Mark price refers to the estimated true value of futures contracts. It takes into account the fair value of an asset to avoid unnecessary liquidations during periods of market volatility. Perpetual futures contracts use mark price as the trigger condition for liquidations.

The mark price is different from the last price. The last price of a contract refers to the latest transaction price, which means the most recent trade determines its last price. A helpful analogy to understand this is: the mark price is like the average price per gallon of gasoline in the entire country, while the last price is the price you pay per gallon at a specific gas station near your residence.

Calculation of Mark Price

The index price is a major component of the mark price. It is the weighted average of the underlying asset (the spot) on major spot exchanges. Unlike the last price, the index price references the prices of the spot asset on various exchanges, including but not limited to Pionex, Binance, Bitfinex, Gate.io, OKX, Coinbase, Huobi, and MEXC.

Mark Price = Index Price + Moving Average of Basis

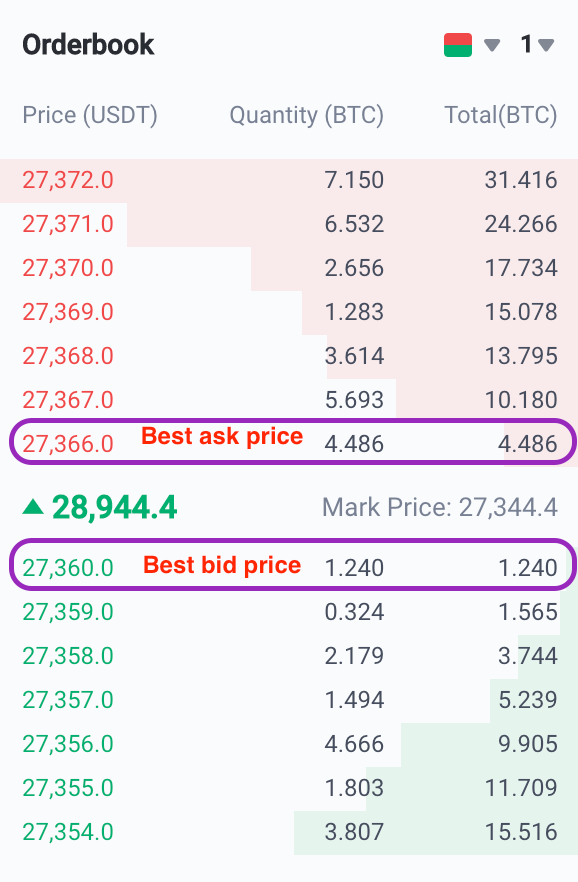

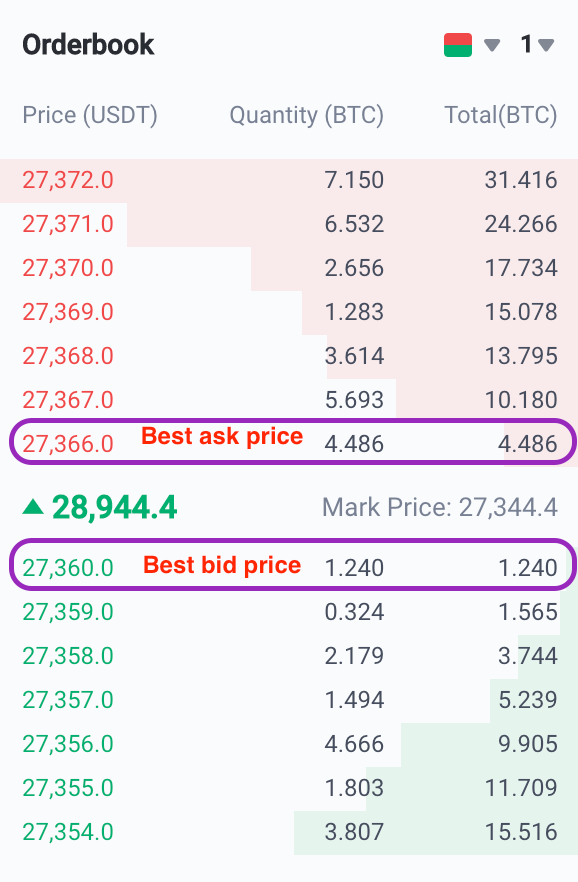

- Basis = (Best Bid Price + Best Ask Price) / 2 – Index Price (sampled every 5 seconds, ignore data if sampling fails)

- Moving Average of Basis = Arithmetic average of valid and legal basis in the previous 5 minutes

The best bid price and best ask price are the best prices offered by the buyers and sellers, respectively: