Bittrex is one of the veteran exchanges for more experienced traders. It is based in Seattle, U.S., and Lichtenstein (Bittrex Global), It allows direct purchases of cryptocurrencies using US dollars as well as trades between more than 200+ cryptocurrencies through their powerful trading engine with an easy to understand user interface. Bittrex has a set of its own APIs, which can be used for automated trading with bots. Having been launched by former employees of Microsoft and Amazon, another one of its biggest draws is its robust security. Since inception, There has never been a case of any form of hack on the website.. Bittrex has high liquidity, worldwide availability including traders from the United States and other parts of the world, useful mobile apps, and low trading fees.

Contents

- 1 What is Bittrex?

- 2 Where is The Bittrex Exchange Located?

- 3 Bittrex Application

- 4 Bittrex Trading Bots

- 5 Bittrex Leverage Trading

- 6 Bittrex Trading Fees

- 7 How to Withdraw Money From Bittrex to Bank Account

- 8 Bittrex Safe

- 9 Bittrex API

- 10 Bittrex Taxes

- 11 What are Bittrex Credits?

- 12 How to Transfer From Coinbase to Bittrex

- 13 Bittrex vs Coinbase

- 14 Bittrex vs Kraken

- 15 Bittrex vs Kucoin

What is Bittrex?

Bittrex is a cryptocurrency exchange which was founded in 2014 by three cybersecurity engineers. It is a leader in the blockchain revolution. Bittrex.com provides lightning-fast trade execution, dependable digital wallets and industry-leading security practices. Their mission is to help advance the blockchain industry by fostering innovation, incubating new and emerging technology, and driving transformative change.

Where is The Bittrex Exchange Located?

The Bittrex cryptocurrency exchange debuted on the market in 2014 and it is a US-based cryptocurrency exchange headquartered in Seattle, Washington. It was created by a very experienced team of cybersecurity professionals led by CEO Bill Shihara. Before starting his own product, the creator of Bittrex has worked for 11 years at Microsoft, working on the Windows operating system, he was the security development manager at Amazon, and also created malware protection and automation strategy for the BlackBerry ecosystem.

Bittrex Application

The bittrex exchange is available to all android and apple phone users. The Bittrex Global mobile app makes trading cryptocurrency more convenient and accessible than ever before without compromising on transaction speeds, security or uptime. Users can now access the markets and features of the Bittrex Global trading platform wherever they go.

The Bittrex Global mobile app gives the convenience of having a digital wallet on your phone, with the platform’s industry-leading security practices. Manage your token and digital asset holdings on the safest platform to trade and store cryptocurrency.

The mobile app helps to keep track of your holdings with up to date prices for cryptocurrencies like Bitcoin, Ethereum and more. The Bittrex Global mobile app provides detailed statistics at a glance, a customizable favorites list and more to improve your cryptocurrency trading experience.

Bittrex Trading Bots

Speaking of using a crypto trading bot, the most important decisions require choosing the right crypto exchange. The right platform will benefit from your trading mechanisms just like you intended. But choosing a wrong or not so beneficial platform will not give the anticipated result.

It is very crucial that you select a reliable, secure and credible digital asset exchange that has also proven its efficacy with automated bot tools. Bittrex falls into this category. Finding such an exchange is no longer a mean feat.

As one of the world’s oldest and largest crypto exchanges that supports over 200+ digital assets on its portal, Bittrex is a very credible trading platform. With an easy to use user interface(UI) and acceptance of various payment methods, the exchange is suitable for traders of all scales, sizes and geographical locations. This also makes it an amazing choice for those who use bots solutions, whether they are located in the US or in any other supported countries.

You can’t trade with bots directly on bittrex so all you need to do is to connect your trading account on bittrex to a bot providing service using API. Some of the services are made available on 3commas, bitsgap, Tradesanta, Cryptohopper.

Bittrex Leverage Trading

What are Leveraged Tokens and How Do They Work?

Leveraged tokens are ERC20 assets that provide leveraged exposure to cryptocurrency markets directly rather than through managing leveraged futures positions.

Each leveraged token is designed to respond to the movement of the coin they are attached to. For example, BULL is +3x and BEAR is -3x. This means, for every 1% BTC increases, BULL will increase by 3% and BEAR will decrease by 3%.

