Compared with the traditional margin trading, the Leveraged Tokens allow investors to gain leveraged exposure without worrying about liquidation risk and simplify the management of leveraged position, therefore, they have been favored by many investors since launch.

However, the limitations of traditional Leveraged Tokens, especially the volatility drag, are also obvious. As an exchange that has always been committed to providing users with better products, Pionex launched new leveraged tokens, Pionex Leveraged Tokens, to solve these problems.

Contents

What are Pionex Leveraged Tokens

Same as the traditional Leveraged Tokens, Pionex Leveraged Tokens can also offer the high leveraged exposure and have optimized the rebalancing mechanism —— Pionex Leveraged Tokens maintain a variable target leverage instead of the fixed and constant leverage.

How we name the Leveraged Tokens?

The name of Pionex Leveraged Tokens maintains the same logic with traditional Leveraged Tokens, consists of 3 parts, “Coin+ Leverage+ Long/Short”. For example, BTC3L means BTC 3x Long, BTC3S means BTC 3x Short. The following Pionex Leveraged Tokens are available in Pionex now: BTC3L, BTC3S, BTC1S, ETH3L, ETH3S and ETH1S, and Pionex will offer more options for customers in the future.

How is the leverage decided?

The variable leverage of Pionex Leveraged Tokens fluctuates within a certain range following the cryptos prices, and the rebalancing will be “triggered” only if the leverage exceeds a certain range. In this way, Pionex Leveraged Tokens not only avoid the liquidation risk, but also reduce the impact of volatility drag.

To understand how does variable leverage work, you need to know how to calculate the leverage first.

If you long BTC with 3x leverage in margin trading, the more the price increases, the lower the leverage will be. On the contrary, If the price goes down, the leverage will be higher compared with the moment you created this order. So the formula of the leverage is:

Leverage= current price* the leverage of the order/ the price of the order + the leverage of the order*(current price- the price of the order)

It looks complicated, but it is very easy to understand with practical examples.

For example, you use traditional leveraged position to 3x Long BTC when the price is 10000 USDT, then the leverage at that moment is 3x = 10000*3/10000+3*(10000-10000); later the price goes to 11000 USDT, then leverage becomes lower = 11000*3/10000+3* (11000-10000)= 33000/13000 = 2.5385x.

How does the rebalancing mechanism work?

The core difference between Pionex Leveraged Tokens and traditional Leveraged Tokens lies in the different rebalancing mechanisms. The nitty-gritty of rebalancing is increasing or decreasing the exposure to achieve the target leverage (the leverage you chose when you created this order), and the rebalancing mechanism means the rules that trigger the rebalancing.

The rebalancing mechanism of traditional Leveraged Tokens is: When the spot market price changes 10% and every day at 0:00 (UTC+8)

The rebalancing mechanism of Pionex Leveraged Tokens is:

1) 3x Long Pionex Leveraged Tokens: when the leverage fluctuates within 2.2x-4.0x, the rebalancing will not be triggered; when the leverage exceeds this range, the Pionex Leveraged Tokens will be rebalanced back to 3x;

Assuming that the BTC spot price is 10000 USDT and the rebalance price is α, then:

- To triggered the rebalance of 3L leveraged tokens, α need to be: 3α/(3α-20000)= 2.2 or 3α /(3α -20000)= 4.0, so α = 12222.22(+22.22%) or α=8888.89(-11.11%)

2) 3x Short Pionex Leveraged Tokens: when the leverage fluctuates within 1.8x-4.8x, the rebalancing will not be triggered; when the leverage exceeds this range, the Pionex Leveraged Tokens will be rebalanced back to 3x;

Assuming that the BTC spot price is 10000 USDT and the rebalance price is α, then:

- To triggered the rebalance of 3S leveraged tokens, α need to be: 3α /(40000-3α )= 1.8 or 3α/(40000-3α)= 4.8, so α= 8571.43 (-14.29%) or α=11034.48(+10.34%)

3) 1x Short Pionex Leveraged Tokens: When the leverage fluctuates within 0.7x-1.5x, the rebalancing will not be triggered; when the leverage exceeds this range, the Pionex Leveraged Tokens will be rebalanced back to 1x.

Assuming that the BTC spot price is 10000 USDT and the rebalance price is α, then:

- To triggered the rebalance of 1S leveraged tokens, α need to be: α/(20000-α)= 0.7 or α/(20000-α) =1.5, so α= 8235.29 (-17.65%) or α= 12000 (+20%)

How much is the funding fee?

The funding fee of Pionex Leveraged Tokens is equivalent to traditional Leveraged Tokens which is directly deducted from the leveraged token price, 0.03% per day. That means the price of the leveraged token will decrease 0.03% every day at 00:00 (UTC+8).

Advantages of Pionex Leveraged Tokens

The new Pionex Leverage Tokens have the following advantages:

· Avoid the risk of liquidation, more friendly to beginners

· Earn more and lose less compared with Margin Trading

· Reduce the impact of volatility drag, more suitable Grid Trading and other trading tools.

Let’s combine the market and see how these advantages are realized.

(The following examples do not include transaction fees and funding fees)

· One-direction market

If you keep up with the crypto market, you must know that Bitcoin’s extreme price plunge to the $3K level on 12th, March, a sudden 40%+ price drop.

