Sideways Gain (invest stablecoin) is a dual investment product that lets you earn high insterest income daily at your target yield until your stablecoin is swapped for crypto.

Contents

What is the Best Time to Use Sideways Gain?

Sideways Gain (invest stablecoin) is built for you to use when the market is not volatile. It is an investment tool to earn a return in stablecoin at daily settlement until it drops to or at our recommended strike price that matches your target APY.

In the graph below, someone set the target APY to be 10000.00%, and the system finds the product that has a strike price of 22,000 and APY of 248.25% which is the closest one to the target. The product settles daily at 16:00 in the person’s time zone, and he earned more than 100%, sometimes even 300% APY each day.

How does Sideways Gain work?

Suppose you would like to invest in crypto but don’t know how the price of crypto will move in the future. Sideways Gain is the one for this scenario. For example, the current price of BTC is $20,000, and you would like to invest $18,000 to earn a 36% annualized yield by subscribing to Sideways Gain with USDT-BTC pair. Our system finds a product at a strike price of $18,000, which settles the next day for you to subscribe. In this case, the daily return would be 36% / 365 = 0.1%.

You would expect the following payoff at settlement the next day:

Scenario 1: Price of BTC ≥ 18,000 USDT, you get (1+0.1%)*18,000 = 18108 in USDT

Scenario 2: Price of BTC < 18,000 USDT, you get (1+0.1%) = 1.001 in BTC

In other words, if the market price stays above the strike price, you’ll earn interest in stablecoin. And if the market price drops below or at the strike price, you’ll buy cryptos at the strike price with investment + interest earned.

STEP-BY-STEP Tutorial

- Log in to your account at pionex.com.

- Find the “Earn” -> “Structured” button on the top bar tools

- Find the “Auto-invest” button on the left-hand side

- There is [Sideways Gain (Invest Stablecoin)] at the bottom of the page.

- Click on “Create the bot” and follow the instruction below

Step 1: Please Fill in the Following Parameters

- Auto-Invest Strategy: (you can subscribe to our sideways gain product with 2 strategies)

- Daily Fall Ratio: the percentage of price decrease you expect to happen the next day. We will find you the product with a strike price at (1+ daily fall ratio)*current market price

- Target APY: the annual target return you expect with this investment. We will find you the product with an APY closest to your target.

- Structured: crypto – stablecoin pair; choose the pair you would like to invest

- Investment: Amount of selected stablecoin you want to invest. You can also use the sliding bar to fill in the investment amount.

- APY higher limit, APY lower limit: the range of APY you expect, we will find the best product with APY falls between the lower and upper limits.

We will find the best product that fits your need based on the daily fall ratio or target APY you inputted. At the bottom of this page, you will see the product information with the strike price, settlement date, duration, annualized return, and return at each settlement.

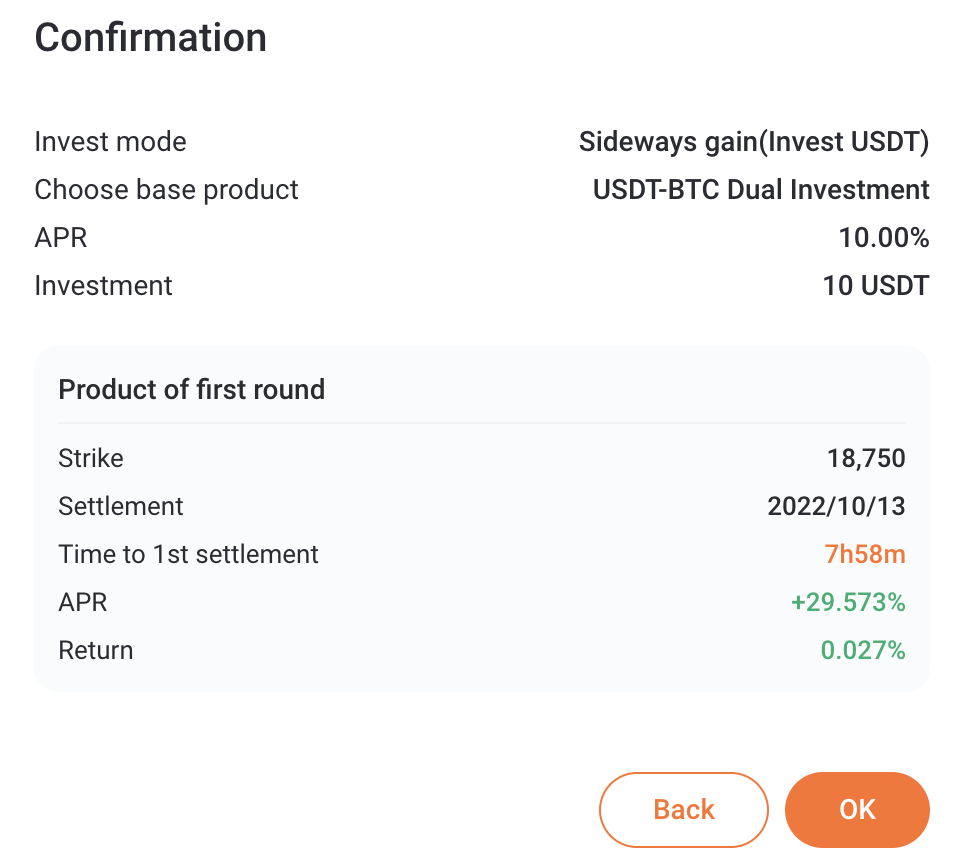

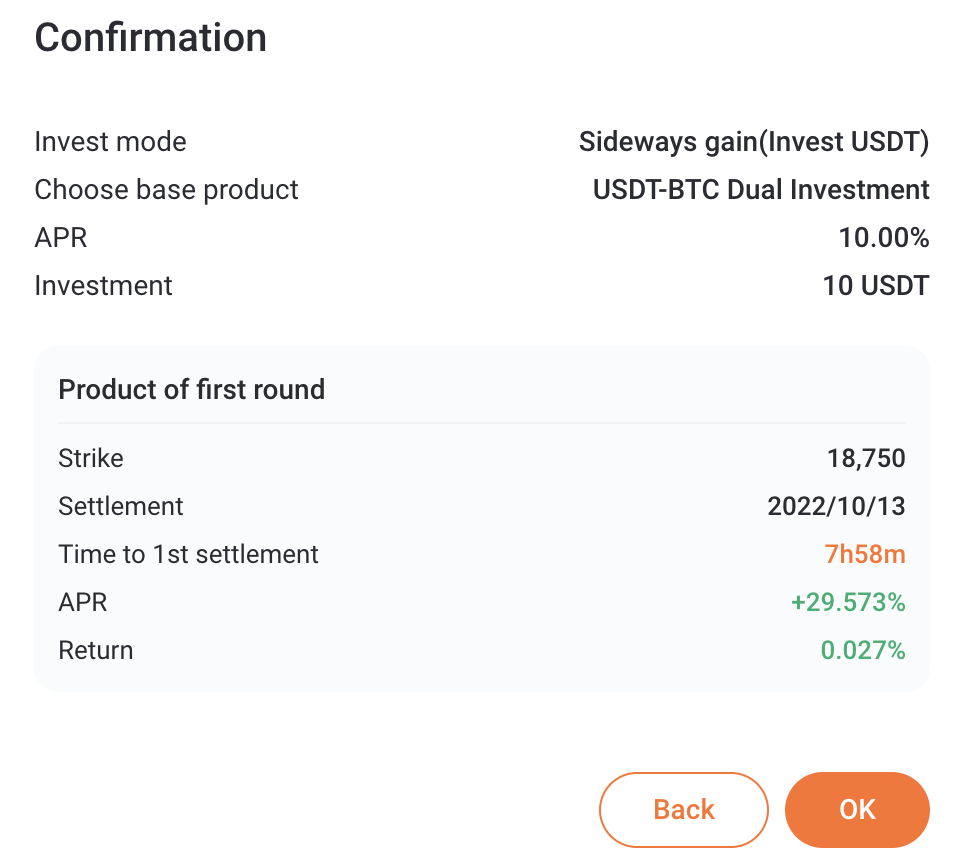

Step 2: Please Make Sure Everything is Correct

Then you will be directed to the confirmation page, ensure everything is correct, and wait for your daily return.

Benefits and Risks

Benefit:

If the market is not volatile, likely, your order will never be exercised at settlement, which means you can keep earning high daily yields in stablecoin.

Risk:

If there is a sudden price change, all your earnings in stablecoin may be swapped for crypto at settlement, which means you buy crypto at a higher price and may cause some potential loss.

FAQ

Q: When should I use Sideways Gain?

A: When the market is not volatile, or you are confident in predicting how much the market will rise/drop. Subscribing to Sideways Gain returns the interest rate you set, and you get paid daily!

Q: What are the differences between Covered Gain and Sideways Gain (Invest Stablecoin)?

A: 1. Settlement Period: Covered Gain settles based on your choice; Sideways Gain settles daily.

2. Strategy: Covered Gain: You get to choose the target sell price. Sideways Gain: Pionex finds the product that best fits your target APY or daily fall ratio.

Q: What should I do if the market suddenly became volatile and my order was exercised?

A: If you invested stablecoin with sideways gain, a sudden price change causes you to swap for crypto. In this case, you can invest your crypto in Covered Gain and wait for the price to bounce back. But this is a risk you take when predicting the market has low volatility.