices hit a new high 10 month high when this news came out. WTI crude oil increased by 7% within two weeks; Brent crude oil passed the $90 mark, jumping more than 8% within two weeks.

The significant increase in oil prices suggests that inflation will continue to impede the U. S. government, and the Federal Reserve’s high-pressure monetary policy cannot be withdrawn as expected. As a result, the market has reevaluated its expectations for the Federal Reserve’s interest rate hike, leading to a sustained increase in interest rates. The 10-year U. S. bond yield has also risen to 4.27%, its highest level since 2007. The increase in US bond yields is driving the dollar to its highest level in almost six months, signaling the peak of the year.

The phenomenon of “if dollar rises, then everything else falls” has again become the theme of the market, with crypto asset prices falling again.

Technical Analysis

BTC

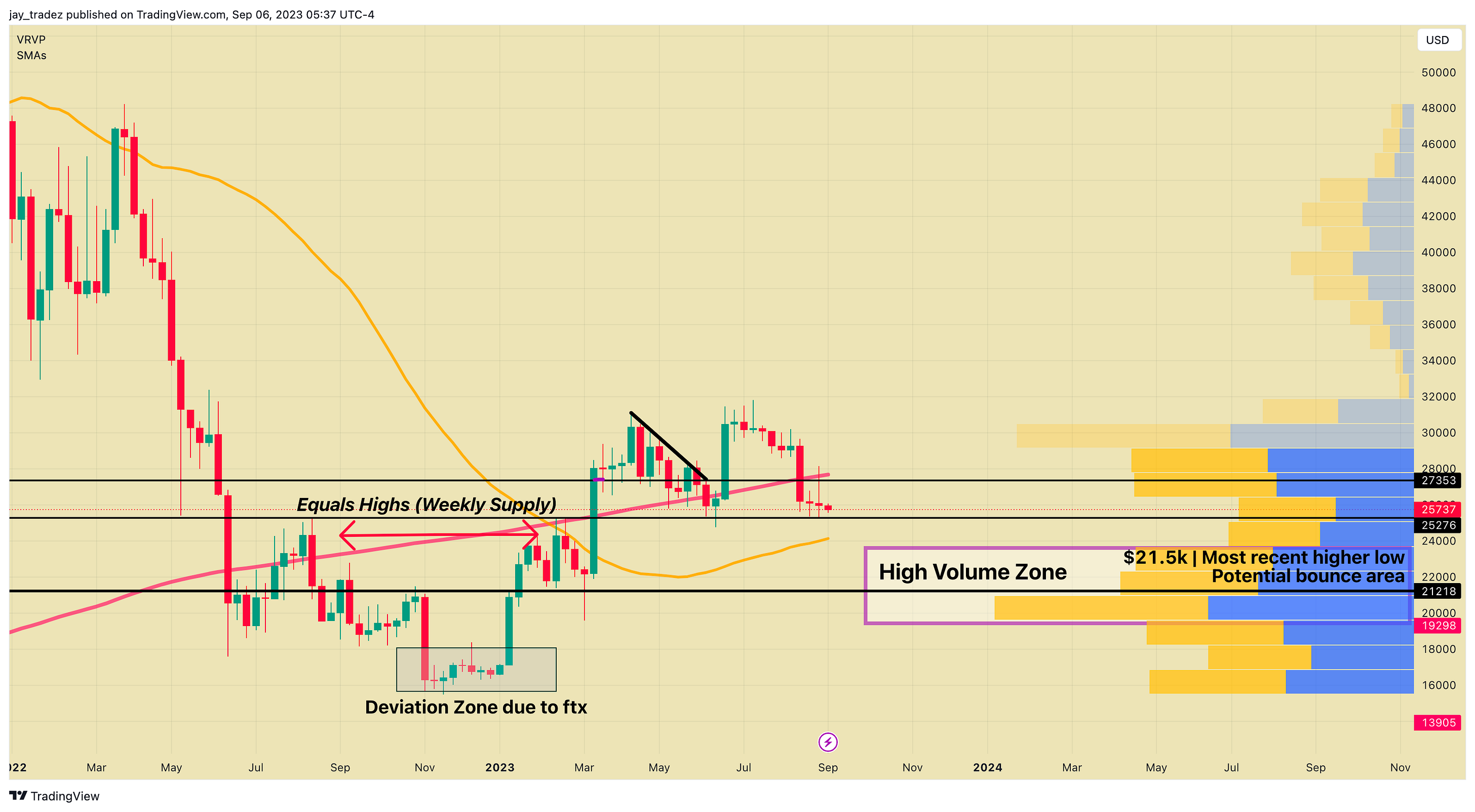

Our previous perspective remains accurate, as we stated that the recent Grayscale victory did not cause any significant short-term shifts. Therefore, we did not pursue this trend. If you followed our research, you would have been aware that chasing the $28,000 resistance was unwise. Traders who disregarded the technical levels and pursued it suffered losses and were liquidated, due to Bitcoin retracing the entire upward move. See below for the charts shared last week and the outcome this week.

Going forward we don’t see any clear indication of direction just that $28,000 – $28,500 confirmed as strong resistance and $25,000 as the first area for buyers with everything underneath being a high volume transaction zone, with special importance given to $21,500 and $23,000. With the clear weakness displayed last week with the positive news it only solidified our view and we place more likelihood that we will get a break under $25,000. Unfortunately from the chart there is no insight to the long-term direction or trading set-up at the moment. We hold the same view as last week: bearish biased consolidation.

ETH

There hasn’t been much change in the ETH market. It attempted to regain support at $1,650 but failed and closed below that level, even after Grayscale’s win. This confirms the weakness of ETH compared to BTC, and the strength of the resistance at $1,650. Our recommendation is to prioritize BTC, as ETH is relatively weak, having fallen below its June low and looks structurally worse. It would be a welcome sign of strength if it could regain the $1,650-$1,700 daily and weekly range. To sum up, the market appears weak as a whole and since ETH is weaker than BTC both technically and narratively, it’s hard to argue in favor of trading it.

Altcoins

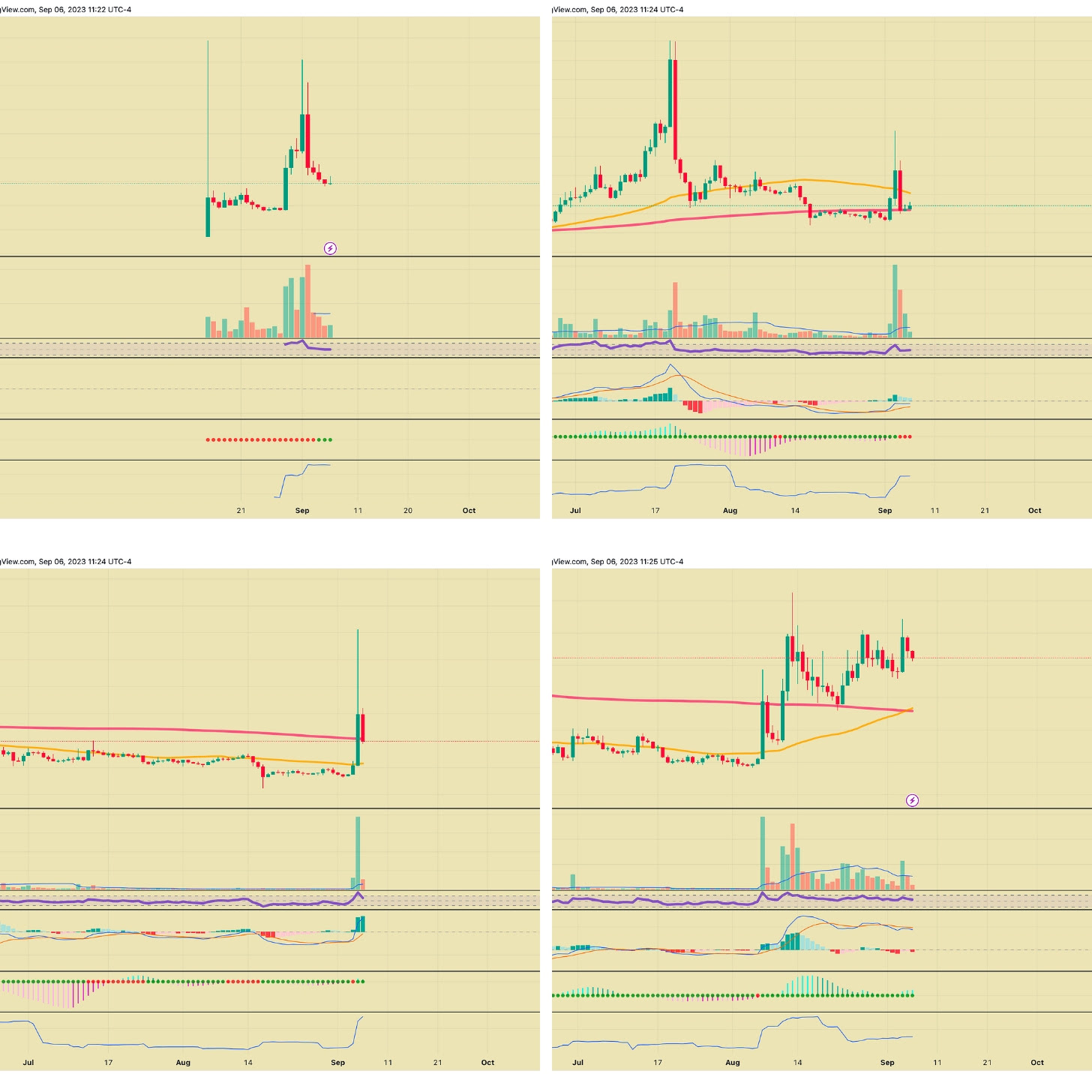

We noticed an interesting trend on altcoins recently. Coins have spiked out of the blue with huge volume and no real news behind the rally. Some of these coins include $AGLD, $BLZ, $LPT, $CYBER and $FLM. Most if not all of these coins have under 50 Million in market cap and recent daily volume on the day of the spike have been near or over its total market cap. Seems like whales are taking advantage of the low liquidity and manipulating the price of these coins. We don’t support these pumps and they are the reason regulators are skeptical about pricing manipulation in Crypto.

Trading Recommendations

Bitcoin

Because the index and volatility are both falling, and in conjunction with the NUPL we recommend that users start a manual investment program and choose a $25,000 plunge bet to invest in Bitcoin cash with a 1-2 day investment period and an annualized return of 24%~33%. If the price of Bitcoin continues to fall, we will buy at $23,000.

For those with Bitcoin right now we would use covered-gain to generate interest on your coins. We have a high-confidence that prices will consolidate and not break-over $28,000 in the short-term. So generating 8% more Bitcoins yearly is an attractive offer currently.

Ethereum

Due to the Cancun upgrade and ecological improvements such as layer2 at the end of the year, we believe it is still possible to outperform Bitcoin in the second half of the year given ETH’s relative weakness. For ETH we continue to recommend a 1-day investment of 39% using a 5% – 10% position size to buy ETH at $1,550.