What’s the Grid Trading Bot?

Grid Trading Bot is a kind of computer program as a tool to help you auto buy low and sell high within a certain price range you set. For example, if you predict that the price will fluctuate between $10 and $1000, then you can run a Grid Trading bot to help you auto buy low and sell in this price range. As long as the price fluctuates within the range you specify, the bot will keep making arbitrage for you without any manual operations.

Contents

- 1 Why you should use Grid Trading bot?

- 2 How does Grid Trading Bot trade your coins ?

- 3 How does Grid trading bot place orders?

- 4 How to calculate the grid spacing?

- 5 Don’t need to predict the market and price direction?

- 6 What’s the Wide Price Range Grid Trading strategy?

- 7 What will happen if the price goes out of the price range?

- 8 What market can Grid Trading bot make profits in?

- 9 How to select coins for running Grid Trading bot?

- 10 How does Grid Trading Bot know my initial buy cost?

- 11 What’s the difference between setting big number of grids and small number of grids?

- 12 Does the number of grids influence the profits? And how to set a good number of grids?

- 13 Will trading fee eat much of the profits?

- 14 The pros of Grid Trading bot

- 15 The cons of Grid Trading bot

- 16 Who need Grid Trading bot?

Why you should use Grid Trading bot?

Grid Trading Bot is a new choice when you trade cryptocurrency. You don’t need to predict the market, the price direction, or do some market analysis, it will just auto buy low and sell high 24/7 to arbitrage in a certain price range you set up. More importantly, Grid Trading bot can solve the problems fundamentally that most retailers have. What are the problems? Sell the coin to get a very small profit once the price goes up a little, or sell the coin to cut loss once the price goes down a little, which will make you profit little while losing a lot. The longer time you trade in this way, the bigger loss you gonna make. So trading should return to rationality, not perceptual. Grid trading can strictly implement trading strategies without being influenced by emotions.

The concept for Grid trading bot is very simple — buy low and sell high, which means the bot will auto buy when the price goes down, and sell when the price goes up. This is the basic way to manually trade spot to earn profits. However, most people can’t follow that because of human emotions. You will get greedy when the price rises, and be afraid when the price falls. How can you solve this problem? You need a tool that can strictly follow your trading strategy to sell and buy without emotions. Grid Trading bot is a good option.

How does Grid Trading Bot trade your coins ?

No matter which crypto trading pair you trade, when you set up a Grid Trading bot, it will keep positions on both coins for this trading pair at the same time. Let’s take the BTC/USDT trading pair as an example. After creating a BTC/USDT Grid Trading bot, the bot will hold BTC and USDT both, and it will place the BTC buy orders with some USDT below the current price and also place some BTC sell orders with some BTC above the current price.

When the current price starts to fall and hits the grids( BTC buy orders), the bot will buy BTC with USDT automatically. When the current price starts to rise and hits the grids( BTC sell orders), the bot will automatically sell BTC to USDT, that is, buy low and sell high.

How does Grid trading bot place orders?

If you wanna create a Grid Trading bot, there are some parameters you should set. For example, you set $5,000 ~ $10,000 as the price range and 6 girds. So the grid spacing is $1,000. If the open price is $7,500, how will the bot place orders based on the above parameters? The bot will place buy orders at $7000, $6000, and $5000, place sell orders at $9,000 and $10,000. Why not placing orders at $8,000? According to the above settings, set sell orders above the open price, buy orders below the open price and keep $1,000 as the grid spacing, $8,000 will not be placed.

When will $8,000 get placed? If you create a Grid trading bot at $7,500 as the open price, and the current price hits $9,000. Once the $9,000 sell order gets executed, a new buy order will be placed at $8,000, which means once a sell order gets executed, a buy order will be placed below the current price.

How to calculate the grid spacing?

There is a formula to calculate the grid spacing: ( Upper limit-lower limit)/( the number of grids-1). For example, if $5,000~$10,000 is the price range, and the number of grids is 6, then (10000–5000)/(6–5)=1000, so $1,000 is the grid spacing. Normally, you should set the larger grid spacing for the coins with higher fluctuation, set the smaller grid spacing for the coins with smaller fluctuation.

Don’t need to predict the market and price direction?