Leveraged tokens are priced based on the trading of FTX perpetual futures. Each leveraged token holds the amount of futures contracts necessary to maintain the target leverage ratio.

For example: For $10,000 of notional value of BULL, the BULL account on FTX buys $30,000 worth of BTC perpetual futures in order to generate a leverage ratio of 3x.

Why Use Leveraged Tokens?

Leveraged tokens create a more simplified leveraged trading experience. By rebalancing each day (described below), leveraged tokens have a comparatively lower risk of liquidation as compared with traditional leveraged trading using futures contracts. To participate in leveraged tokens, users just need to buy and sell tokens. There is no managing margins or collateral or liquidation prices as with leveraged trading.

Additionally, leveraged tokens are ERC20 tokens. They can be withdrawn like any other token, something that cannot be done with a leveraged position.

Bittrex Trading Fees

If you are a Bittrex user, you can benefit from a fee schedule that improves as users have more trading volume in USD. The more you trade, the more you save. The fee schedule below provides the applicable rate based on the account’s 30-Day Volume and if the order is a Maker or Taker.

The Bittrex trading fees are incurred when an order is filled by the Bittrex matching engine. When an order executes the buyer and the seller are each charged a fee based on the total price of the executed order. The fee (commission) charged by Bittrex on each executed trade is calculated by taking the (amount * purchase price * rate) for the given trade. Orders that don’t execute are not charged. Orders that are cancelled are refunded in full.

The fees vary by the currency pair being traded, your 30-day trading volume, and whether the order filled is a Maker or Taker. Bittrex reserves the right to change the commission rates at any time, discounts and incentives are provided temporarily on the incentive programs.

30-Day Volume

The trading volume impacts the price you pay for every trade. The bittrex trading fees are built to reward users who drive liquidity to Bittrex markets to ensure the ecosystem is healthy. Your trading fees are reduced according to the USD value of the total volume traded by your account over the previous 30 days period.

The 30-days volume is calculated on a daily basis, updating each account’s volume calculation and trading fee schedule between the hours of 00:30 UTC and 01:30 UTC each day.

You can check your current 30-Day Volume by logging in and navigating to Account > My Activity.

Maker-Taker fees

Every executed trades in the bittrex matching engine are between an existing order that is on the order book and a newly placed order. The order that is already on the order book is the “Maker” order. The newly placed order is the “Taker.” The fees charged to the buyer and a seller in a transaction are based on which order is the Maker and which order is the Taker.

Any newly entered order doesn’t immediately match with any orders already in the system or is not completely filled by existing orders on the order book, the remainder of the order goes onto the order book and becomes a potential Maker order for a future trade.

Take this example: In a USD-BTC market, assume there is a sell order for 0.75 BTC on the order book (the maker order). If a trader places a buy order for 1.0 BTC that matches the 0.75 BTC order’s price, there will be one trade for 0.75 BTC where the newly entered order is the Taker. If the remaining 0.25 BTC from the new order does not match with another order already on the book, it will be placed on the buy side of the order book and will potentially be the Maker order of another future trade.

Maker orders

The Maker orders make liquidity available on a market by being entered onto the order book. Better still, Maker orders are not filled when they are placed but instead wait until a future order is placed to match them. The Maker order can be on the sell side or a buy side of the order. If an existing order on the order book is matched with a newly placed order (the Taker), the Maker order in the transaction will be charged the maker fee.

Taker orders

The Taker orders reduce (take away) liquidity on a market. The orders which execute immediately and take volume off the order book are takers. The Taker order can be on the sell side or buy side of the order. If a new order is placed and it matches against another order already on the order book (the maker), the taker in the transaction will be charged the Taker fee.

Transaction fees

Blockchain

When moving funds on the blockchain to and from Bittrex,cost is incured for users related to the specific coin’s network fees.

- Deposits: Fees are not charged by Bittrex for deposit. Also be aware that some tokens or coins are required to be moved by your funds to another address before it can be credited. This means the coin or token’s network will charge the normal transaction fee for this send and is not something Bittrex can avoid.

- Withdraws: Any token or coin has a network transfer fee that is built into it, and bittrex charges a small amount to cover this fee. Fees can be viewed for each coin or token by clicking the withdraw button next to the coin to bring up the withdrawal window which shows the network fee charged.

Fiat

Bittrex will not charge fees for any USD deposits and withdrawals. Check with your bank as they might charge a fee to send your wire transfer as well as receive a wire transfer from the bank. Secondly, if your bank uses an intermediary bank, you will have to check with them to see if they charge a fee for such transaction

Bittrex Withdrawal Fees

If you intend to withdraw your coins or token from bittrex exchange, the table below show the charges in coin/token to be taken as withdrawal fees

BitTrex Deposit & Withdrawal fees: https://www.cryptofeesaver.com/exchanges/fees/bittrex

How to Withdraw Money From Bittrex to Bank Account

The following 4 steps will demonstrate how to withdraw money from bittrex to bank account:

When performing a cryptocurrency withdraw:

- Enter the receiving address into the “Address”field,

- Enter the amount you wish to send in the “SendAmount” field,

- Select the wallet balance to withdraw from in the“From” drop-down menu,

- Press the “Request Withdrawal” button.

Bitcoins can not be withdrawn into a bank account directly. You can either sell them to somebody who then transfers money to your bank account, or you can sell them at an exchange and withdraw the funds from there.

Bittrex Safe

One of the most important questions that any cryptocurrency trader can ask is whether an exchange is safe and secure. Indeed, recent history is littered with a number of high-profile exchange hacks.

Unlike some of the other older exchanges in the space, Bittrex has not suffered any breaches. Indeed, the fact that the three founders are cyber-security experts is a great advantage for the exchange.

Let us take a closer look at some of the more specific security procedures and protocol at Bittrex.

Exchange Security

On the exchange coin management side, Bittrex claims that they operate what is called an “elastic, multi-stage wallet strategy”. This basically governs how they access their coins and move them from cold to hot wallets.

They also state that the majority of their coins are kept in cold storage. This is one of the most important requirements for cryptocurrency exchange security. Cold storage is the practice of keeping coins in an “air-gapped” environment where they can’t be accessed.

When the exchange needs to access these cold stored coins, they will probably require a multi-signature authentication and it will be moved into the exchange’s “hot” wallets. These are the wallets that are connected to the servers and process the deposits / withdrawals.

Communication Security

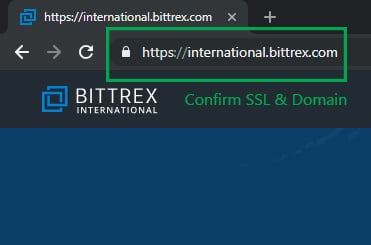

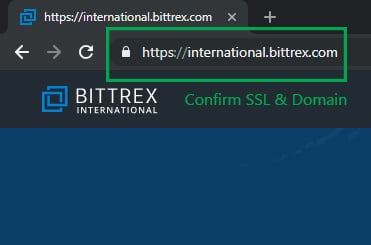

Check domain and Valid SSL

As is standard with most websites these days, Bittrex makes use of full SSL encryption on their domain. This means that all of the information that you send them from your browser should be free from interference.

It is also a great way for you to tell whether you are on a phishing site. If the SSL certificate for the site is invalid then it is likely that hackers are trying to harvest your information.

You will want to make sure that you access the site directly (don’t follow links from other sites). Make sure you have a green padlock in your browser and you are either on bittrex.com or international.bittrex.com.

User Safety

Most cases of exchange theft and phishing come about because of user fault. That is why exchanges implement a number of procedures in order to prevent particular attack vectors.

Therefore, the first thing that you will want to do when you have created your account is to enable two factor authentication. This will act as an extra gate in case of someone getting hold of your account password.

Steps to set up 2FA on Bittrex. Image Source

The Bittrex 2FA makes use of the Google authenticator application which you can download from the Apple iStore or Google Play. You will scan the QR code, confirm the authentication on the exchange and in an email that they send.

Control Your Keys 🔑:Despite how safe Bittrex may be, you want to make sure that you do not leave a substantial amount of coins on the exchange. You can never be 100% certain that no breaches will ever happen.

Bittrex Wallet , Bittrex Wallet Address

Depositing coins on the Bittrex wallet

To deposit coins on the Bittrex app please follow these steps.

- Log in to your Bittrex account and click Holdings on the bottom menu bar.

- Click the Deposit button and locate the currency you wish to deposit in the search bar.

