Weekly Crypto Market Research and Trade Ideas 9/28 – 10/6

Contents

Summary

- Happy Columbus Day!

- Although inflation is decelerating faster than the Fed’s forecast, continued strong employment and economic fundamentals will fuel skepticism about the pace of inflation reduction.

- The market is in a vacuum and prone to a black swan market with sharp upward and downward movements.

- Based on history, following a sharp decline, a recovery to the breakdown level is a bullish signal.

Technical Analysis

Last week, we discussed the possibility of Bitcoin experiencing upward momentum, riding on the support and rebound of $SPY. This week, we observe that Bitcoin has maintained its support at $27,000 and has even formed a new higher-low at this price level. This marks a highly favorable development, indicating a bullish trend on both the hourly and daily timeframes. However, when considering the weekly and monthly perspectives, we still encounter resistance, which could be interpreted as a bearish signal. However, most people here are trading in the short-term, and what we want to see is Bitcoin getting back above $28,000 then we will open up a potential move to $32,000. The $28,000 level is the line in the sand from our point of view that will differentiate if we get back in a bullish regime or continue to be weak.

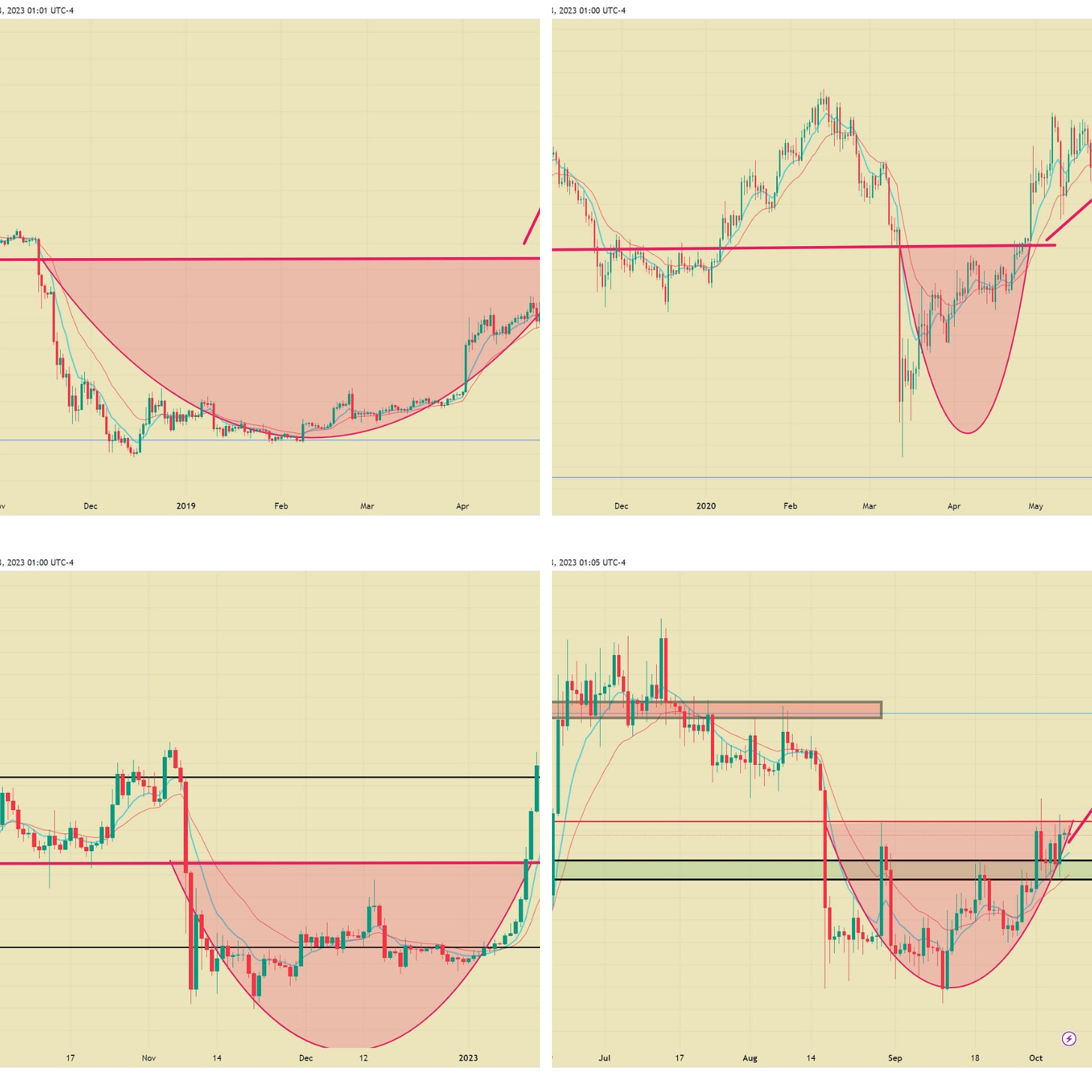

Another factor supporting this move is the analysis of Bitcoin’s historical price action following a rapid decline. When such a decline is reclaimed, it typically signals a continued upward trend. This contradicts conventional technical analysis, where a price break below support is often seen as establishing strong resistance.

In the case of Bitcoin, when the price reclaims the entire drop and returns to a previously breached support level, many traders might attempt to short it, assuming it has become a resistance level. However, this assumption doesn’t hold true for Bitcoin.

Below, we present examples from 2019, 2020, and 2022, where rapid declines were followed by retracements. It’s noticeable that, in most instances, when Bitcoin manages to recover to the point of the initial breakdown, it tends to resume its upward movement. Interestingly, the ideal time to short Bitcoin is when sellers are in control, and prices cannot even reach the breakdown level.

2019, 2020, 2022, 2023

On the flip side, if prices fail to hold above $27,000, the new higher-low, we will revert back to the $25,000 support again. From how it reacts to that level, we can judge where Bitcoin will likely go.

Macro Analysis

Wednesday Data To The Rescue

On Wednesday, we saw a weak trend in the job market data. U.S. employment was released by ADP on Wednesday – in September, the private sector added just 89,000 jobs, a number well below August’s figure of 177,000 jobs. More importantly, the number was much lower than the 153,000 expected. We also expected Friday’s non-farm employment report to reveal a trend – that job growth is slowing. However, considering that ADP and non-farm employment data have repeatedly shown contradictory trends since the pandemic, it will take time for ADP’s forward-looking effect to prove itself.