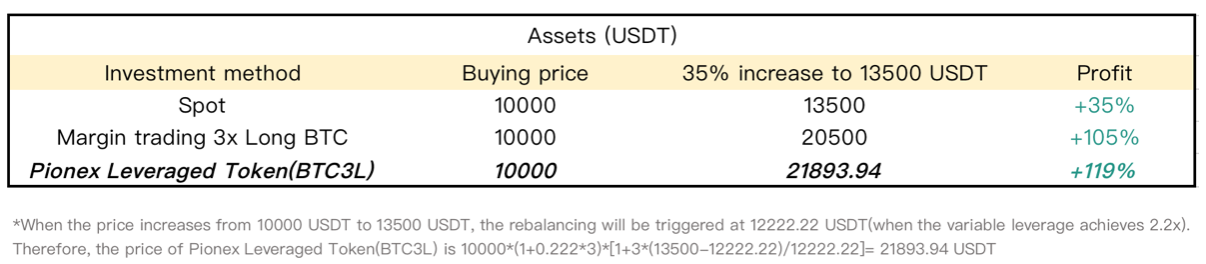

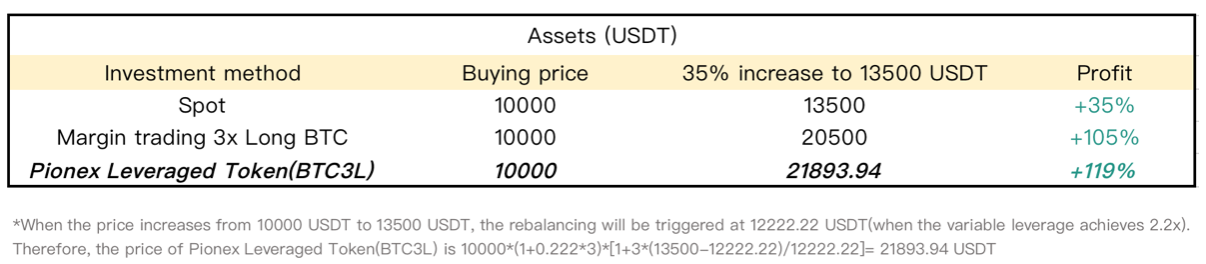

Based on this extreme one-direction market, let’s use two examples to understand how Pionex Leveraged Tokens work. Assume that the Bitcoin current price is 10000 USDT, and then 1) a sudden 35% decline to 6500 USDT; 2) a sudden 35% increase to 13500 USDT. When the BTC price is 10000 USDT, we use 10000 USDT respectively to invest in spot BTC, 3x Long BTC(margin trading), and Pionex Leveraged Token BTC3L.

1) When the Bitcoin drops to 6500 USDT:

2) When the Bitcoin rises to 13500 USDT:

We can see that the variable leverage of Pionex Leveraged Tokens can help users lose less and avoid liquidation in extreme plunge; and when the price rises sharply, it can help users earn more.

· Sideways market

In sight of the previous performance of Bitcoin at 10,000 USDT, this is a key resistance level and the price will go back and forth around this price. Then what impact will such “back-and-forth friction” have on Leveraged Tokens and Pionex Leveraged Tokens?

If the Bitcoin price fluctuates between 10000 USDT – 11000 USDT and we use 10000 USDT respectively to invest in Grid Trading bot with spot BTC, 3x Long BTC (margin trading) and Pionex Leveraged Token BTC3L when the BTC price is 10000 USDT. As we all know, the Grid Trading bot works based on the principle of “high throw bargain – hunting”, so after 8 arbitrages, the net asset value results will be as follows:

We can see that when the price fluctuates within a small range(sideways market), even if there is a small increase, the volatility drag caused by the rebalancing mechanism of traditional Leveraged Tokens will still make the user lose, and this kind of loss will be even more significant in a longer period, such as a quarter or a year.

Pionex Leveraged Tokens will be triggered when the price fluctuates in a small range due to the variable leverage between 2.2x -4.0x, which can reduce the impact of volatility drag and increase profits by leverage exposure. This is why Pionex Leveraged Tokens are more suitable Grid Trading tools.

Pionex Leveraged Token+Grid Trading Bot

Grid trading is suitable for oscillating and rising market, and the oscillating period and Grid profit show a positive correlation, that is, the longer the oscillating period, the more grid profit.

Pionex Leveraged Token+Grid Trading Bot will help customers to earn more by the leveraged exposure and fluctuation in price, at the same time, avoiding risks when the price break out of the normal range.

Reverse split regulations

When the price of Pionex leveraged tokens falls below 0.1, or when the price fluctuates substantially below 0.1, the reverse split mechanism will be triggered.

The reverse split multiples are generally 20, 50, 100 times, etc. Let us take 50 times as an example.

Before the reverse splitting, assume that the user holds 1000 leveraged tokens, the net value of the token is 0.03, and the corresponding asset is 30 USDT.

After the reverse split, the user has 20 leveraged tokens (1000/50=20), and the net value of the token is 1.5 ( 0.03*50=1.5); the corresponding asset is 30 USDT.

The reverse split will not affect the total assets, but it will reduce the number of positions. Therefore, it is not recommended to buy when the net value of the token is low. The price of the token can continue falling due to reverse splitting.

Risk Warning

Pionex Leveraged Token can avoid liquidation, but if you misjudge the market and the price increases/decreases in the opposite direction, you may lose. Even if the price returns to the normal range again, due to the rebalancing mechanism, the price needs to increase/decrease more to cover the loss.

Therefore, Pionex Leveraged Tokens are more suitable for short-term investment while long-term holdings will increase the risk of loss. In addition, there may be a situation where both Long and Short Leveraged Tokens lose at the same time in extreme fluctuation, please pay attention to investment risks.