- Read and accept the Deposit Instructions.

- If you do not have a generated wallet address, you will be prompted to click Generate New Wallet Address to generate your new wallet address. Copy this deposit address to your clipboard.

- Please make sure to read the coin deposit instructions if they are available. Some coins require a minimum amount to be sent before they are credited. Some coins will require a message/payment ID/tag/memo. This means you must send the coins to the address we provide and attach this message/payment ID/tag/memo to the deposit to route the coins to your account. If you do not attach this, you will risk losing these funds.

- You can now deposit coins to this address. Please make sure that you only send the same type of coins to this address. This means if you generate a BTC address, you should only deposit BTC to it and not some other coin. If you deposit a different coin than what the address was generated for, you risk losing these coins permanently and will be subject to the Bittrex Deposit Recovery Policy.

Bittrex API

Bittrex provides a simple and powerful API consisting of REST endpoints for transactional operations and a complementary Websocket service providing streaming market and user data updates.

Access to and use of the API is governed by our Terms of Service. If you are a user of Bittrex.com, the applicable Terms of Service are available here. If you are a user of Bittrex Global, the applicable Terms of Service are available here.

Bittrex Taxes

This guide is solely to help you pull the information from Bittrex necessary for your taxes. You are encouraged to consult a tax professional if you need personalized advice.

Failing to report your earnings could result in several penalties, including criminal prosecution and large fines.

If you did any of the following, you must report your activity to the IRS.

- Received coins through an airdrop or a fork

- Traded or invested cryptocurrency

- Received an income in cryptocurrency

- Converted cryptocurrency to fiat

- Made a payment with cryptocurrency

You do not need to report activity if you:

- Purchased but did not sell any cryptocurrency

- Gifted cryptocurrency to someone (under $15,000/person)

- Purchased cryptocurrency with a Solo 401(k) or Self-Directed IRA

- Transferred between exchanges or wallets

It’s very simple to access your data from Bittrex.

You must be logged into your Bittrex account to access personal information and records for Trading (Orders), Deposits, and Withdrawals. Below are the following items you need to collect:

Personal Information

Your personal information can be found on the Account page under Profile.

Trading Records (Buy & Sell Orders)

Bittrex will only display a limited amount of your order history on our website. To pull your full order history, go to the homepage and click Orders. For your full order history, click on the Download History button.

Withdrawal & Deposit Records

To access your withdrawal & deposit records, go to the homepage and click Holdings.

Under Holdings, click on Withdrawals and navigate to your Withdrawal History or Deposit History to access your record of transactions. You may copy or screenshot this information.

Since Bittrex only displays a limited amount of deposit and withdrawal history, you may file a support ticket to access a full copy. When submitting a ticket, select the General Support Request form. It may take up to a week to fulfill the request.

Once you have accessed all necessary documents, you will first need to determine your Cost Basis.

You will have to track how much you paid for coins separately. Your crypto cost basis includes the purchase price plus other costs associated with purchasing the cryptocurrency, such as fees or commissions from the exchanges. You can calculate this simply by doing the following:

(Price of Crypto + Any other fees) / Quantity of Holding = Cost Basis

Next, you will need to determine and calculate any Gains or Losses

- Go to your Trading History file and group all sales of like coins together (all ETH sales, all BTC sales).

- Determine the USD value of the coins on the day of the sale, you can use coinmarketcap to do so.

- Sum the USD value of all the coins sold during the year together and subtract the cost basis you calculated previously.

It can be difficult to keep track of all this information, which is why there are tools out there which can automatically link to your Bittrex account to calculate your basis, gains, losses, and tax liability. We strongly recommend doing your research before using any 3rd party tools and advise caution when sharing data through an API. Be sure to go through our Account Security Checklist for more information on Bittrex security resources.

Now What?

Since Bittrex does not provide tax reports, you will have to report each trade and transaction on Form 8949. You will need a description of the coin sold, date acquired, date sold, proceeds, cost, and gains or losses. Once you have input this information, calculate the totals and transfer this amount over to the 1040 Schedule D.

What are Bittrex Credits?

Bittrex Credits is a rewards program for eligible customers, enabling users to earn commission-free trades by trading on Bittrex.com.

How Can I Sign Up?

By trading on Bittrex.com you automatically earn Bittrex Credits. As we said, it is a reward program! We will also do promotions from time to time where we will airdrop Bittrex Credits to our loyal customers.

How Can I Earn Bittrex Credits?

Credits are earned based on the commissions you pay on your trades. Credits are transferred into your account a few moments after your order has closed. The more you trade, the more you earn.

How Can I Spend Credits?

You may redeem Bittrex Credits for a commission-free trade once you accumulate enough. An option to do so appears automatically in the trade confirmation dialog box.

How Much Is a Credit Worth?

One Bittrex Credit is worth $0.01 USD towards trading commissions. To pay trading commissions on an order with Bittrex Credits, users need sufficient credits to cover the entire commission for the order. Credits cannot be redeemed other than for trading commissions on the Bittrex platform, cannot be removed from the Bittrex platform, and have no cash value.

How Do I Know How Many Bittrex Credits I have?

Your credit balance can be viewed on the Holdings page.

What If I Cancel My Order After Choosing to Pay With Bittrex Credits?

Bittrex returns Bittrex Credits in proportion to the unfilled amount of the order at the time of cancellation. The Bittrex Credits will be added back to your account a few moments after your cancellation is processed.

Can I Use Bittrex Credits From The API?

You can use Bittrex Credits when placing orders from the v3 API by including “UseAwards’ ‘: true in the request body. Note that the order will fail if you do not have sufficient Bittrex Credits available. You can get your current Bittrex Credits balance by querying any of the balance APIs and looking for BTXCRD.

How to Transfer From Coinbase to Bittrex

Why transfer from Coinbase to Bittrex

Coinbase is a wallet or small platform which is specially used to purchase any cryptocurrency or to make them use as your wallet.

- Log onto Coinbase

- Go to your bitcoin holding screen

- Click the receive button

- Copy the the receive address (definitely cut and paste)

- Log onto Bittrex.

- Go to your holdings (wallet)

- Click the withdraw button next to bitcoin.

- It will ask you “how much” – fill that in

- It will ask you for a send to address. – Paste in the coinbase address that you copied from step 4.

- Verify that the network fee is acceptable (you’ll get a couple choices, definitely choose either medium or fastest.

- Click send.

Bittrex Overview

Bittrex is a Seattle based Veteran crypto exchange, founded in 2013 by Bill Shihara, Richie Lai, Rami Kawach who all previously worked at Microsoft.

The Exchange is known popularly for its Speed, stability and high emphasis on the security of its users. Bittrex has never recorded any hack or loss of customers’ funds, this is a rare feature.

Bittrex:

On the other hand, Bittrex is supported in many countries worldwide except Cuba, the Crimean region, Iran, North Korea, and Syria and individuals with economic sanctions levied against them.

The two Exchanges are global just like LocalBitcoins and Paxful

Accepted Payment Methods

- Bank Transfer

- Credit/Debit card

- All supported cryptos

Bittrex vs Coinbase

Coinbase and Bittrex are two of the most popular and most well-regarded cryptocurrency exchanges. In this Coinbase vs. Bittrex review, we’ll go over the advantages and disadvantages of trading on each, who each platform is best suited for, and more.

Coinbase and Bittrex have been around for a while and both follow a similar flow of users, and this flow might not be so different from what brought you to your search.

Here is my journey from Coinbase to Bittrex.

I will make the point that I started out on Coinbase because it was easy to navigate. I purchased some BTC, ETH, and/or LTC and got some skin in the game, but in time, I wanted more.

However, I wanted to start trading other coins, and the Coinbase fees were starting to look daunting so I started to look at other alternatives such as Poloniex, Gemini, Bittrex, and others.

Even if this pattern doesn’t accurately describe your journey, it is very insightful to the difference between Coinbase and Bittrex.

See, Coinbase is a great place for newcomers to buy cryptocurrency and is the leader in attracting new users and is considered a “unicorn” among startups valued at $1.6 billion. They have an easy platform but they do not offer margin trading, and also the 1.49% trade fee is too high for wealthy investors.

However, many of these users eventually advance their understanding of the cryptocurrency world, and they want to stop paying the relatively high Coinbase fees and to explore new waters with different altcoins. This is when they end up splitting off to a variety of different exchanges that make Bitcoin appear more conventional and familiar. A lot of people feel more comfortable entrusting their money to a service that gives them more trading flexibility and offers lower fees.

