If you’d like to generate a tax report for your crypto transactions, or simply view how much you’ve made on Pionex this year, CoinLedger is a great, easy-to-use option. With CoinLedger, calculating your crypto taxes is simple. Follow the steps below to import your Pionex transaction history into CoinLedger, or check out this link to sign up.

Step 1:

First, log in to your Pionex account from the mobile app or website.

Step 2:

Next, import your transactions from any of the exchanges you have connected to your Pionex Trading Account. CoinLedger supports the following exchanges which can be connected to Pionex (click the hyperlinked guides for instructions on importing these into the CoinLedger app):

Step 3:

Once you’ve copied over your API Key and or/Secret, navigate to the CoinLedger app. Next, head to Step 1. Import. Select Add Account then choose the exchange which you’ve connected to Pionex. Click on Auto-Import then enter your API Key/Secret into CoinLedger. Click Connect, and your transactions will automatically import.

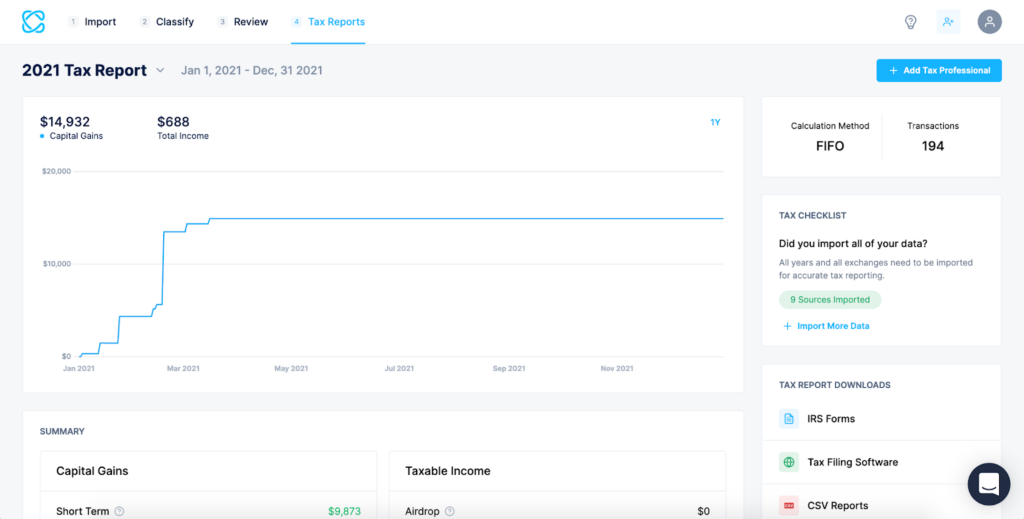

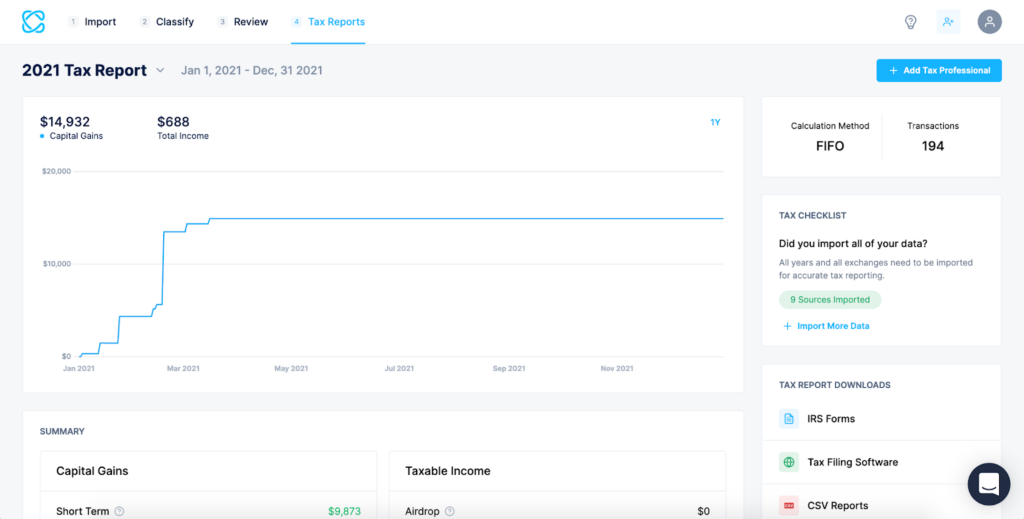

You can then download your complete capital gains and losses information to file with your taxes.

If you have any questions or concerns about your import, head over to CoinLedger and reach out to their Support Team at any time!