Friday

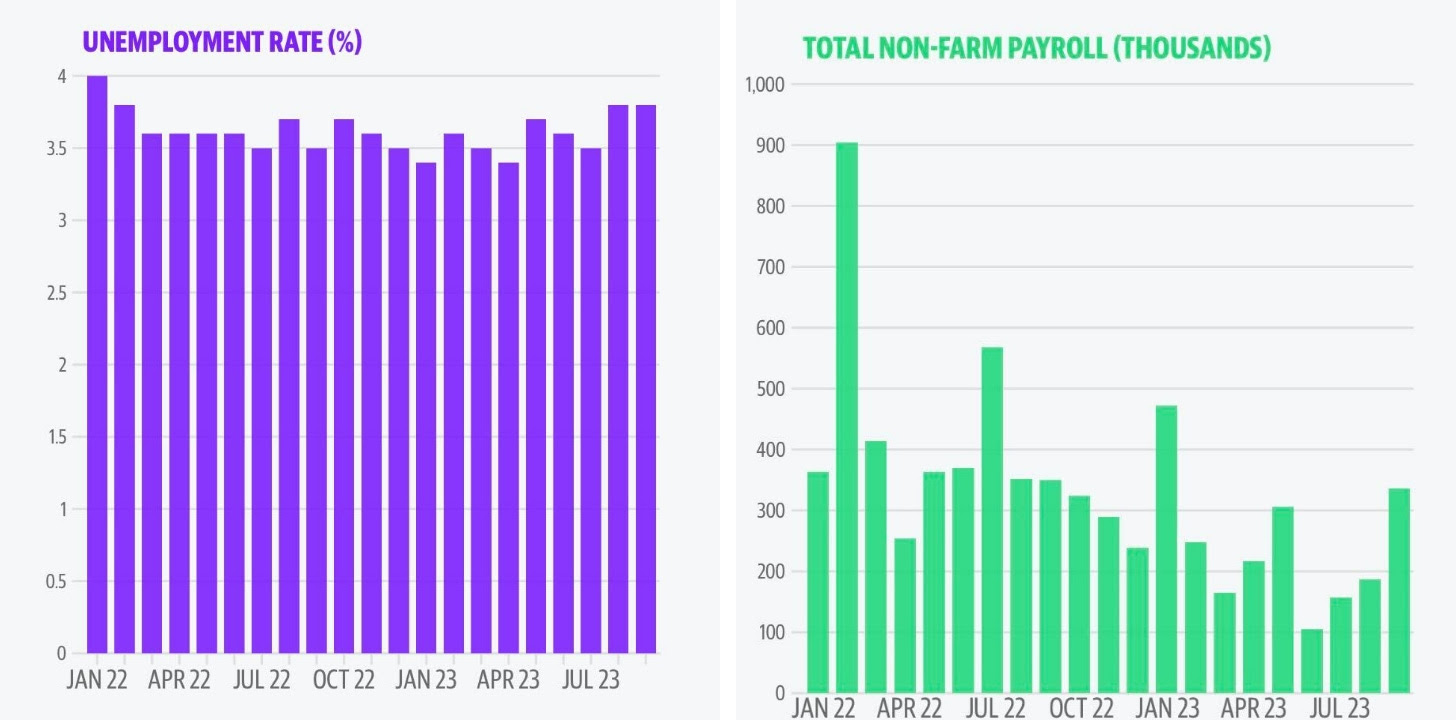

Friday’s nonfarm payrolls report showed that the U.S. added 336,000 jobs in September, suggesting that the labor market is cooling too slowly and that U.S. economic fundamentals are still resilient.

The increase in nonfarm payrolls was nearly double the 170,000 jobs economists had expected. The revised August and July employment reports released Friday showed 119,000 more jobs were created in those months than previously reported, according to the U.S. Bureau of Labor Statistics. The unemployment rate was unchanged at 3.8 percent in September, the same as in August and the highest level since February 2022, according to the Bureau of Labor Statistics.

In our view, the strong employment numbers have prevented monetary policymakers from relaxing their tightening bias. Although inflation is decelerating faster than the Fed’s forecast, continued strong employment and economic fundamentals will fuel skepticism about the pace of inflation reduction. Further, the Fed’s heavy-handed monetary policy will have to continue “higher and longer”. Fed Chairman Jerome Powell said labor markets still need “some softening” to keep inflation down to the Federal Reserve’s 2% target. Powell warned that if this does not continue, it could prompt the Fed to raise interest rates again.

Inflation Factors Easing

In the meantime, several factors appear to be converging to push oil prices lower. These factors include decreased demand, anticipations of future supply growth, and a flurry of panic selling initiated by technical and algorithmic traders. The cumulative impact of these elements has led to a consecutive two-day drop in US crude oil prices, exceeding 8%. As a result, WTI crude prices have dipped below $82 per barrel, and the selling pressure shows no sign of abating.