Many of these users find the features they want on Bittrex. They end up spreading out their holdings across Coinbase, Bittrex, and potentially a hard wallet or two.

This Coinbase vs. Bittrex review will help you to understand the differences between these platforms, and which will suit you the best.

Bittrex vs Coinbase: Available Cryptocurrencies

Bittrex is perfect for those who want to buy a bunch of different altcoins. The best thing about Bittrex is that it will allow you to buy a wide variety of altcoins, and this ability is where Bittrex stands head and shoulders over Coinbase. However, Coinbase does have its separate platform called Coinbase Pro where you can trade a lot of cryptocurrencies these days.

Bittrex claims to be the next generation in crypto currency trading and they support the trading of a whopping 190+ different coins, while Coinbase only allows its users to purchase and sell three of the most popular cryptocurrencies – Bitcoin, Litecoin, and Ethereum. They plan to add more cryptocurrencies in the future, but they’ll probably only add a few more of the most popular ones.

Supported Countries

Coinbase currently serves a total of 33 countries (although this may soon drop to 32 as Vogogo, their Canadian payment service, shuts down).

Although Bittrex is a US-based broker and is available globally, several states have limited or no access to Bittrex, which probably reflects the evolving nature of cryptocurrency regulation in those states.

Security

There are so many great exchange options out there. However, in order to be a successful exchange in the modern day, your security has to be absolutely water-tight because a single poorly handled security threat could be lethal for the exchange company’s user-base.

Coinbase offers the most robust security in the entire Bitcoin exchange market and has never been hacked in its 5 years of operations. Coinbase treats USD wallets like bank accounts and are insured up to $250,000 by FDIC (Federal Deposit Insurance Corporation), which is an independent agency of the United States government that protects you against the loss of your insured deposits. At any given time, only 2% of Coinbase holdings are exposed, and any losses incurred are fully insured by a syndicate of Lloyd’s of London. 98% of customers’ cryptocurrency funds are stored in secure offline cold storage, and the private keys used for authorization of cold storage transactions are held in fragments between offline hard drives and paper, in different locations with backups in case of losing any pieces. They also offer two-factor authentication (2FA), email notifications and use PGP email encryption.

Bittrex is being handled by a group of “security freaks” that are focused on keeping their customers safe at all time and they pride themselves on providing a secure platform and employ the most reliable security technologies available. These include utilizing an elastic multi-stage wallet strategy that keeps 80% to 90% of all funds offline. Bittrex also offers 2-Factor Authentication, and I strongly advise using the Google Authenticator for the 2FA’s that you would be doing. Speaking of 2FA’s, a huge number of their registered members were hacked at around April 2016, but the users that had 2FA installed had no issues with their accounts being compromised.

Both Coinbase and Bittrex are considered very secure platforms. However, both sites are exposed to a small risk of being hacked because even tenured security experts in the world know that there is no such thing as a “perfect system” or software that can keep you safe. Storing your funds on either exchange long-term is not recommended because it increases the potential of them getting hacked. Storing them for a short-period is fine. However, you should only keep what you plan to actively trade.

Coinbase, Ideal for Newbies

The reason why so many people get into the cryptocurrency world through Coinbase is that people at Coinbase have done an amazing job at creating an extremely user-friendly interface. This makes buying coins a very simple process.

Both Coinbase and Bittrex allow its users to buy BTC, ETH, and LTC. However, the platforms are drastically different for beginners.

Bittrex is a secure online cryptocurrency exchange that allows its users to trade coin pairs with each other similar to a forex or stock exchange, which can get complicated for newbies and there’s a lot of room for making small but expensive mistakes.

Coinbase, on the other hand, is easier to use than an exchange and keeps the process very narrow-focused and simple.

When trading fiat currency for BTC, ETH and LTC, Coinbase allows you to deposit your fiat currency and purchase your selected quantity. Coinbase is so much simpler and more convenient to use for many first time users, and that’s the reason why so many users prefer this site. Coinbase is great place for newcomers to purchase cryptocurrency and buying crypto via Coinbase is a very straight-forward process:

Credit/Debit Card Purchases:

- Verify your account

- Verify your Credit Card

- Instantly purchase BTC, ETH, or LTC at the set price

Both Coinbase and Bittrex Are Trusted Companies

Both Coinbase and Bittrex are based in the United States and they both have been around for a while.