Originally, we shouldn’t predict the market but should get prepared for it. The logic of the Grid Trading bot is to set up the price range in advance. Whether the price is rising, falling, or fluctuating, the price is always going within the price range you set up, and then the bot will keep making profits for you.

Are there any extreme situations? Of course. If there is a sharp rise or a sharp drop so that the price goes out of the price range, the bot will stop arbitraging unless the price goes back to the price range. Any solutions to fix it? Sure- Set a large price range as you can that I call it 「Wide price range Grid Trading strategy」. The larger the price range you set up, the higher probability the price moves in the range. And then just be friends with time.

What’s the Wide Price Range Grid Trading strategy?

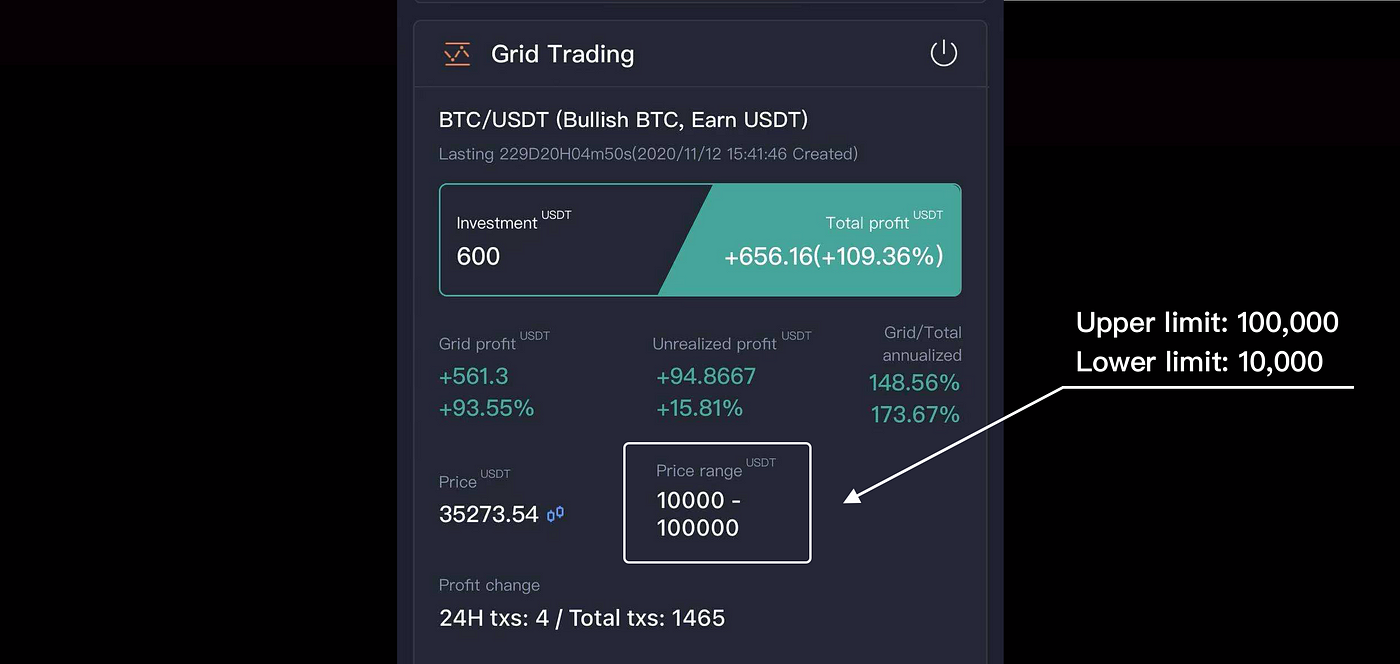

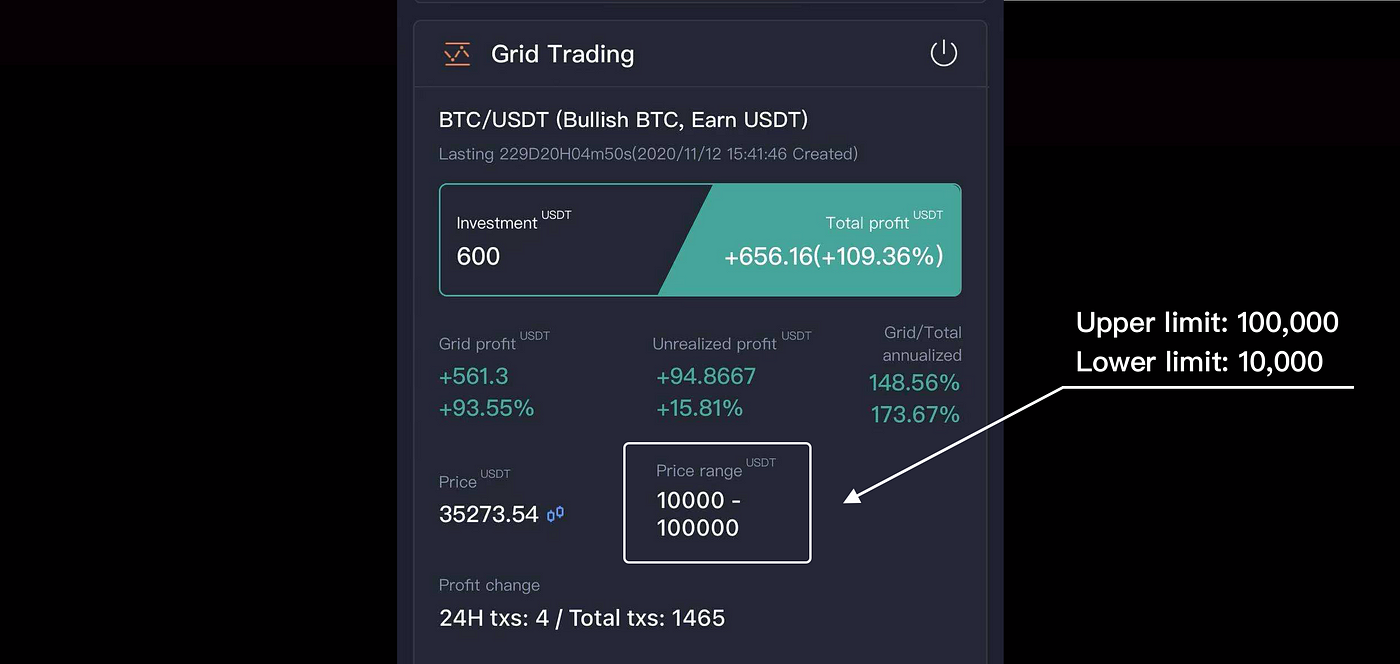

Many experienced traders keep talking about the Wide Price Range Grid Trading Bot Strategy. Actually, what’s it? When you create Grid Trading bot, you will set a lower limit and an upper limit as the price range. And the bot will arbitrage in this range. Sometimes, if the current price goes out of the range, the bot will stop making profits unless the price goes back. Any solution to fix it? SURE, SET A WIDE PRICE RANGE. My BTC/USDT Wide price range Grid Trading bot strategy as an example:

My price range is $10,000 to $100,000, the price keeps going within the range for over 229 days, and the bot has arbitraged for 1,465 times, profited over +100% with $600 investment. You can set a very low price that you think is a better price to buy the dip as the lower limit, a very high price that you think is a good target price to sell your coin to make max profits as upper limit. Normally, you can set the upper limit ten times bigger than lower limit. Or you can check what’s the highest and lowest price within 1 or 2 years and set the prices as your range.

Why I keep running this Wide Price Range Grid Trading Bot Strategy?

(1) I believe BTC has a big potential in the future.

(2) I hold some BTC at the same time, I am also running a BTC Grid Trading bot to arbitrage and avoid my emotion mistake.

(3) The wide price range Grid Trading bot can run for a long term without worrying whether the price will go out of the price range or not.

(4) I don’t like watching the market all the time, and doing many market analysis.

So if you think some coins like BTC, ETH have big potential in the future, you can keep a wide price range Grid Trading bot strategy like what I am doing now.

What will happen if the price goes out of the price range?

When the price goes out of the range you set, the bot will not work unless the price goes back. If the price doesn’t go back anymore, the bot will also not work anymore. So there are 3 options that you can choose if the price goes out of the price range:

(1) Stop the bot and create a new one

(2) Wait for the price back to the range

(3) Set advanced settings- “Stop loss price(Stop loss)”and “Close bot at( Take profits)”, which means if the price hits the “stop loss price” and “close bot at “ price, the bot will be canceled.

What market can Grid Trading bot make profits in?

Normally, Grid trading bot will have a good performance in the up-trend market with big fluctuation or high-frequency fluctuation. And if you create the bot at a dip price, you gonna have an amazing profits.

How to select coins for running Grid Trading bot?

I think there are two indicators that could be considered to select coins for running Grid trading bot: (1) liquidity (2) volatility.

Liquidity, in some degree, stands for the market depth, which means the ability to sell and buy easily or not. If liquidity is not good, you may buy it easily while hard to sell, which is not good for the bot’s arbitrage. And volatility is to show how the price moves, if the price keeps going down for a long term without any returning, or just moves around some price with a small fluctuation, like the price of USDC is always moving around $1, which is also not good for the bot’s arbitrage. So you can select some coins that have good liquidity, volatility and even a long history. And you also see the potential, just do it.

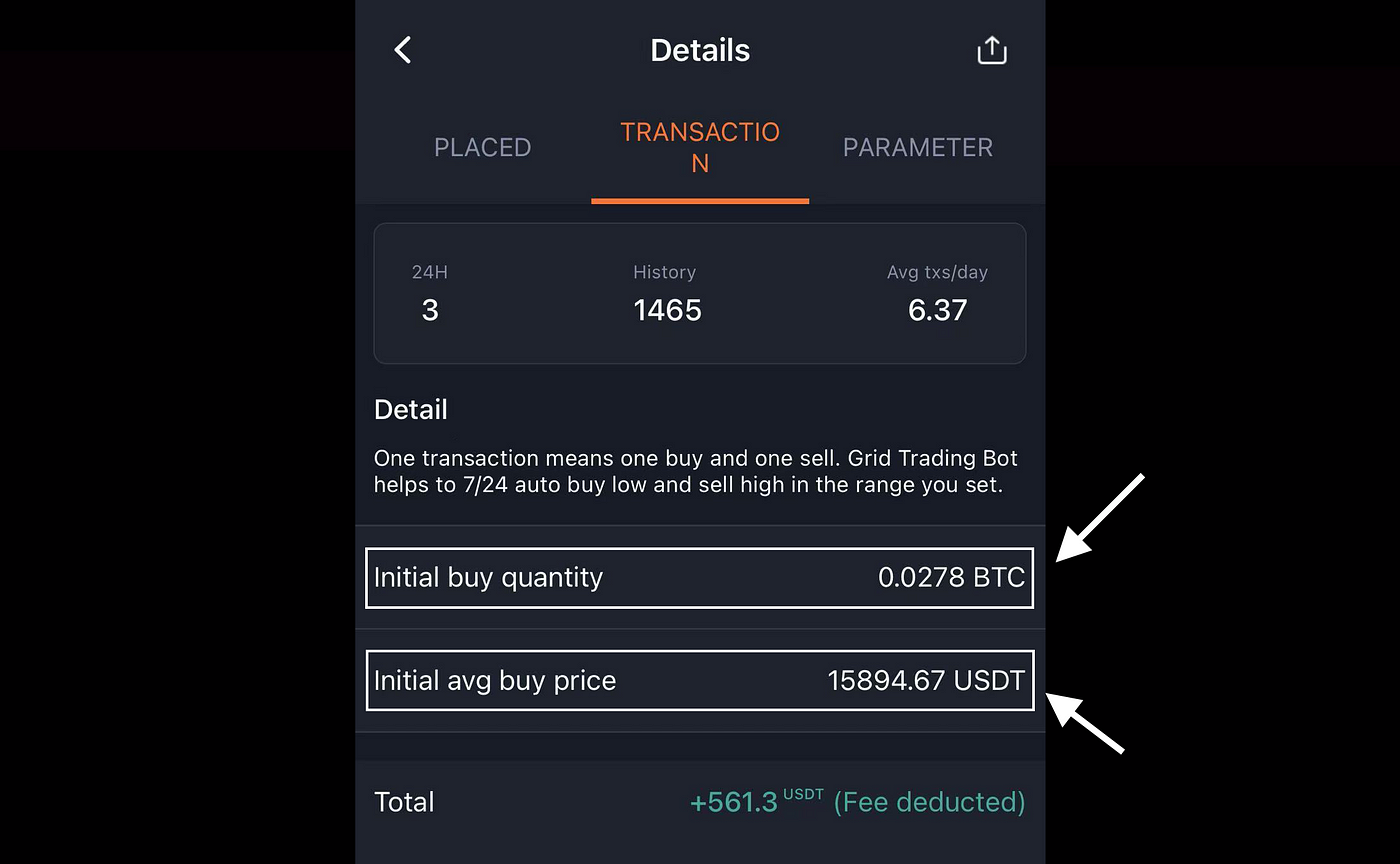

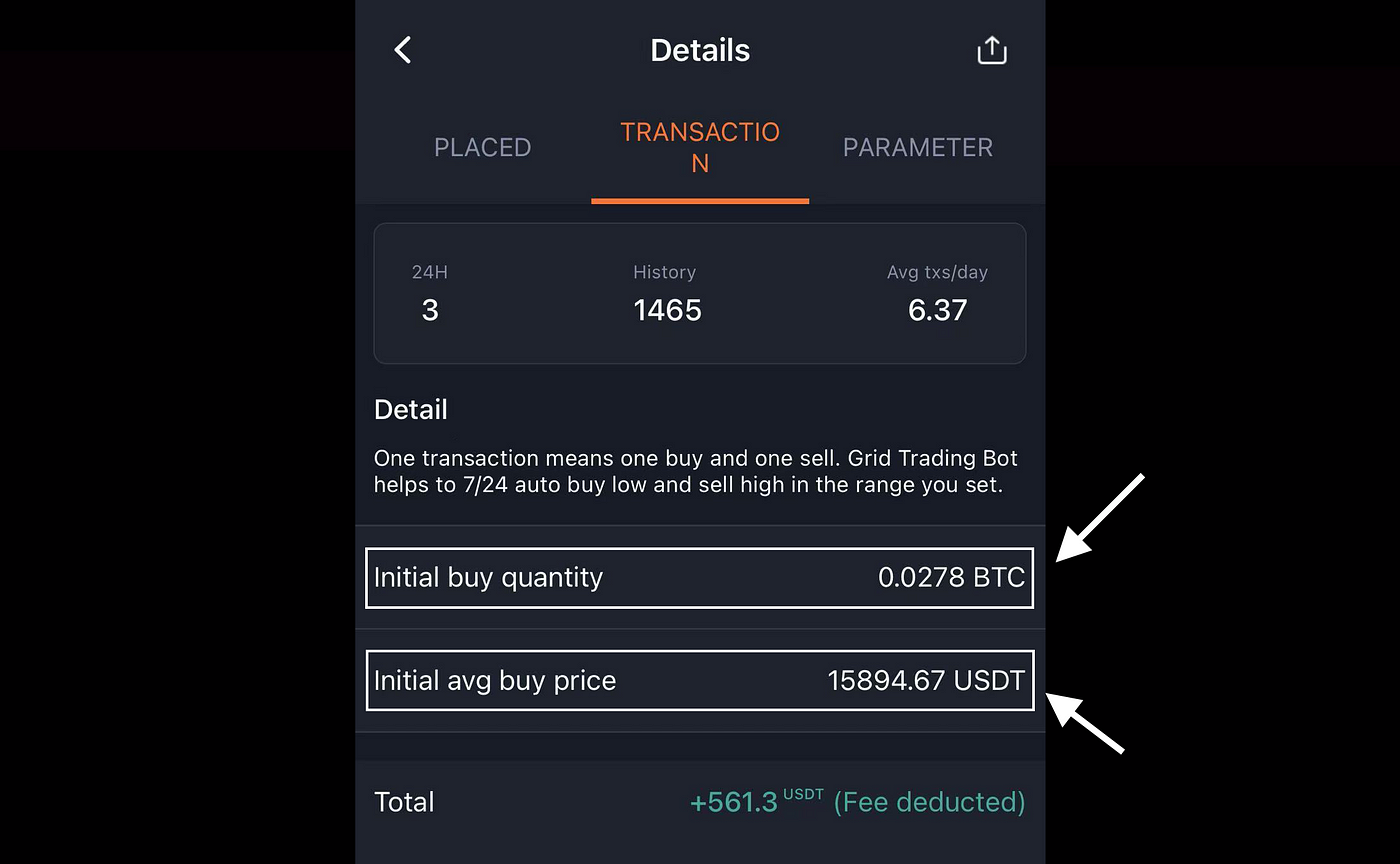

How does Grid Trading Bot know my initial buy cost?

Grid Trading bot never knows your initial buy cost. And it just uses the open price to calculate the initial avg buy price. For example, you bought your BTC at $500, and now you create a bot with a $35,000 open price, the bot will use $35,000 to calculate the initial avg buy price for setting up the bot as the following pic shows.

So I recommend using USDT to create Grid Trading bot. For example, you can use USDT to create the bot with BTC/USDT trading pair, which is to earn USDT as profits. You also can use BTC to create the bot with ETH/BTC trading pair, which is to earn BTC as profits.

What’s the difference between setting big number of grids and small number of grids?

This is like fishing. For some coins with relatively large fluctuations, you should set fewer grids to catch big arbitrage, and you will also pay less trading fees at same time. And you can set more grids for some coins with small fluctuations in order to catch small arbitrage. In a word, if you want to catch “big fish”, use the “fewer grids, catch “small fish”, use more grids according the coin’s fluctuations.

Does the number of grids influence the profits? And how to set a good number of grids?

Grid profit =( Single grid profit-trading fee ) × arbitrage times. So the number of grids does influence the profits. We can easily know that the more arbitrage the bot makes, the higher possibility you can make profits. Now the max number of girds on Pionex Grid Trading bot is 200 for common users ( VIP is 500, Market maker is 1,000), So how many grid can I set up?

ETH/USDT as an example, If you set 1,000 ~10,000 as the price range, and you can set 200 grids. after setting all the parameters, you can see that the bot will calculate the total investment for running this bot.

If you don’t have enough funds to run the bot based on the parameters you set, you can deposit some funds to your Pionex account, or you can also reduce the number of grids, price range to reduce the funds.

Will trading fee eat much of the profits?

To avoid the frictional costs caused by frequent arbitrage made by Grid trading bot, you should keep the profit per grid bigger than the trading fee, and now all the profits showing have been deducted the trading fee. The following pic shows the arbitrage made by the bot and each profit that deducted the trading fee.

The pros of Grid Trading bot

(1) Reduce the risk. The logic of Grid Trading bot is that it’ll buy some Bitcoin at the current price, keep some USDT with the bot, laddering buy and sell if the price stays within the range (BTC/USDT as an example), which can improve the fault tolerance. If you all in BTC and the price drops, you may have a 20% loss, but the bot may only make a 10% loss, because it still keeps some USDT.

(2) Reduce the influence of emotion. After setting the bot, you don’t need to watch the market frequently, because you are ready no matter whether the market is going up or down. This can avoid the emotions of manual trading.

(3) The high possibility of making arbitrage if there is fluctuation. Grid trading can make money in the fluctuating market. The longer fluctuation the market makes, the more arbitrage the will make.

The cons of Grid Trading bot

(1) The price range is limited. If the price goes out of the range, the bot will not work anymore unless the price goes back.

(2) The fund utilization rate is low. After you create a bot, the funds for running this bot can no longer be used to trade unless you close the bot.

(3) Also will make a loss in the downtrend market. Grid Trading bot will also make a loss in the down trend market. Holding will also make the loss in the downtrend market. While comparing to holding, Grid Trading Bot will make less loss.

Who need Grid Trading bot?

(1) No time to watch the market. If you don’t have enough time to watch the market like you are have a meeting while the market moves, which may make you miss the chance to make profits. After setting it, you don’t have to worry about it, just check the performance every day

(2) Don’t like watching the market. If you dislike watching the market every day, just set up the parameters to keep a bot, which is your good option.

(3) Prefer a stable income instead of getting rich overnight. The greater the profit, the greater the risk you will have. So being friends with time.

(4) Don’t know how to do the market analysis. If you can not determine whether the bulls or bears, the price is low or high. Grid Trading bot can help you buy low and sell high automatically without doing market analysis.

❤️If you have any questions or wanna share your trading ideas with me, you can email mario@bituniverse.org. I am willing to hearing from you.