The decline in oil prices has, in turn, raised concerns about the outlook for economic growth and inflationary expectations. Consequently, the market has once again taken steps to lower expectations regarding the Federal Reserve’s likelihood of raising interest rates in the near future.

Fundamental Analysis

Liquidity Remains a Concern

The active supply of Bitcoin within the 1-2 year range (measured by the 1-day moving average) has recently reached its lowest point in 21 months, standing at 2.33 million BTC. This signifies that more than $64 billion worth of Bitcoin has remained dormant for at least a year, reflecting a notable reduction in movement. In essence, over $64 billion worth of Bitcoin has stayed untouched for a minimum of 12 months. Furthermore, it indicates that the available Bitcoin supply for buying and selling is currently at its scarcest point since 2022.

Our interpretation of this data suggests that liquidity remains relatively low, creating a market environment where even relatively modest funds can have a substantial impact, causing sudden and sharp price fluctuations. Consequently, we recommend a cautious approach, which includes reducing contract positions, decreasing leverage, holding cash to absorb market shocks, and pursuing stable investments.

Trading Recommendations

Bitcoin

Futures | Spot

No high-probability swing trades.

Structured Product

Last week, we suggested two covered gain orders with a strike price of $29,000. This recommendation was profitable, as the one with a shorter duration expired out of the money (OTM), and the yields are now available for claiming. The 30-day option still has some time remaining.

For those currently holding Bitcoin, we suggest a $29,500 Covered Gain option with a 12-day duration. Despite our bullish outlook, we anticipate a gradual upward movement, particularly given the formidable resistance levels at $29,000 and $30,000. Therefore, it would be wise to generate additional Bitcoin yields while patiently awaiting price increases.