Based in San Francisco, California, Coinbase is the most popular cryptocurrency exchange platform. It was launched in 2012, and since their launch they have attracted a significant amount of investment capital from reputable investors, venture capital firms, and even banks and financial institutions such as BBVA, USAA Bank, and the New York Stock Exchange. The exchange was founded by Brian Armstrong and Fred Ehrsam, and they’ve served over 8 million customers and helped users exchange over $20 Billion worth of digital currency.

Launched in 2014, Bittrex doesn’t have the same investment accolades as Coinbase. However, it is still seen as a very trusted platform. Bittrex is based in Seattle, USA, and currently experiences 24 hour trading volumes of just under $300M. The site has a good reputation and up until this point. Bittrex was founded by IT and security experts with more than 50 years of combined knowledge from a variety of companies including Amazon, Blackberry, Microsoft, and Qualys.

Bittrex vs Kraken

With the number of trading platforms on the crypto market today it can be hard to decide which exchange is best for you. Bittrex and Kraken are two of the biggest exchanges today, but which is best for you? Our comparison will look at trading fees, pairs, security, and more in order to help you decide which meets your crypto needs.

Kraken Quick Overview

Kraken is one of the most trusted exchanges on the market today and is often one of the top five exchanges by trading volume. Although the company behind the platform was founded all the way back in 2011, the exchange has never faced a serious security incident to this day.

Kraken Pros & Cons

Pros

- One of the original cryptocurrency exchanges

- Never been hacked

- Support for a variety of different funding options

- High trading volumes

Cons

- Not available to New York residents

- Slow account verification

- No support for credit/debit cards

Bittrex Quick Overview

Bittrex is a cryptocurrency exchange oriented towards more experienced traders. Based in Seattle, U.S., and Lichtenstein (Bittrex Global), they offer over 250 digital assets via their powerful cryptocurrency trading engine with a sleek interface and numerous trading pairs. Bittrex also has a set of its own API keys which can be used for automated crypto trading with bots. Launched by former employees of Microsoft and Amazon, another one of its biggest draws is its robust security.

Bittrex Pros & Cons

Pros

- Tons of trading pairs

- High liquidity

- Fiat deposits and withdrawals

Cons

- No margin trading

- Extensive verification

Beginner Friendliness

Fees

- When comparing Bittrex vs Kraken trading fees there is not much to separate the two exchanges. The difference in fees is negligible.

- For Kraken, maker fees, meaning you create an order, start at 0.16% and go down from there, turning to 0% if you have $10 million or more in trading volume in the past 30 days. Taker fees, meaning you accept an existing order, start at 0.26% and go down from there, turning to 0% at $10 million trading volume as well.

- For Bittrex, maker fees start at 0.2% and go down from there, turning to 0% when you have $60 million in trade volume for the past 30 days. Taker fees also start at 0.2% and go down from there, turning to 0.08% when you hit the $60 million volume mark.

- Withdrawal fees for fiat on both platforms vary depending on what type of funds you are sending to your bank account.

Features

Comparing Bittrex vs Kraken features yields little difference between the two platforms, as they both offer similar capabilities, however, each has one notable feature.

Kraken’s stand out feature is Cryptowatch, which is their own creation. Cryptowatch is a trading platform that allows you to trade across multiple exchanges even on mobile. This allows you to find the best rates for the trade you are looking to execute.

Bittrex’s stand out feature is more just something that it offers that Kraken does not, and that feature is the ability to fund your account instantly with a credit or debit card. The caveat to this is that they only accept Visa debit or credit cards, all other credit or debit cards will not work. Still, the ability to fund your account instantly is something you cannot do with Kraken.

Security

When comparing the security of Kraken vs Bittrex we find that they are both extremely secure exchanges. Neither exchange has ever been hacked. They both offer Two Factor Authentication (2FA). The only real difference between the two exchanges is the amount of funds they keep on the exchange at one time.

Kraken only holds 5% of assets on the exchange, keeping the other 95% in cold wallets that are air gapped. They also hold a full reserve in case anything ever happens.

Bittrex holds between 10-20% of assets on the exchange.

Kraken is the superior option as they hold less online, therefore they are less of a target for hackers, in addition, they regularly have experts test their security looking for weaknesses.

Available Currencies

This is one section of the comparison that has a clear and obvious winner, as Kraken only supports 47 cryptocurrencies whereas Bittrex supports over 250. If you are looking to have an extremely diverse portfolio with lesser known assets, then Bittrex is the choice for you. However, if Kraken has the assets you are interested in then there is no specific reason to choose to sign up for Bittrex instead of Kraken.

Trading Power

Both Kraken and Bittrex are considered top cryptocurrency exchanges with high liquidity, however, Kraken tends to have much more volume than Bittrex, in the last 24 hours alone they have moved 10x the volume as Bittrex. While Bittrex is still a top 20 exchange, Kraken is a top 5 exchange.

Any asset that is supported on both Bittrex and Kraken is better to sell on Kraken, as they do volume. Unless the asset you have is solely on Bittrex and not Kraken, Kraken is the better option between the two exchanges.

Ease of Use

Both Kraken and Bittrex would be considered intermediate to advanced trading platforms, therefore not that suited for beginners. Registration for both exchanges is simple but the limited options for instant funding of accounts means they are both better suited to users who already own crypto assets. Both interfaces are easy to navigate and provide many options for customizing trades.

Beginners may find it easier to use a platform that allows instant crypto purchases using credit cards or debit cards, such as Coinbase. That will allow them to get started quicker than Kraken, and while Bittrex does accept credit card funding its only through Visa, which limits many users.

Bittrex vs Kucoin

Choosing between crypto exchanges is perhaps one of the most difficult decisions you will have to make when you decide to get into crypto. In your search, Kucoin and Bittrex are two of the choices you will most likely encounter. On CoinMarketCap, Kucoin and Bittrex crypto exchanges are ranked 36 and 52 respectively according to adjusted trading volume showing they are very popular. This guide should help you make the best choice between these two companies.

Regulation

Kucoin was launched in May 2017 in Hong Kong and is yet to be regulated by any financial regulator. That is not surprising or alarming because only a few crypto exchanges are regulated. Nevertheless, Kucoin exchange has built a reputation of trust and is also one of the few that has never been hacked. The founder of Kucoin is Michael Gam who was once a technical expert at Ant Financial, and this fact gives the exchange some clout.

On the other hand, Bittrex is based in the US and was founded in 2014. They had sought a BitLicense from the New York Department of Financial Services but were denied. The denial was because the exchange had not fully complied with the requirements for a BitLicense. Behind this exchange are Bill Shihara, Richie Lai and Rami Kawach who all have technical backgrounds in tech.

This section is a draw because neither of the crypto exchanges holds any license.

Deposit and withdrawal

Making deposits and withdrawals on Kucoin can only be done in the form of cryptocurrencies and not fiat on Kucoin. To cater to new traders, though, they have partnered with Simplex to allow for buying of crypto by credit card. Bittrex also has a similar structure where they only accept crypto and not fiat but they too have partnered with New York Signature Bank to make deposits in fiat possible, but only through wire transfers.

Once again, these crypto exchanges are tied.

Assets

Both of these crypto exchanges have a lot of assets to offer their clients for trade with over 100 different cryptocurrencies. Although deposits can be made in only a handful of coins, they can then be traded into a myriad pairs. What Kucoin does have is their native token Kucoin Shares (KCS) which allow for transactions within the exchange.

Due to the native token, Kucoin is the winner in this section.

Fees

Trading fees among crypto exchanges are classified either as maker or taker fees. Taker fees are charged when an investor makes a trade at the market prices at the time – market order. Meanwhile, maker fees are charged for limit orders. Therefore, taker fees are usually higher than maker fees. At Kucoin, both maker and taker fees are charged a 0.1% commission. Bittrex charges 0.25% commission for both maker and taker fees.

Winner is Kucoin for cheaper trading fees.

Trading Platforms

There is very little difference in the UI of these crypto exchanges web-based trading platforms. They all allow you to select from the list of crypto pairs and utilize technical tools to analyse the markets. The one difference however is that Kucoin has official mobile apps for both iOS and Android while Bittrex does not.

Winner is Kucoin in providing mobile apps.